Getting Board Approval | Annual Planning

What, how, and when to present your annual plans to the board for approval. This is what I do.

Sponsor: Redefine planning with Abacum’s AI-native FP&A platform.

Most teams waste 70% of their time wrangling data. Top finance teams use Abacum Intelligence to automate the grunt work and unlock better, faster decisions through scenarios and forecasting.

Get our AI in Finance guide, packed with actionable and tactical real-world examples and proven frameworks.

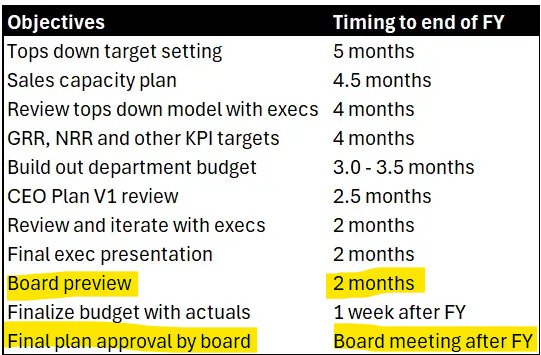

Board Approval Calendar

A good annual planning process starts early and gets alignment from all stakeholders early as well.

Below is my annual planning calendar for a more stable company with some decent revenue scale. Early-stage company timelines are usually more compressed with a few more board touchpoints given how fast things move.

At a minimum, you should have two board touchpoints:

Preliminary board approval in the Q4 board meeting

Final approval in the board meeting following year-end

But when things could be contentious or if there will likely be board member disagreements then the CEO/CFO should chat individually with board members to walk through the plan and their concerns in more detail.

There might still be disagreement, but at least you won’t be surprised by that one board member who wants you to cut burn by 50%…

#1 rule for board meetings is NO SURPRISES. Ideally on both sides, but you can at least make sure your board members aren’t surprised by anything you bring up.

Goals and Key Initiatives

Board members need context. They sit on several boards and they are not living in the financials like the exec team. Don’t just jump straight into the financial plan and metrics.

Start with what you want to achieve over the next 1-2 years. And describe the “tailwinds” and potential “headwinds”. The board wants to know how you are thinking about plan confidence level and potential risks.

The financial plan should map to your goals and key initiatives.

Boards obviously don’t want every single Excel model detail, but…they do want context. There are a handful of assumptions that drive 80%+ of the model. Discuss those key assumptions.

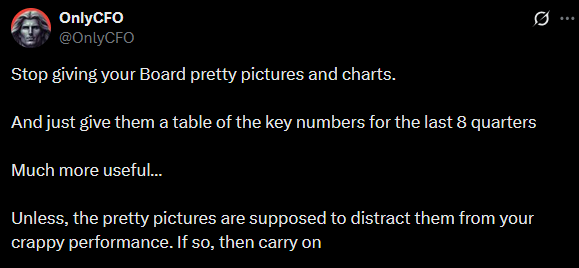

Presenting Financials

I know this goes against what many of you present to your boards….but PLEASE stop presenting pretty charts and graphs that give only a fraction of the information in a good table of numbers.

The board is not afraid of looking at a quarterly trending income statement or key financial metrics. Most prefer it.

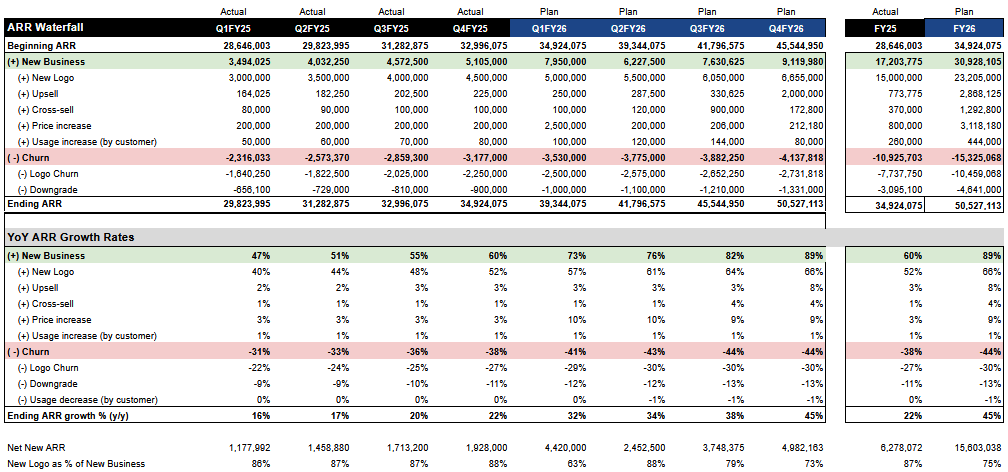

ARR Targets

The ARR target (or whatever topline metric you use) is the most important number to get alignment on. They want to know things like:

What are the major assumption changes from historicals? (AE productivity, decreased churn, increased expansion, churn, etc)

How much buffer is in the plan?

Any forecasted whale deals or significant expected logo churns?

I also include a slide on sales capacity that shows the major assumptions such as:

How many fully ramped reps will we enter next year with?

What is productive capacity? Any forecasted assumption changes here?

What are the other critical assumptions?

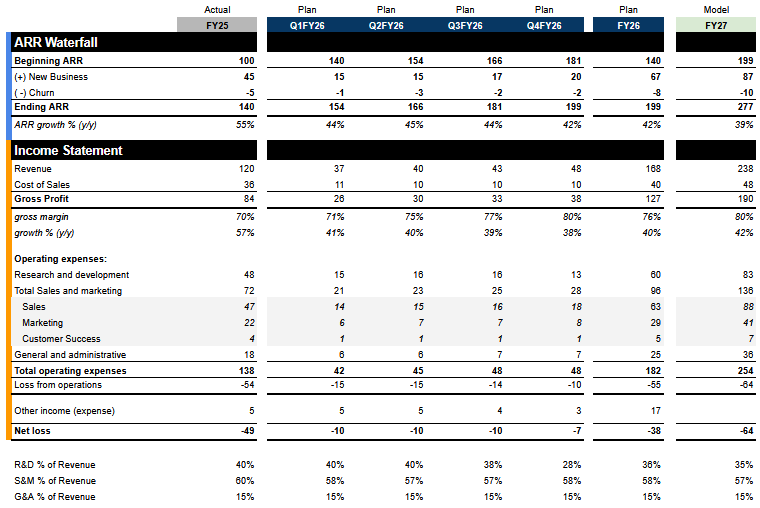

Income Statement

Below is my P&L slide for the annual plan. It’s essentially the same format as audited financials with a few additional breakouts.

ARR Waterfall: I show a summary ARR waterfall here so you can easily see how it differs from GAAP revenue. Be prepared to answer why!

Sales & Marketing: GAAP financials always consolidate these lines but the individual breakouts are usually important.

Percentages of Revenue: It’s much easier to review costs as a percentage of revenue so I include these percentages at the bottom.

A couple other callouts when presenting financials:

Historical Context: Provide at least one year of historical financials.

Plan + 1 Year: Build a Tops Down model for the year after the annual plan you are getting approved. This forces you to be honest about building capacity for the following year.

Show Quarterly Numbers: The linearity of growth and spend is important. If spend is front-end loaded while revenue growth is back-end loaded, the plan becomes less believable (and a lot more risky).

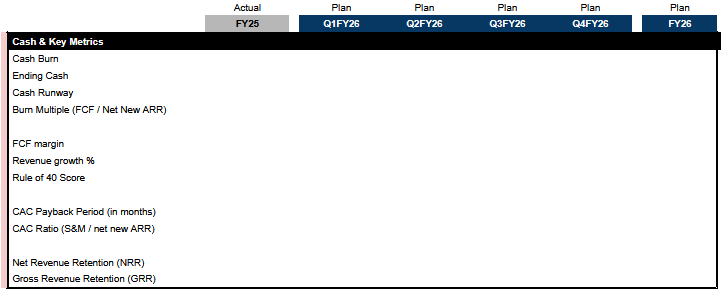

Cash Burn & Key Metrics

All companies that go out of business do so for the same reason – they run out of money. —Don Valentine (Founder of Sequoia)

Cash (and related metrics) are important to the survival of the company. Mismanagement of cash can kill an otherwise good business. Make sure to present and discuss cash and runway in detail.

Also, present the other key metrics that are important for your business, which can be dependent on industry, segment, revenue scale, etc.

Below is an example of what you might present.

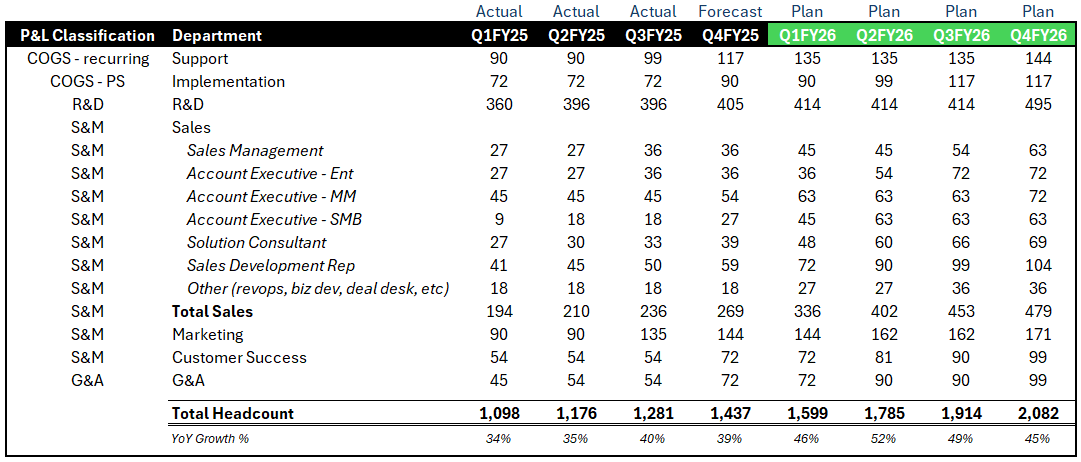

Headcount Plan

In my prior post on headcount planning, I discussed how this is the most important step to get right in the annual planning process. Make sure you show the board the key components in the headcount plan:

Key Hires - What executive (and key VP) hires are in the plan? List them out.

Trending Headcount Plan - Below is how I present quarterly headcount. Mostly summarized so there isn’t too much detail, but I break out sales in more detail. If there is another key function we are focusing on, then I might break that out as well.

Boards get nervous (rightfully so) when the plan has 70%+ of the hiring in H1. Because if sales start to come in softer than expected, you have limited ability to adjust and offset the additional cash burn.

Investment Areas

What are the company’s key initiatives and investment areas?

If the company is taking on any costly initiatives like the below, then explain to the board the estimated costs and impact to the financials.

Expanding internationally

Building a big new product

Creating a channel partner program

IPO prep

FedRAMP compliance

Appendix Slides

Some slides can get thrown into the appendix and not discussed live, but can be important context for the board. Appendix slides such as:

Balance Sheet

Natural P&L

Sales pipeline stuff

Marketing data

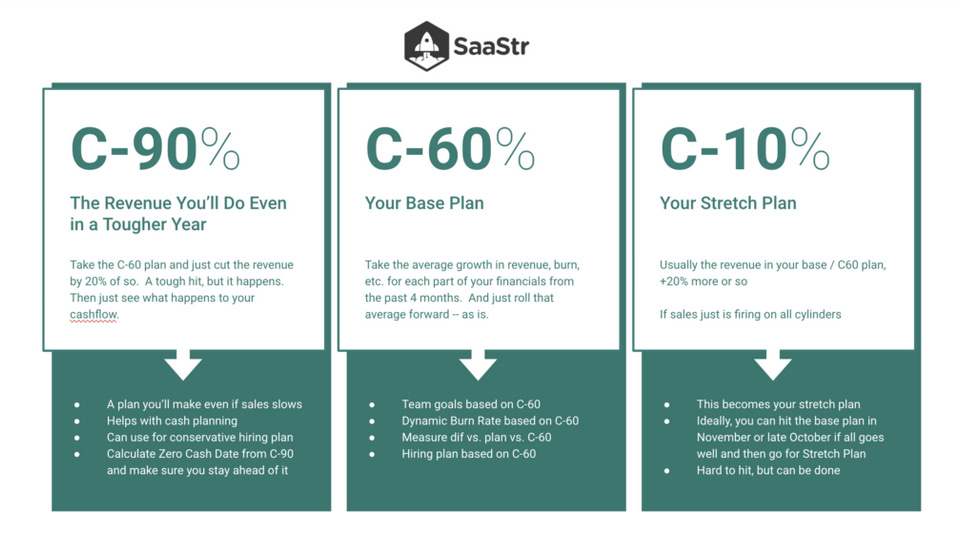

Plan Confidence Level

What is the confidence level of the plan?

There is frequently a board plan (higher confidence) and an internal plan (lower confidence). I like having stretch targets, but I target hitting the quarterly board plan ~80% of the time and then the internal plan closer to 60%.

Jason Lemkin talks about building three different plans based on confidence level. This is a good place to start for most companies.

I don’t care too much about the exact board versus internal confidence levels, but there should be alignment on how you build the plan and the related confidence levels.

Ongoing Monitoring

Congratulations! You got the plan approved.

But the job is not done…

Now you need to monitor performance against plan and adjust accordingly. The one thing that is true about every financial plan is that it is wrong. Ideally, the plan is pretty close to actual performance, but adjustments are usually necessary.

The plan should create guardrails for how you should adjust costs if the plan is missed. Don’t just blindly follow the plan. Adjust based on performance.

I hope your 2026 is filled with high growth rates and profitability!

Footnotes:

Get the AI in Finance guide (from Abacum), packed with actionable and tactical real-world examples

Check out my other newsletter (OnlyLawyer) that one of the best tech lawyer I knows writes. Latest post on how FireFlies AI notetaker was actually just the founder listening to all of your calls and taking notes…