How I Do Headcount Planning

Common mistakes and recommendations for annual headcount planning. Also, get some free headcount planning templates

Sponsor: Redefine planning with Abacum’s AI-native FP&A platform.

Most teams waste 70% of their time wrangling data. Top finance teams use Abacum Intelligence to automate the grunt work and unlock better, faster decisions through scenarios and forecasting.

Get our AI in Finance guide, packed with actionable and tactical real-world examples and proven frameworks.

What’s the goal of headcount planning?

Build the optimal team to execute on the company’s financial targets and strategic initiatives.

Here is what I will cover in this post.

“Organizational Debt” Kills

Capacity-Driven Headcount

GTM

Marketing

Support and implementation

Calendar-Driven Headcount

R&D

G&A

Headcount Planning Checklist

Common Headcount Planning Mistakes

This is not a fully comprehensive guide on everything I do for headcount planning (that would be way too long), but it’s a few important things I think are important.

💡Free Headcount Planning Templates: Keep reading to the end to get them :)

Join 35K+ other subscribers and get the weekly OnlyCFO newsletter in your inbox. Get smarter on finance and stay up-to-date on the latest trends, benchmarks, AI stuff, etc.

“Organizational Debt” Kills ☠️

A term I may have just made up is “organizational debt”. It is similar to tech debt, but I think organizational debt can be more deadly…

Tech debt: The consequence of prioritizing speed over designing the optimal code and software infrastructure. This means making decisions that you know will need to be fixed in the future.

Organizational debt is similar, but with how the organization is built.

Organizational debt: The consequence of prioritizing speed over making optimal people, culture and organizational structure decisions. It can also occur from not having strong leaders willing to make hard people decisions.

Both types of “debt” eventually need to be cleaned up. Otherwise, the debt load will get too large and slow the company down to a screeching halt.

Fixing Organizational Debt

If a company’s team has the largest impact on a company’s success, then spend the time on headcount planning that reflects its importance.

Below are a few questions to consider discussing during annual planning (and maybe throughout the year):

Is the team structure optimal for our current stage?

Has the company outgrown any of its people? (leaders were great startup people but maybe not growth stage people)

Are B/C players making things inefficient? Would just one A player be enough?

Are reporting structures slowing us down?

Has technology changed our needs (👋 AI)?

Do we have roles we never should have hired for?

What bucket does this role/team fall into? (increase revenue, drive innovation, mission critical, candy) - The “candy” roles are nice-to-haves and should be evaluated - see this post.

Don’t ignore your organizational debt…Fix it before it’s too late. It easily becomes a snowball where it becomes so large you can’t hire any A players and the ones that are left leave. Make it part of annual planning.

Benchmarking is Bad. Usually

Hot Take: Most companies would be better off ignoring benchmarks. Why? Because it becomes too easy for leaders to turn off their brains and find benchmarks to support the headcount number they think they need.

Things are moving too fast in 2025. And software/AI companies are becoming so differentiated that most benchmarks aren’t that informative about what you should do (most benchmarks need deeper segmentation to be useful).

Leaders love blindly applying these rules of thumb from other companies or benchmarks. Some examples include:

We need 1 SE for every 2 AEs

Marketing should be 1/3rd of sales spend

Once a company has $50M of ARR we need [X] role/team

That may have been true at other companies or what benchmarks say the average cloud company does, but it does NOT mean you should.

Build your plan without benchmarks. After the plan is done, then maybe see how it lines up with the benchmarks and think why you are different.

Benchmark Trends

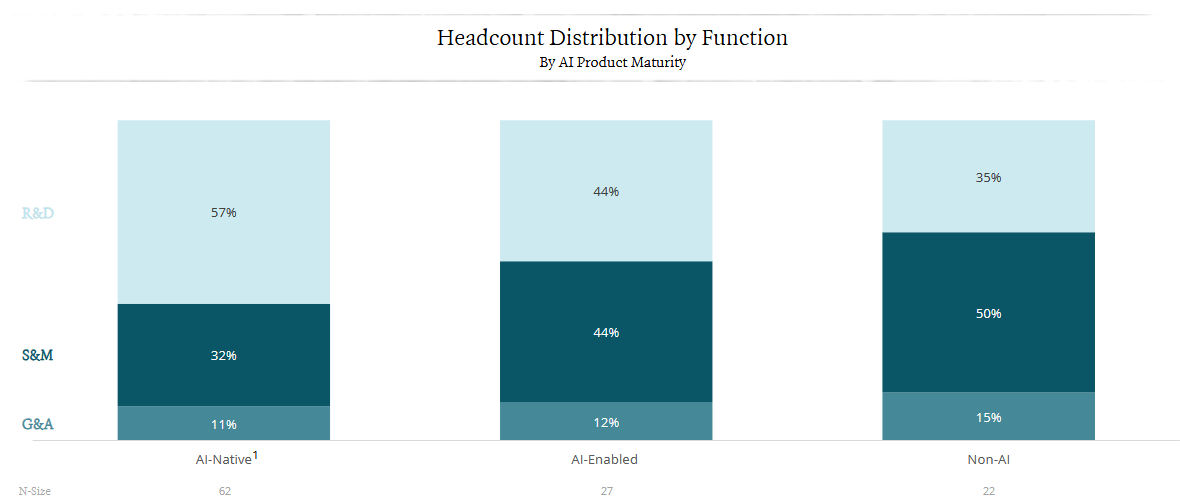

One thing I do like about benchmarks is that trends can be informative and help shape how companies think about things. For instance, I think the below chart is really interesting. New AI-native companies have much lower AE HC ratios (which means the GTM pod costs from above are a lot smaller).

And it is interesting to see how AI-native headcount distribution is different. There are lots of potential variables that may account for this, but the trend is interesting.

Some Benchmark Report Favorites

Now that I have bashed benchmarking…I actually do like reviewing benchmarks. Just don’t like company leaders relying on them :). Below are some of my favorites.

Private Company Data

ICONIQ - I reference their reports more than anyone else

Bessemer - they have some good deep dives into topics and benchmarks

Tidemark - they have really good reports and benchmarks for vertical software

Benchmarkit - they have great benchmarks and other useful content

VC private benchmarks - several VCs have anonymized data of their portfolio companies that are good

Public Companies

Building Department Headcount Plans

I think of headcount planning in one of the below two buckets:

Capacity-driven

GTM (AE, SE, SDR, CSM, etc)

Support

Implementation

Calendar-driven

R&D

G&A

Capacity-driven headcount planning often feels easier (but frequently has more mistakes) because it’s much more math-driven while calendar-driven headcount can feel a bit more black box.

Below are a few key things I do for each of these.

1. Capacity-Driven

GTM Headcount

I plan for GTM HC by triangulating between the below three methods:

Sales capacity model (already covered here)

GTM Pod model (see below)

Headcount and efficiency metrics/benchmarks (see above)

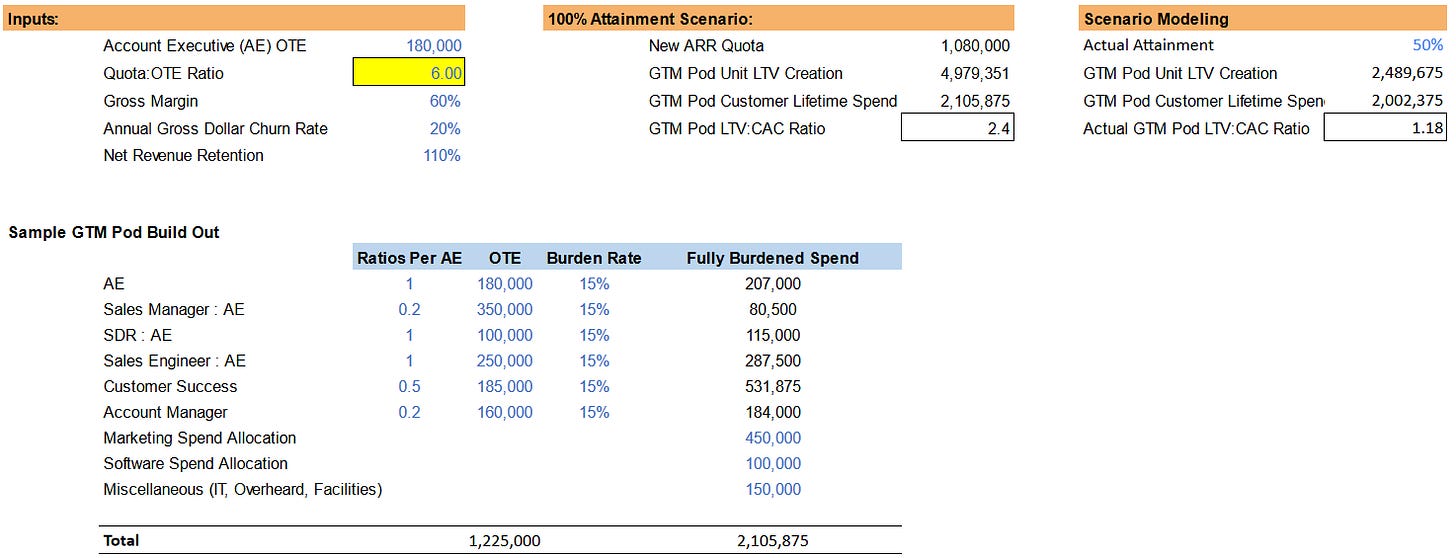

GTM Pod model

The GTM pod analysis is an underrated method to ensure proper GTM headcount planning. And it forces more prioritization which in turn ensures higher GTM efficiency.

This analysis looks at the atomic GTM unit (or “GTM Pod”) required to sell. And then you can determine the true cost to sell $1 of revenue and what must be true for the economics to make sense.

»Here is a model I created to show GTM Pod efficiency that you can play with.

Marketing

Marketing is a bit more art than science, but you need to look at data to know how to best deploy the marketing budget. Marketing folks are often the worst leaders in understanding ROI of their spend so spend some extra time with them…

Yes, marketing ROI can be fuzzier, but don’t use that as an excuse for not looking at data.

What is the trend of marketing spend relative to sales?

What is marketing as a % of revenue?

What is total CAC (and split between marketing and sales)?

What programs performed the best?

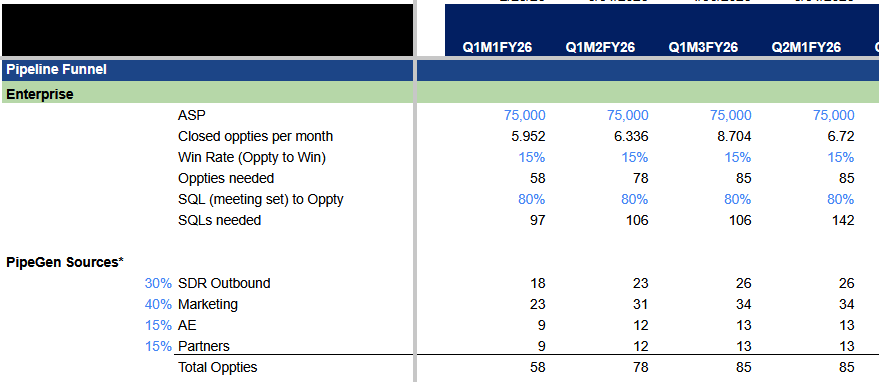

The goal for marketing is to figure out the highest ROI activities to get sufficient pipeline to achieve sales targets. For modeling, I start with my sales target and work backwards to show what needs to be true to put us in a spot to hit our revenue goals (i.e. what is our ASP, win rate, oppties needed, etc).

Also, make sure everyone is aligned on where pipeline is coming from (SDRs, marketing, AEs, channel, self-serve). I have seen many fights because there was no alignment on pipeline targets by team.

Support & Implementation

Sorry if you are on this team, but no one likes you from a financial perspective. And everyone wants to give you the least amount of budget. Just facts…COGS and G&A are close friends in this way.

I don’t have any cool hot planning tips, but here are two callouts:

A cross-functional effort is needed to decrease costs/time required in these areas.

Make sure you have good, clean historical data to use to build an accurate forecast.

2. Calendar-Driven

R&D

The most widely used metric is simply, “Is R&D as a percentage of revenue within benchmarks for our scale, growth, and selling motion?”. But there are a few things to consider:

Scale: The higher the ARR, the smaller the % should be

Growth: The higher the growth, the higher % is more acceptable.

Selling motion: Product-led typically has a higher %, but should be accompanied by a lower sales/marketing % (in theory)

Apart from the above benchmarking, what are the company’s key initiatives and do we have the team to accomplish them?

Can we execute the product roadmap that we promised to sales?

What products/features are we prioritizing and what’s the payback period?

What key initiatives are we targeting?

G&A

Similar to R&D, but less complicated.

What are benchmarks based on revenue scale and growth? Selling motion doesn’t impact G&A

G&A gets the least amount of budget. Duh. At least until IPO prep time.

Increases with business complexity: financial audits, international expansion, legal stuff, etc

Headcount Planning Checklist

Let’s start with my favorite quote on headcount (that I have repeated way too much):

Large staffs of successful startups are probably more the effect of growth than the cause. - Paul Graham

Step 1: Align on Strategic and Financial Initiatives

Before any detailed headcount planning is performed, align with leaders on next year’s priorities, financial goals, and strategic objectives. Annual planning should create alignment across the entire company.

If all the leaders (down to the managers) don’t understand the broader objectives, then it is impossible for them to properly do headcount planning.

Iterating on the plan is SO much easier when leadership is bought-in on the financial targets.

Step 2: Review Headcount LAST

I want leaders to review the below and in the following order. The order is important.

Processes — existing and planned changes

Tools — existing and planned changes

People — existing and current needs

We may not plan to fix all the process or tooling because it isn’t currently worth it. But it should be evaluated before people needs.

And I definitely want every single person evaluating AI stuff before they come to me for more headcount (or to backfill). That is required.

Step 3: The Headcount Review

Now that we know the company goals and have reviewed the specific departments’ current and planned environment, we can get into the detail of headcount planning.

Current headcount

Current year remaining new additions

Open headcount (actively recruiting)

Approved headcount (not actively recruiting, but approved to hire in current year)

Next fiscal year headcount plan

**Make sure you don’t forget any of the headcount in #2 while building your plan! It happens a lot…and then you have missing headcount in the plan that leaders are expecting.

Current Headcount

A company’s needs often change. The business outgrows folks, business needs change, tech changes, etc. Some level of “zero-based budgeting” needs to occur for headcount, especially today as a result of the shift with AI.

Zero-based budgeting can take a lot more time but it is important to regularly do some level of zero-based budgeting with headcount, especially today.

New Hire Timing

I have built a lot of annual plans. When I explain to leaders that cuts have to be made after their initial requests, they figure it out.

There is usually bloat or requests for things that when pushed, leaders will figure out how to do it without them.

Creativity thrives when resources are constrained. Limiting headcount resources is often a good thing…even if cash runway isn’t an issue.

Employee Attrition

I don’t typically model any expectation for employee attrition because it is hard to predict. Any gap between when an employee leaves and when the replacement starts is potential upside to the Plan.

Exception: You NEED to estimate sales rep attrition in the sales capacity plan. See my prior post on sales capacity planning.

But beware that the potential upside from attrition often doesn’t materialize…new person needs a signing bonus, have to hire an external recruiter to find some roles, new person requires a higher salary, etc. So it’s usually not wise to bank on savings from attrition.

Modeling Employee Cost

How much does an employee really cost?

Base Salary

Bonus/Commission

Employer Taxes

Health Benefits

Computer and other equipment

Software access

T&E for offsites, client visits, etc

Make sure to account for the entire employee burden because it adds up quickly. Continually monitor your headcount cost forecasts versus actuals so you can continually improve how you forecast.

Contractors

The full-time contractor versus employee game…

I have seen too many companies game financial metrics and lie to themselves about budgeting because of this classification difference.

If you have a full-time “contractor” that you have no intention of terminating anytime soon, then you have an employee…Not for legal purposes of course, but just treat them like an employee for metrics and headcount planning. These are most often the folks hired through a PEO/EOR (Rippling, Deel, Remote, etc)

Also, be mindful of when you are hiring a lot of these folks in a specific country that eventually you will need to set up an entity and there are lots of things (including financial) that you will want to consider.

Keep the Survivors Happy

Dave Kellogg discussed this in his blog and I think it is REALLY important.

Keep the company a great place to work for those who still work there (aka, the survivors).

Almost all of us have been in cost cutting mode at some point over the last few years. Many mistakes have been made. But a major one with a ripple effect is not keeping the survivors happy. They then are miserable, don’t do good work, and then leave…and it becomes a vicious cycle.

It’s better to cut more headcount from the plan and make sure bonuses, raises, promotions, offsites, etc are still available to those who stay.

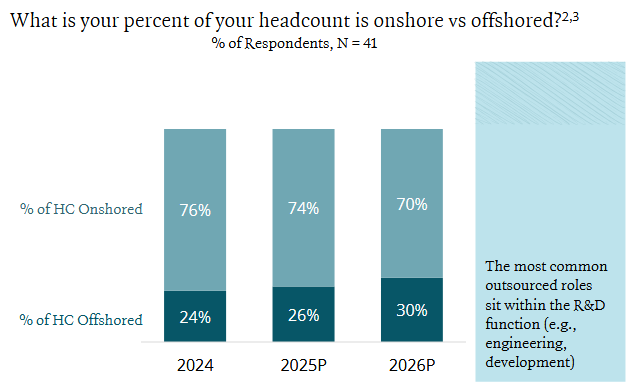

Offshoring

Some interesting data below on percentage of headcount that is offshored. As companies push for efficiency and fundraising becomes more difficult, more companies are pushing more headcount offshore to save money.

From a planning perspective, many companies overestimate the savings from offshoring. There are definitely a lot of savings possible, but just make sure you account for everything (your EOR can usually help with this).

In Summary

Get your leaders bought-in to the financial plan. This is critical.

If the team is the most important factor in a company’s success, then spend the time planning for the right team that reflects that importance.

Don’t overly rely on benchmarks. Use your brain.

Keep your employees happy.

Check out my financial model templates in the footnotes

Footnotes:

Here is the OnlyCFO Headcount Planning Template

Here is the OnlyCFO GTM Pod Headcount Math Model

Find amazing accounting talent in places like the Philippines and Latin America in partnership with OnlyExperts (20% off for OnlyCFO readers)

Nice post.

Jaap Westrik had great coverage on Sales Headcount Planning at our recent event:

SLIDES https://research.cloudratings.com/view/500666740/17

VIDEO https://youtu.be/P6AQPrpAFNA

450k marketing budget per AE 👀

That’s an interesting number to keep track of. That feels like a very well supplied demand engine