Guide to Survive a Recession 📉

Recession + AI will be a deadly combo for many companies

Today’s Sponsor: NetSuite

CFO’s AI Survival Skills

It seems AI is transforming nearly every aspect of finance at lightning speed. As CFO, developing these skills now will set you apart from other finance chiefs by confidently utilizing AI for organization-wide strategy.

Download CFO’s AI Survival Skills to discover the five skills you need to remain indispensable in the age of AI.

The prediction markets are estimating a 55% chance of a recession this year. That’s up from just 18% in January! Trump’s tariffs (and subsequent pauses, reversals, etc) have caused these odds to soar over the last few weeks.

If you don’t have a plan for how to handle a recession when the odds are >50% then you aren’t going to make it.

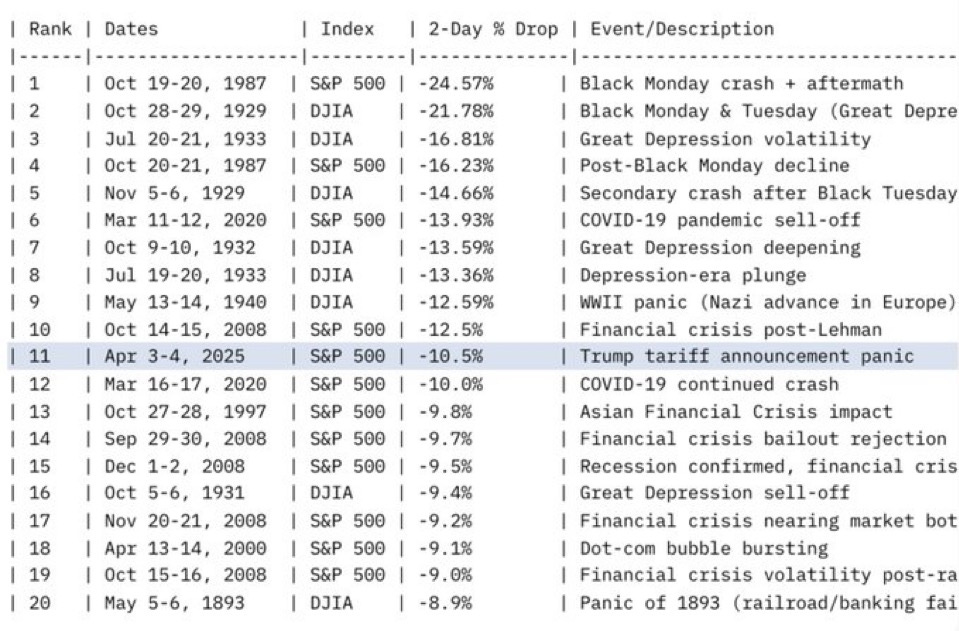

And the stock market has been on a roller coaster over the last few weeks. The stock market volatility has felt like holding on to a meme stock (like GameStop). We experienced the 11th largest 2-day % drop in the stock market this month. And then it was up 12%, down 5%, etc. we are still down 17% from the Nasdaq high just a few months ago.

Volatility & Uncertainty

I am not smart enough to know how the tariffs will play out or the exact impact on the software world but here is what I do know…

Companies (led by their CFOs) will be tightening up spend and being more risk off as uncertainty rises.

Also, investors HATE uncertainty. This is a big reason the stock market has been selling off. Hard to guess what Trump will do next…And this uncertainty trickles down to the private markets:

Uncertainty and volatility rises

Stock prices drop (as do valuation multiples)

IPO window shuts and M&A slows

VC fundraising slows down (since there is less liquidity)

Companies need to stretch runway so spending slows

Other companies also slow spend so your revenue also declines. Therefore you further reduce your spend.

And the viscous cycle continues…

What Companies Can Do?

This is wartime for many companies. AI + recession makes for the perfect storm to kill A LOT of companies that fail to adapt.

But…on a positive, it is also a fantastic opportunity for some companies to win.

Here are some things companies should do if/when we enter a recession:

Leading sales metrics. Wait a bit longer before adding more sales headcount. Don’t keep hiring to your original 2025 plan if leading metrics are weakening. Over hiring in sales can turn into a downward death spiral as there are too many reps chasing too few deals and then the best reps leave. I know your fancy sales capacity model says you need X number of reps to hit plan, but…

CAC Payback Period. AI + recession means I am more uncertain about churn rates than ever before. As a result, metrics like LTV mean a lot less. I want to de-risk my sales by having a short CAC payback period.

Burn Multiple / Cash Runway. this one should be obvious but you want relative burn multiples to decline.

All companies that go out of business do so for the same reason – they run out of money. — Don Valentine (founder for Sequoia Capital)

Accelerate AI Adoption. A recession will accelerate the adoption of AI. There are two opportunities here:

Selling AI to make companies more efficient

Implementing AI to cut costs

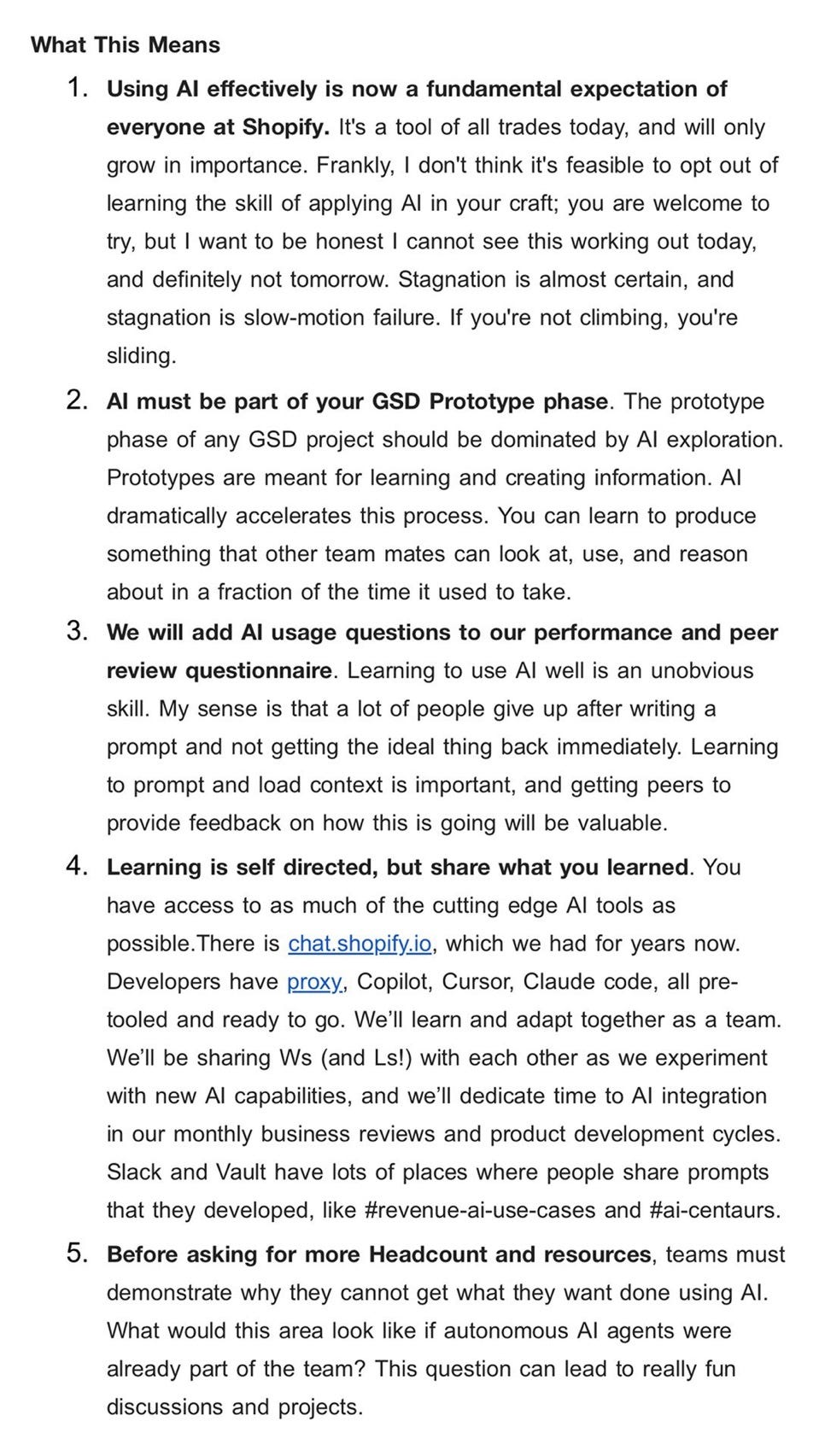

In a leaked Shopify memo we can see how innovative companies are thinking about AI (below is part of that memo). A big theme being - “hire an AI before you hire a human”.

Review tech spend. Two important things:

Re-evaluate tools based on new tech (AI stuff) available. Many companies are able to rip out legacy (more expensive and less efficient) tools when they do this.

The “need-to-haves” become a lot more scrutinized during a recession and many tools will become “nice-to-haves”.

Review marketing spend: We all know there is waste here but it will be even more scrutinized in a recession. Unless you are sponsoring the OnlyCFO newsletter…in that case you should spend as much as possible 😎

Taking less bets. Become more disciplined in the bets you take. Growth companies need to take bets (and a recession will create new opportunities) but take higher conviction bets.

Re-evaluate team. Do you have the right people to help weather the recession storm? I promise you that not all leaders and team members are built for that.

Layoffs: Related to some points above, but a recession also likely means people cuts. And with AI adoption accelerating, the question isn’t just “hire AI before you hire a human”….it’s also “what can AI do that humans currently do”.

More plan updates. Don’t stick to the original plan when everything is changing. Leaders won’t like you taking away approved 2025 budget, but you need to do it. Circumstances have changed.

Product positioning. There are 4 buckets of tools:

Increases revenue

Improves efficiencies

Mission critical (e.g. cybersecurity)

“Candy” - nice-to-have tool that doesn’t really fit into the above groups

“We save you money” becomes a lot more powerful in a recession. Figure out how to position your product as a money saver. Also, a lot of products that we thought were in buckets 1-3 will be exposed as being nice-to-have.

Default Alive

There are two different but related concepts that I think about in the trade-off between growth and efficiency:

Default Alive - not requiring additional outside capital to run the business. This means a company has a path to cash flow positive before the current cash runs out.

Default Investable - a company’s metrics are good enough to raise another financing round even in a recession.

Eventually every company should be default alive (the goal is to eventually make money :). But for fast growing companies it usually means growing slower.

No matter how good your growth is, you can never safely treat fundraising as more than a plan A. You should always have a plan B as well. - Paul Graham

Every company needs a plan B in 2025. Create a plan of what you will do as you see the signs of a weakening environment. A mistake I frequently see is that folks start cutting expenses to get to default alive (or extend runway) based on previous sales targets. But if a recession hits and all tech spending declines then you need to be extra conservative with sales forecasts too. Underestimating the impact to your sales forecast will destroy your cash runway VERY fast.

Just don’t run out of cash!

And if you have a strong cash position (and/or are profitable), you will get some really good opportunities during a recession.

For example, there will be a lot of companies that go out of business or are forced to sell during a recession. Companies that stay disciplined and have a good cash position will be able to take advantage of these deals.

Final Thoughts

Those companies that are disciplined will not only survive a potential recession, but they will be well positioned to take advantage of great opportunities.

AI + recession will be a deadly combination for many legacy companies. Many companies will get destroyed because they didn’t adapt. And some companies will take advantage of the opportunity and come out stronger on the other side.

*Share this with your finance teams (and entire company). People should understand what becomes important during a recession so they are prepared.

Download CFO’s AI Survival Skills to discover the five skills you need to remain indispensable in the age of AI.

Check out OnlyExperts to find offshore finance resources. They have some amazing talent for 20% the cost of a U.S. hire