How Profitable Should SaaS Be?

Gross margins set the profit ceiling, but how much does a cloud company's operating expenses vary? What should operating expenses be?

Today’s Sponsor

I just published a SaaS Chart of Accounts Guide in collaboration with NetSuite. A good chart of accounts is the foundation for all financial reporting so make sure your company is set up properly!

This guide includes a full sample chart of accounts and department listing. It is exactly what I use as a finance leader at software companies.

The theory is that cloud companies can print money at scale with 25%+ free cash flow margins. This profit potential combined with the ability of these cloud companies to scale revenue incredibly fast is the reason why they can receive such high revenue valuation multiples — an average of nearly 16x for the top 10 cloud companies as seen below.

However, not every cloud company is the same in its ability to generate high profit margins. The two components that can vary a lot amongst these cloud companies are:

Gross margins: Revenue less cost of sales (COGS). These are the direct variable costs of selling.

Customer support

Customer success management (maybe)

Infrastructure costs (AWS, GCP, etc)

Dev Ops

Professional services

Operating expenses (OpEx): Costs to run the business

R&D - engineering, product, design

S&M - sales, marketing, and customer success

G&A - finance, accounting, legal, HR, etc

I have previously written an article on the power of high gross margins, so this post is focused on the operating expense piece.

Operating Leverage

Operating leverage is a financial concept that analyzes how a company's cost structure impacts its profitability as sales fluctuate. Operating leverage measures the magnification effect of sales changes on operating income.

Most cloud businesses don’t really have much true fixed costs, but rather a lot of the leverage at scale comes from the recurring nature of its revenue.

The below chart from KeyBanc shows the customer acquisition cost (CAC) ratio. For example, in 2021 it costs $1.20 to acquire $1.00 of ARR on a “blended” basis (new and expansion) and $1.78 to acquire $1.00 of new customer ARR.

Companies in high-grow mode (most new ARR is coming from new customers), the acquisition cost of that revenue is nearly 3x that of existing customers ($1.78 vs $0.61).

As companies mature and revenue growth slows, the percentage of revenue coming from the less expensive expansion revenue increases significantly. The impact of this shift can (and should) dramatically reduce operating expenses as a % of revenue.

A key part of this is the ability of companies to both retain existing customers and have opportunity to expand their accounts over time. If either of these are weak then it will be MUCH harder to meaningfully improve profitability at scale.

Costs to Maintain Customers

As mentioned above, there are two core pieces driving a companies’ operating expenses:

Driving revenue growth through new customers and existing customer expansion

Maintaining existing customers (i.e. what does it cost if there is no growth)

It is somewhat impossible to cleanly break these two up because they are correlated in many ways — for example, in order to keep customers long-term you need to continually innovate which should also drive new customers.

But understanding the theory of the minimal costs required to maintain customers is important because it helps you understand the maximum profit potential of the company and the directional goal for when growth slows.

So what are the costs required if the company decides not to grow at all, but wants to maintain its existing customers?

Cost of Sales (aka COGS)

This is the easy one because it represents the direct variable costs of servicing a customer (things like infrastructure cost, customer support, etc).

R&D Maintenance

Theoretically this would be the minimum R&D activity to just keep the existing customers based on the solution purchased. This would include things like bug fixes, maintenance, tech debt, etc. However, churn would likely increase if you don’t innovate at all.

Customer Management

There is some base level of costs to just maintain relationships with existing customers. This may be a customer success manager and/or an account manager. You wouldn’t be able to 100% remove these people just because the company isn’t growing.

Marketing

While most of marketing in the high-growth phase is targeted to new business, there is certainly some overlap and also targeting of existing customers to continue to expand their accounts — increase NRR (net revenue retention).

G&A - This would be the back office support needed to maintain existing customers and business operations.

If you take all of the above costs, it will show you how profitable a company could be if you shut down all new growth opportunities.

What impacts the efficiency in operating expenses?

There are two primary factors that impact the level of operating expense efficiency:

Revenue scale

Revenue growth

Revenue Scale

The higher the revenue the higher the leverage in operating expenses.

For example, below is the G&A expense as a % of revenue for public cloud companies. While the distribution can be quite large for the earlier stage public companies, G&A typically drops to below 15% once a cloud company reaches a significant revenue scale.

*Note that the below includes stock-based comp (SBC) so that likely drives some variability at the early stages

This happens because of the efficiencies that come with scale. After you have a fully built out G&A team (accounting, finance, legal, etc) those costs shouldn’t move proportionally with revenue.

Revenue Growth

The faster a company is growing revenue the higher OpEx as a % of revenue will be. This is particularly true for the S&M costs as I illustrated above because of the much higher costs to acquire new business vs expansion. Also, during periods of high revenue growth companies frequently need (or at least think they need) to hire a bit ahead of current revenue to make sure they can support the growth.

There is also the impact of accounting revenue being a lagging indicator for cloud businesses. This is amplified for high growth companies. For example, a company doubling in ARR from $100m to $200m in a year may only show $150m of accounting revenue for the year, but it’s at a $200m ARR scale. Compare this to a company that grew from $140m to $160m ARR and also shows $150m of accounting revenue. Both have the same accounting revenue, but the first company is going to have much more complexity and likely a higher OpEx because of its ARR scale and growth rates.

What should a company’s OpEx be?

Like most answers, it depends.

Below is a list of public cloud companies with the highest revenue scale (sorted by revenue growth). These companies are mostly more mature with slower growth.

As you can see above, the difference in total OpEx % between the high growth bucket (top 10 highest growth cloud companies) and scaled revenue companies (companies above) is 24 percentage points, which has a huge impact to profitability.

S&M - 18 percentage points between high growth and scaled revenue

G&A - 9 percentage points between high growth and scaled revenue

R&D - somewhat surprisingly R&D doesn’t fluctuate too much as a % of revenue as a company scales. In my opinion, the more mature (high revenue, low growth) should be spending less on R&D.

There are a few things worth pointing out:

S&M has the biggest change between high-growth and mature companies because of the costs to acquire new customers discussed earlier. This is why customer retention is the single most important factor in the long-term profit potential in a cloud business.

Gross margins become clearly critical when looking at how profitable a mature company can become. Despite Twilio having nearly the lowest OpEx % of these companies, it has by far the lowest free cash flow (FCF) margins because of its 49% gross margins. The big difference in gross margins makes it really hard to generate more free cash flow.

Atlassian has the lowest S&M spend, but by far the highest R&D spend. This is because of the PLG (product-led growth) sales motion of Atlassian versus most of the other companies listed above being more sales led. Understanding the business context is important because Atlassian may look incredible efficient from a customer acquisition perspective since its S&M is so low, but when combined with R&D (which powers a lot of its sales) it looks like an entirely different story.

Operating Expense Data

Over the past two years (March 2022 to March 2024) there have been 60 out of the 75 cloud companies in this data set that have improved their operating expenses as a % of revenue, 5 stayed flat, and 10 increased their OpEx %. There has been a strong push to become more operationally efficient since 2021 so it makes sense that most have dramatically improved.

Some have certainly improved more than others. Zscaler’s improvement is particularly impressive because they already had relatively low OpEx in 2022. Now in 2024 Zscaler’s OpEx % is nearly half of most of these other companies while still growing revenue at similar speeds.

Below are the companies with the top 10 lowest OpEx %. Most of these are more mature companies with slower revenue growth as I would expect. Vertical software (like Veeva) can be extremely efficient.

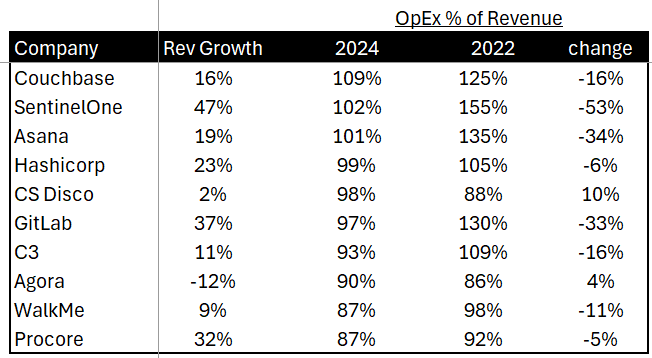

Below are the companies with the top 10 highest OpEx %. Other than SentinelOne, most of these companies aren’t growing that fast. High expenses with mediocre revenue growth. While most of them reduced their OpEx % fairly significantly since 2022, many of them still seem way too high given their revenue growth.

Summary

Not all cloud revenue is created equal. Gross margins set the ceiling on how profitable a company can become as these costs are generally directly variable with revenue. A cloud company with 50% gross margins (Twilio) will never be as profitable as one with 90% gross margins (Autodesk).

Operating expenses are the next group of expenses. Unlike gross margins, operating expenses should meaningfully decrease as a % of revenue as a company matures and revenue growth slows. Some companies are much better at achieving this than others.

Being efficient with operating expenses can be a major strategic advantage as it enables the company to further capture growth opportunities (or return money to shareholders).

Pay attention to a company’s operating expenses and a company’s ability to reduce OpEx in the face of slowing growth. Many people think that every cloud company should be able to decrease operating expenses to the same % of revenue at scale and generate those beautiful 25%+ FCF margins….but it unfortunately isn’t true.

Footnotes:

Grab my SaaS Chart of Accounts Guide and get your books set up the right way

Join the community by becoming a paying subscriber and get access to me and other finance leaders in software companies! Ask questions, get answers, and communicate with your peers.

Sponsor OnlyCFO Newsletter and reach 17k+ CFOs, CEO, and other leaders in the software industry.

**For educational purposes only. Nothing here should be considered investment, legal, or tax advice

One thing that can blur the line when looking at Opex % is whether it includes the amortization of software development costs. Some of the names in these examples include it in cost of revenue and others in opex (and some in both). It would be nice if FASB would finally put a clean stake in the sand as to where it should go.