How To Hire Internationally 🌎

Pros, cons, costs, and "gotchas" when hiring internationally

Today’s Sponsor: NetSuite

I created an OnlyCFO guide for financial dashboard reporting in partnership with NetSuite. This guide is exactly how I have built great financial dashboards for my leadership team and board.

Get my free guide and template for financial reporting dashboard 👇

I have been talking to a lot of people over the past month about hiring internationally. The conversations have been kicked off for 2 primary reasons:

Cost savings - recession fears, need to extend runway, efficiency, etc

Competitive dynamics - many new VC-backed HR startups

have emerged onto the market in the past few years and several

people have asked for recommendations for global hiring

platform alternatives.

Because of the increased interest, I reached out to Remote to dive deeper and leverage their data.

I have also hired a lot of international employees myself and while it has gotten significantly easier there are still lots of things to watch out for.

Keep reading for my list of pros, cons, costs, gotchas, etc. 👇

How to Hire Globally

There is a fear of international compliance, HR, tax, etc. And for good reason…there is a lot of different opinions based on risk tolerance and it can be complex to navigate.

I think of hiring in foreign countries in terms of three levels:

Hire as contractors

Cheapest and easiest to manage as you just pay like any other contractor. You will pay a higher hourly rate but don’t pay all the full-time employee burden costs.

Hire under an employment of record (EOR)

As you have more full-time contractors then hiring under an EOR will prevent compliance issues. This is more expensive than #1 because you pay them as employees (taxes, benefits, etc) and there are also EOR fees. This is what makes a company like Remote so attractive since it pushes out having to set up an entity a lot longer.

Set up a legal entity and directly employ the hires

Once there is a critical mass of employees you should consider setting up your own legal entity and employing everyone directly. This can be very time consuming and expensive, but at some point it will be required to stay compliant.

The timing of when to move between these levels can be country specific. For example, some countries (like the U.K.) require setting up an entity much earlier than other countries.

If you ask a lawyer, then they will probably say that you shouldn’t hire people internationally as contractors if they are full-time (and you should start at #2) and that you should set up an legal entity much earlier. But…A LOT of international hiring is done via contractor status and EORs can take you pretty far.

OnlyCFO Rule of Thumb:

The below are my general guidelines (not tax/legal/etc advice :) then I check for country specific circumstances:

A few contractors in a country is probably fine

Past a" “few” contractors I move them to an EOR

Past ~20 EOR employees in a specific country I consider spinning up an entity

Employee Experience:

Consider the pros/cons of moving between these levels for employees. Each time you move levels there will be issues that come up. Some employees will ALWAYS complain.

Will you take contractors hourly pay down when you move them to an EOR since they get benefits now? I promise many won’t like that…

When you move to an entity will the benefits be as good? Your company is likely much smaller than the benefits a global EOR provider can give so the benefits will either be worse or more expensive.

If you have a plan to quickly hire a ton of people then consider starting in level 2 (EOR) or even level 3 (legal entity) to avoid the friction around changing compliance levels.

Offshoring Cost Savings

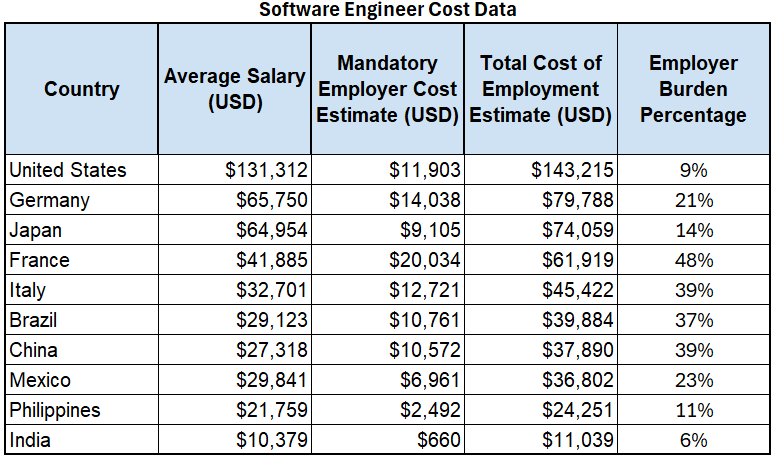

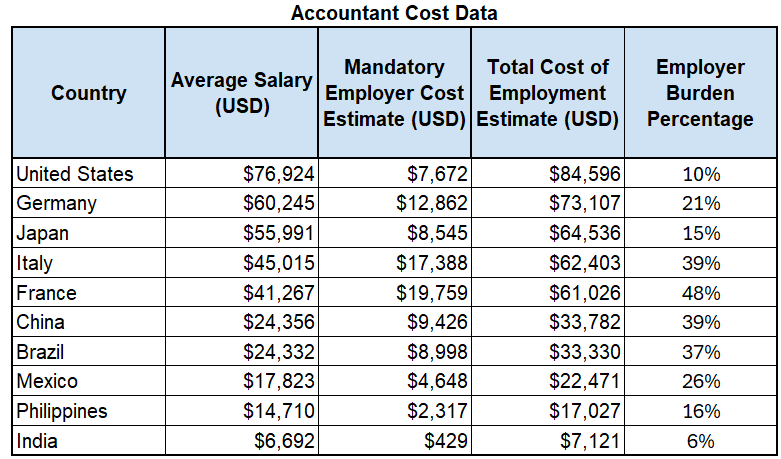

The budget savings from building global teams can be significant. Below are some example employee cost differences for a few countries for a junior software engineer and accountant.

You can save 80%+ on headcount depending on what country you hire in.

‼️Warning: Be careful of other employer costs on top of basic salary (see “employer burden percentage” column above). This is the mandatory employer cost divided by average salary.

These can vary A LOT between countries and can significantly change the cost savings math. Examples include: insurance requirements, severance accruals, taxes, required bonuses, etc.

For example several countries require additional month bonuses:

Philippines: 13th month pay is mandatory.

Portugal: 13th and 14th month salaries are common (paid in June and December).

Italy: 13th month is standard, 14th is common in certain sectors.

Brazil: 13th month mandatory.

Greece: Often includes 13th and 14th month payments.

Remote has a Employee Cost Calculator that shows the total cost of employment for employees in different countries globally.

As you can see in the table above, France has an insane employer burden cost of 48% while India only has 6%. Make sure to consider these additional costs when evaluating where to expand globally.

Other Considerations

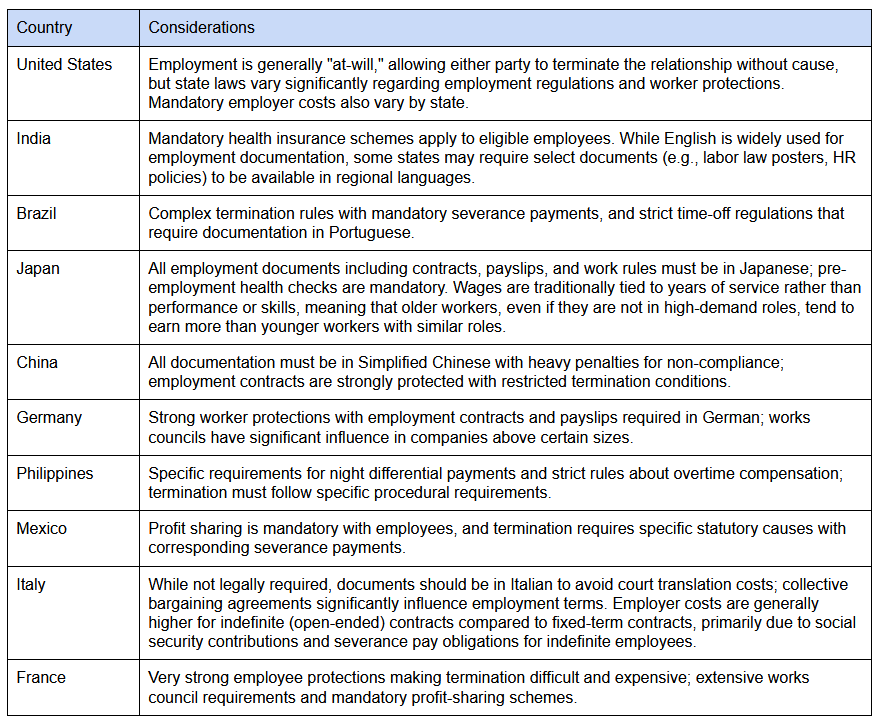

Make sure to talk to someone with experience hiring into the countries you are considering. Some countries (particularly in Europe) make things very difficult.

For example, I would want to be VERY sure that a candidate located in France is a great fit and has unique experience, given how hard it is to fire someone there.

Below are a few other country specific considerations and ideas of things you should be thinking about when evaluating compliance and where to hire internationally.

**NOTE: Not legal, tax, or payroll advice.

Footnotes:

Check out OnlyExperts to find offshore finance resources. They have some amazing talent for 20% the cost of a U.S. hire

Check out the OnlyCFO Financial Reporting Dashboard Guide & Template

*Remote is a sponsor of OnlyCFO. Appreciate them helping with this article → check out their service: Remote

Thanks for sharing, a really good overview. A good follow-up would be to tackle the corporate tax implications of hiring in other countries (e.g. what this means for IP residency and permanent establishment issues). Cost savings and operational considerations are just one facet of a very complicated issue.

Very interesting comparison of employee costs between countries. Also, a nice summary of key considerations for hiring in each country.