IPO Floodgates Opening?

Will ServiceTitan open the IPO floodgates? It may be the exact IPO we need to give others the courage to follow their path.

Today’s Sponsor: Leapfin

Webinar: Budget for better accounting in 2025 with Help Scout CFO Shawna Fisher

Leapfin is hosting a timely webinar to help you budget more strategically. In 2025, prepare to finally address the underlying issue that slows every close, obscures rev insights, makes audits painful, and crushes your teams: your accounting data. Register now! You’ll learn:

why your accounting data is the problem

how CFOs and controllers can ace collaboration to budget for better outcomes

how Help Scout uses Leapfin to find and fix revenue inconsistencies

Plus, you’ll get a critical tip about investing in AI for accounting.

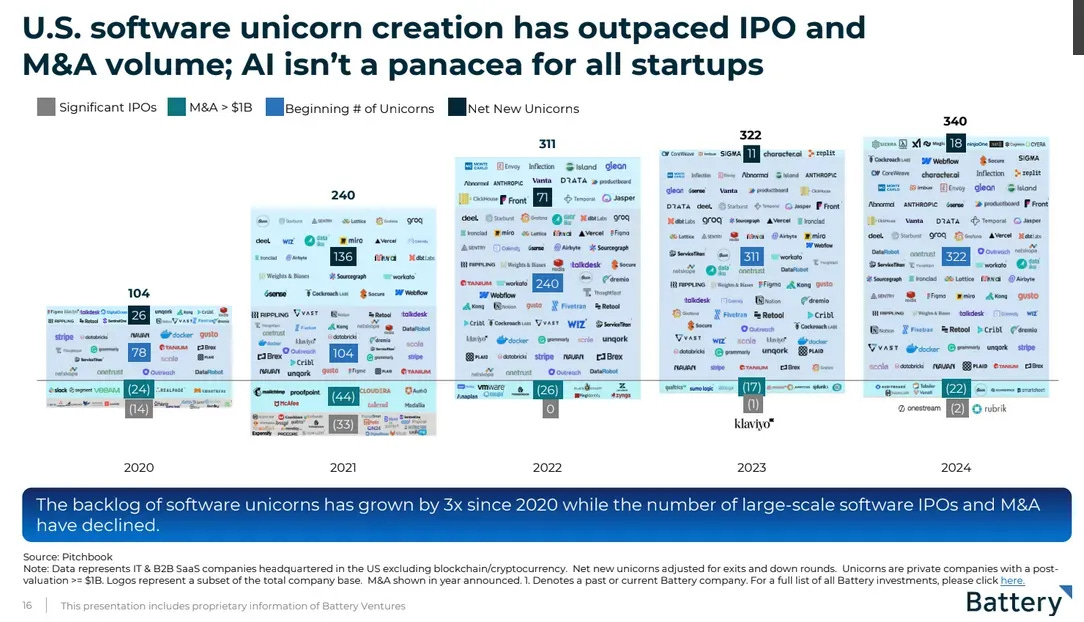

The IPO Drought

The drought of cloud IPOs over the past three years has been brutal for employee and investor liquidity. There are SO many late stage unicorns that have been stuck in IPO limbo. With only 3 “significant” cloud IPOs in three years, we have been anxiously waiting for more IPOs to help break open the IPO markets and pave the way for more cloud companies to take the leap.

ServiceTitan is hopefully doing that for us now. Last week they filed their S-1 document to be able to IPO.

This post is not another S-1 deep dive, but rather a look at the current IPO market and what the ServiceTitan IPO might mean for the many other late stage companies anxiously waiting for their turn.

ServiceTitan might be the perfect IPO to give many others the courage to also IPO if it is a successful IPO.

Keep reading on what the ServiceTitan IPO might mean for others…

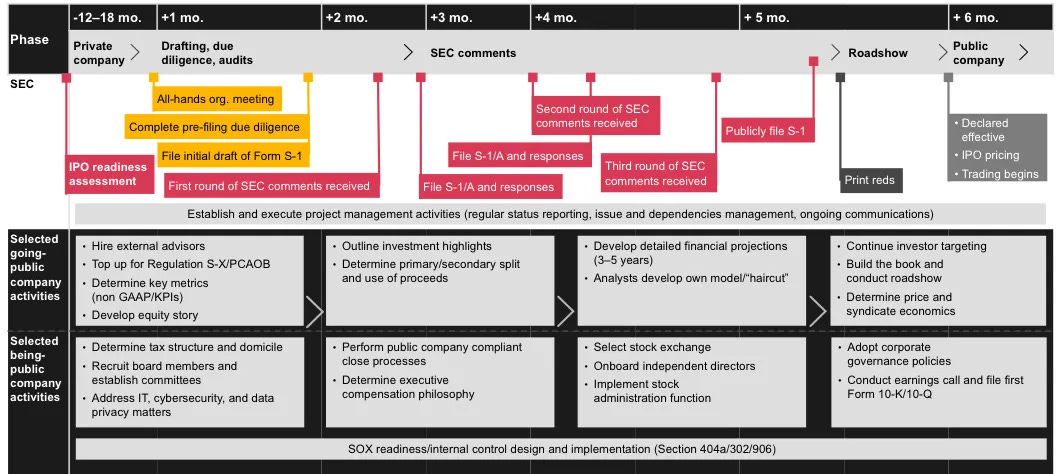

Timeline & IPO Prep

Initial S-1: Typically after publicly filing an S-1 a company is aiming to go public in about 3-4 weeks, so ServiceTitan is looking at a December IPO.

Roadshow: The roadshow takes ~2 weeks and this is where the company executives fly around the world and pitch institutional investors on the IPO.

At the time an S-1 is publicly filed most of the hard IPO prep work is done. The previous 12-18 months are where most of the heavy work actually takes place (see PwC’s IPO preparation timeline guide below).

Below are some of the things that must be done from a finance perspective in preparation of an IPO:

Build out a public company team for finance, accounting, etc. You need people with the right experience leading up to the IPO.

Auditors must review all quarterly and annual financial statements. This requires lots of prep work from the internal accounting team.

S-1 document must be written and reviewed. This isn’t as easy as it sounds. All numbers have to be carefully reviewed by ServiceTitan, the auditors, and legal. The team must carefully craft their message and choose the right key metrics.

Act like a public company for 4+ quarters. Companies preparing to go public need to get some reps in before actually going public. Ensuring they can accurately forecast with a “beat & raise”, perform mock earnings calls, etc.

Prepare the roadshow deck and presentations.

Build a very strong forward financial model. It’s important to go public with confidence in forecasting and during period of expected strong revenue growth and endurance.

Will ServiceTitan Open the IPO Floodgates?

ServiceTitan is only the 4th cloud IPO since 2021 so many companies are anxiously waiting to see how it performs with the expectation that a good performing IPO will pave the way for many more. And there are A LOT of private companies hoping to go public soon.

So based on ServiceTitan, what will it take to IPO?

After each cloud company that has gone public (OneStream & Rubrik) we wonder if now is the time for the IPO window to really open. But the ServiceTitan IPO might be the best litmus test for the public market’s appetite for IPOs so far because of its somewhat mediocre metrics.

A lot of private companies that have been waiting around also have pretty good metrics, but they look very different than the 2021 IPO class. So if ServiceTitan is successful then it may give many others the confidence to also IPO.

ServiceTitan Financial Snapshot

Scale

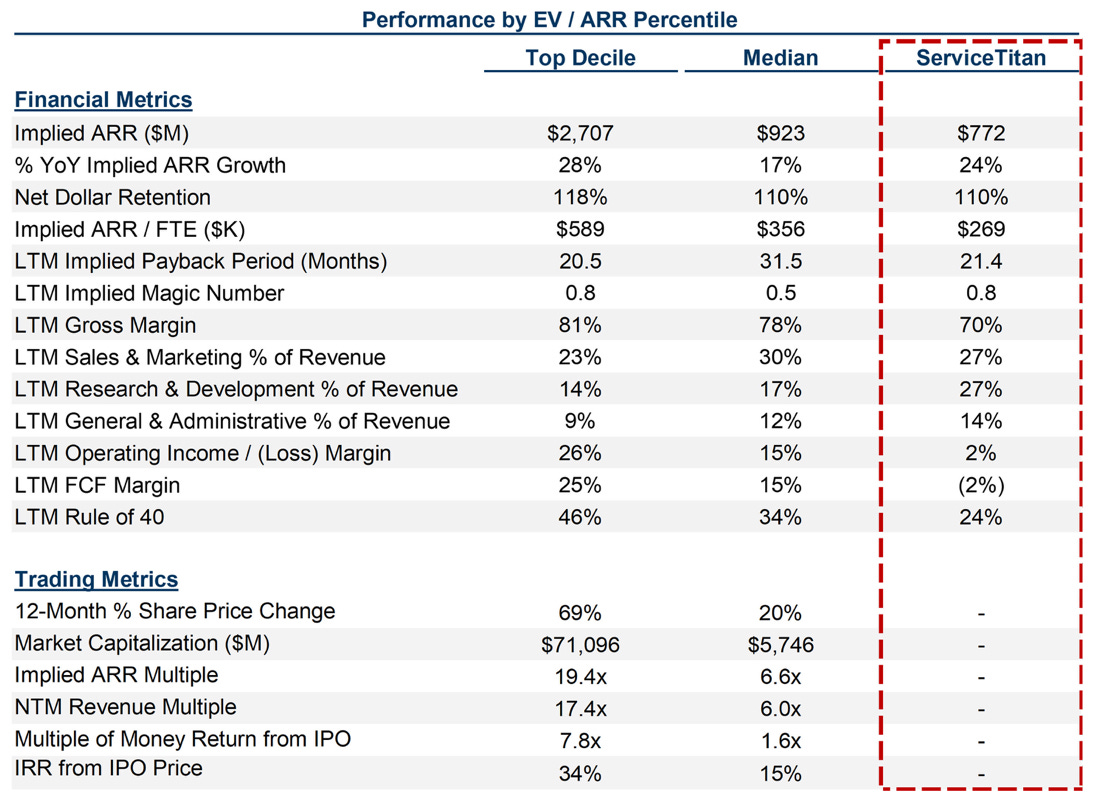

While certainly not consensus, many people believe that cloud companies need ~$500M in revenue to go public today. ServiceTitan is at $685M in LTM revenue. For reference, the other 3 IPOs over the past 3 years went public with $500M to $800M in ARR…so this benchmark has held up.

Revenue Growth

Amongst public cloud companies, ServiceTitan has top quartile revenue growth (barely but it still counts).

BUT…it’s also important to analyze the revenue growth in relation to the revenue scale. While ServiceTitan has good revenue growth, it is below the median sized public cloud company.

I think ServiceTitan will IPO with close to the minimum level of acceptable revenue growth for its scale. Anything much lower than 24% at its scale would be really hard to get investors very excited about, especially when you consider ServiceTitan’s other metrics (keep reading).

GRR & NRR

95% GRR and 110%+ NRR for the past 10 quarters is one of ServiceTitan’s strong points…especially considering the segment that they sell into. While revenue growth (at its scale) is a bit mediocre, the stickiness of ServiceTitan is what may get investors excited.

The name of the game in cloud investing right now is durable revenue growth and that starts with high customer retention. Lots of cloud companies are going to struggle over the next couple of years because of customer retention issues so those companies that can prove their revenue is more durable should receive a valuation premium relative to their metrics.

Profitability & Rule of 40

While ServiceTitan has made a lot of recent improvements, their biggest issue is profitability. They are just barely turning breakeven at $700M in revenue.

And when you look at it with their mediocre revenue growth (relative to their scale), ServiceTitan’s Rule of 40 Score is not very good. Almost all of the companies around their Rule of 40 Score trade at a lower revenue multiple.

ServiceTitan vs Public Benchmarks

When looking just at ServiceTitan’s financial metrics, it seems like a pretty mediocre IPO candidate. Don’t get me wrong, getting to $800M ARR is a huge achievement…BUT it’s revenue growth and profitability for its scale is not that exciting for investors.

See the below public cloud company comparison that Meritech put together of top decile, median and ServiceTitan.

ServiceTitan’s somewhat mediocre metrics is why it may prompt a ton more cloud companies to consider IPO’ing now IF the ServiceTitan IPO is successful. A lot of late stage private companies have paused IPO plans as revenue growth quickly slowed in 2023 through today, but if this is the new normal (and ServiceTitan can do it) then it may give others the courage to also move forward.

Pressured IPO?

Lots of companies are feeling a bit more pressure to IPO today as investors and employees want liquidity…especially those companies that have been planning to IPO for 2+ years but put on the brakes given the weak IPO market.

ServiceTitan is under a bit more pressure to IPO though given its “dirty term sheet” it accepted, which is maybe partially why they are pushing to IPO now.

The company has raised ~$1.4B. In 2021, ServiceTitan raised $200M at a peak $9.5B post-money valuation. But most recently, in November 2022 they raised a Series H at a $7.6B valuation that included a compounding IPO ratchet structure.

An IPO ratchet gives investors downside protection if the company raises or IPOs at a lower valuation - investors receive more shares as if their investment was done at the new lower price. But if the IPO is above the investor’s price of the ratchet round then there is typically no impact. Both investors and the company want this latter outcome.

ServiceTitan has a “compounding ratchet” though. This means that after 1.5 years from the Series H, May 2024, the “compounding” part of the ratchet kicks in and the hurdle price begins to grow by 11% annually, compounding quarterly.

This ensures that ServiceTitan is heavily incentivized to IPO as soon as possible to avoid continued dilution.

Based on most early estimates though, it appears that ServiceTitan’s ratchet structure will kick in and add dilution because its IPO valuation will likely be lower than the hurdle price ($7.6B valuation + the impact of the compounding).

* Structure like this can be really dangerous so be careful before accepting it — may not be worth the higher headline valuation. Everyone is optimistic that it won’t matter (because the future valuation will be much better), but in a downside scenario these terms can be very destructive.

Final Thoughts

I hope the ServiceTitan IPO does really well and it encourages many other late stage private companies to also IPO.

While the ServiceTitan financial metrics aren’t that exciting relative to benchmarks, I am bullish on vertical software compared to most horizontal software today. And particularly in the industry that ServiceTitan is serving. For that reason, I do think their revenue and other growth metrics might be more durable than most software companies and maybe that is something investors will appreciate and pay a premium relative to their current metrics. But ServiceTitan really needs to show that revenue growth is durable AND that they can continue to significantly improve profitability at the same time.

🫡 Good luck ServiceTitan team and I hope other IPO candidates follow your path soon!

Footnotes:

Sign up for the OnlyCFO webinar series! Our first one is on how your annual planning might break in 2025.

Check out this IPO guide 👇

Send an email to onlycfo@onlycfo.io if you want to be a sponsor of the OnlyCFO newsletter or my new webinar series. Get in front of 28K+ finance/accounting professionals

Check out OnlyExperts to find offshore accounting resources. They have some amazing talent for 20% the cost of a U.S. hire.