Is Customer Success COGS or OpEx? | Understanding Gross Margins

Accounting for customer success and the importance of gross margins

Join the other 13K+ subscribers reading my newsletter. I write 1-2 articles per week on the software industry.

Investors and operators obsess over gross margins and rightfully so given its impact on long-term profitability. But there is diversity in what makes up gross margin which causes bad benchmarking, comparisons, and valuations.

In this post I will cover everything that makes up gross margins with a particular focus on customer success. I have talked about customer success a lot, but the topic of its income statement classification deserves a post because this is the most debated area within gross margins.

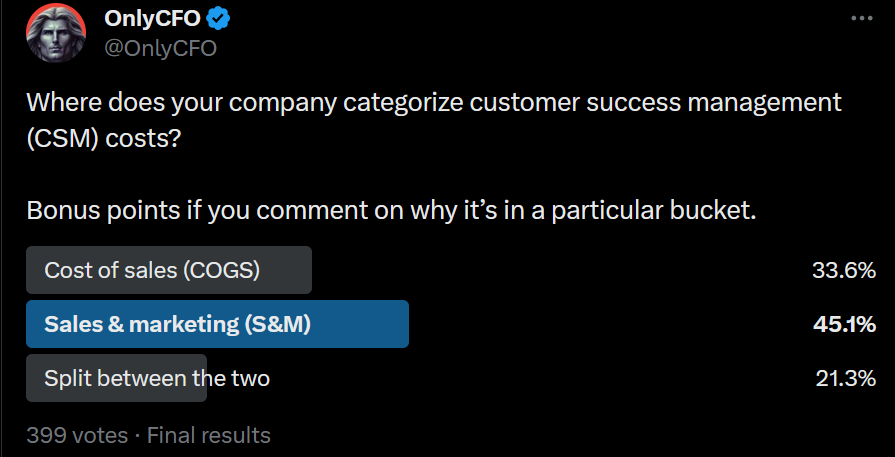

I ran the below poll and received a lot of great comments….it is clearly a confusing area.

What goes into gross margins?

Gross margin tells you how much (either as a $ or % of revenue) profit you have after subtracting "COGS” from revenue. COGS stands for cost of goods sold, which is a bad name for the expenses associated with selling software, but everyone uses this shorthand. On financials it will always say something like “costs of sales” or “cost of revenue”

In the formula below gross margin is expressed as a percentage of revenue. Viewing gross margin as a percentage of revenue is generally more useful because then it is comparable across benchmarks and other companies.

Below are the typical expenses that are included in COGS (and gross margins):

Professional services

Support

Customer Success Management (maybe)

Infrastructure costs

Dev Ops

Of the above items within COGS, the first three commonly fall under the broader “customer success” bucket. This is why when we talk about customer success expense categorization we must be clear about what we are referring to.

Professional Services = COGS

Also known as “PS” or “ Pro serv”. These are the folks who implement the software tool, provide customization to the tool, training, and other similar types of services. These are services that are typically defined in a contract with contracted deliverables and they are usually paid for separately from the software tool (earlier-stage companies often give professional services away for free though).

There is essentially no debate that professional services should be included in COGS.

Pro Tip: Professional services gross margin should almost always be a separate line if there is a material amount because the gross margin profile and scalability of professional services is VERY different than subscription revenue. Investors really just care about subscription revenue.

Support = COGS

Basically every software company has a support function of some kind. These are the folks who handle all inbound questions from customers for technical support, bug issues, etc. There is almost always a contractual requirement around the level of support that will be provided. It is usually included in the overall software price but sometimes companies have a premium support tier that you must pay extra for.

Similar to professional services, no one debates that support should live in COGS.

Customer Success Management = It Depends

Customer Success Management (CSM) is where all the debate and diversity in accounting practice lives.

This issue is driven by the below:

Lack of understanding of what CSMs are actually supposed to do

Misuse of the CSM title because it sounds better

Company stage causes CSMs to be utilized differently. Example: Early stage companies often use CSM to fill product gaps and act like support

I am not here to explain the role of CSM, but rather explain how it should be accounted for based on how a company utilizes its CSM org

Given CSM teams can account for 5-10% (or even more) of revenue getting the income statement categorization right is important.

Infrastructure Costs = COGS

This should be straightforward. This is the AWS, GCP, Azure infrastructure costs a company has to host customer accounts. There may also be other 3rd party software a company uses to integrate or provide additional services to its customers that should also be included in COGS.

DevOps (internal engineering) = COGS

These are the folks that are keeping the production environments up and running. These folks are frequently not included in COGS in the early days of a company because an engineer is just doing this part-time and companies don’t want to allocate their time to COGS. But eventually there is a separate team for this which should be included in COGS.

Where Should CSMs be Categorized?

CFOs: Want CSMs to be categorized as sales & marketing (S&M) so gross margins look better because investors care a lot about high gross margins.

Auditors: In my experience unless CSMs are clearly doing one or the other then the auditors won’t fight you on where the CSMs are categorized.

Investors: While they like to see high gross margins, they want to see comparability to other companies. And they need to understand how all expenses (COGS and OpEx) scale with the business.

How CSMs should actually be categorized depends on what the CSMs are actually doing.

Let’s start with the activities that CSMs may perform that should be categorized as COGS:

CSMs acting as support but with a fancier title

Performing customer training

CSMs filling product gaps

Ensuring the product and service delivers on the contract and customer expectations

When CSMs are doing what they are designed to do then I think they should be categorized in S&M (if not 100%, then at least mostly in S&M).

The below activities that CSMs do should be in S&M:

Drive expansion. New revenue through expansion is obviously a sales activity. Maybe CSMs are comped on NRR, have an expansion quota, or simply have an objective of finding expansion opportunities that they then pass to sales reps. They do not need to hold a quota or expansion target though….it just matters what they are doing.

Drive adoption. Under a seat-based pricing model, increased adoption often does not directly drive revenue. Customers may just adopt new features or get unused seats utilized. But under a pure consumption model it certainly drives increased revenue. The seat-based model still drives revenue though but it’s less direct through higher retention and expansion as more value is realized.

Developing relationships. CSMs build relationships throughout the customer. The outcome of these relationships are increased retention and expansion.

Drive retention. Many people say that if CSMs are retention focused and comped only on GRR then that is COGS. I disagree that it is a black and white decision. It depends on the activities they are doing and not the direct goals. Lots of things can drive retention — better product experience, stronger relationships, higher adoption, really great support, etc. All of these things should not be categorized the same though. Retention is the outcome, not the activity. If the CSM is performing the activities that I labeled as COGS then that is your answer, mostly everything else I would argue is S&M.

CSM Categorization Test

Here is my hack for people debating whether their CSM team should be COGS or OpEx:

If you had to eliminate your entire CSM function, then who would take over their responsibilities?

If it’s your support or professional services team, then it’s COGS. If it’s your sales reps (or someone else in sales) then it’s S&M.

As I said above, when CSMs are doing what they are designed to do those skills align much better to sales reps than support folks.

There are many companies (Snowflake as a prime example) who have disbanded CSM teams and put those responsibilities on their sales reps. These companies will theoretically have more sales reps than those companies with CSMs since they are managing customer accounts. But I promise you that none of those companies are allocating any sales rep time to COGS.

Similarly, if your “CSMs” are doing support work then there is no way you would have your sales reps take over if you got rid of the CSM team.

Why Gross Margins Matter

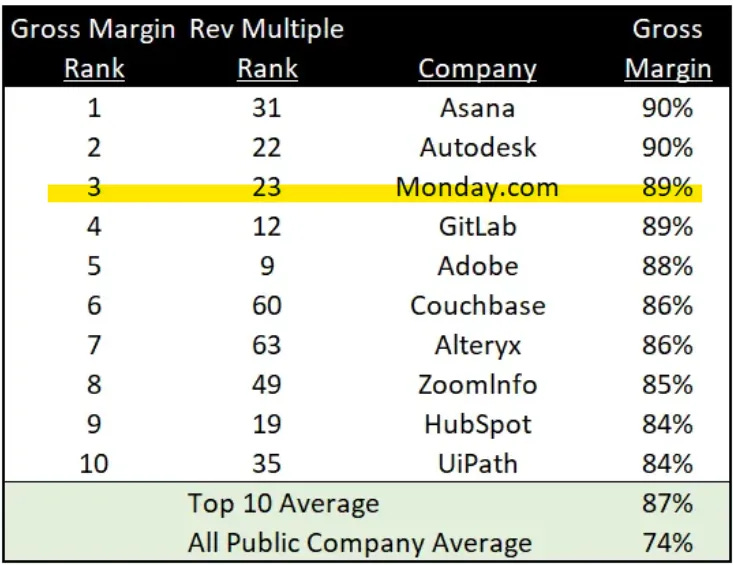

The reason investors care so much about gross margins is because it is supposed to represent a ceiling on a company's profit potential. Cloud companies can be so richly valued relative to revenue because they should be able to generate 20%+ free cash flow (FCF) margins at scale with some companies able to generate significantly more as seen from one of my prior posts below...

Incrementally improving gross margins is significantly harder than improving OpEx at scale as gross margins represent the direct and ongoing costs of providing the service.

Ultimately it shouldn't matter if CSMs sit in COGS (and therefore impact gross margins) or sit in OpEx and just impact total income. The long-term FCF potential result is the same either way assuming that CSMs will scale with the business in the same way. Investors just need to understand how much leverage is in gross margins and OpEx.

But nearly every investor will see a company with 75% gross margins and 50% OpEx as better than a company with 70% gross margins and 55% OpEx because they assume that OpEx of the two companies can be reduced to the same amount, but gross margins are basically fixed.

Also, if customer success management is actually S&M then it should decrease as a percentage of revenue over time because new business as a % of ARR decreases. If you find that it stays flat as a percentage of revenue then perhaps it belongs more in COGS.

Takeaways

Here are my two key takeaways:

Gross margins can be inconsistent between companies, so you need to understand what is being included/excluded. This will help investors understand how much leverage is in gross margins vs OpEx compared to other companies.

Where CSMs are categorized depends on their underlying activities. If you had to fire the CSM department then who would take over? If sales, then your CSM team should be in S&M and if support then they should go to COGS.

Feel free to share your thoughts if you disagree.

📚 Other Reading

2023: Year of Customer Success & Gross Churn

Do Customer Success Teams Add Value?

How to Ready an Income Statement - Software Edition

Other Interesting Charts

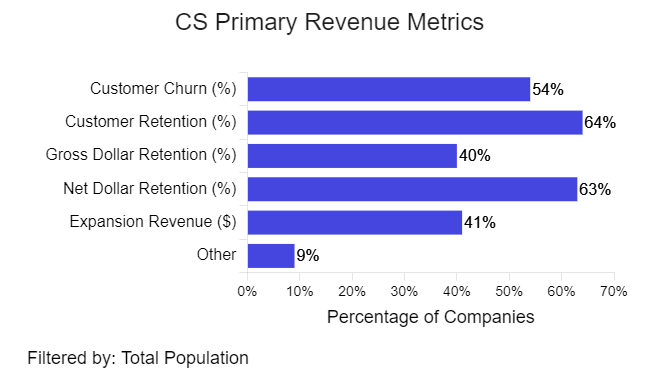

Benchmarking data is from benchmarkit.ai

Even though bringing into COGS hurts the gross margin (as you correctly argue -- something that doesn’t “look good”) I feel that the S&M company expense should record activities focused on selling and marketing as opposed to satisfying and renewing.

I like the idea of the recurring expenses of satisfying and renewing to help in COGS.

When you think about the exercise of estimating LTV and CAC -- something that’s done wrong so many times, since people make bad assumptions about churn especially, but also about what the ongoing costs each year are -- putting these ongoing renewal costs in COGS feels smarter /better.

Nonetheless, if I were the decided and CFO -- in this world, I wouldn’t put 80% in COGS, as you would look “worse” than your peers.

And I think ultimately m, you’re trying to steer people to make the right choices given the facts and comparable of today.

So yeah I suppose I wouldn’t “advise” people to put 80% into COGS today unless we could get everyone else to treat it the same way (of course that’s impossible!)

Great topic! Once again, you and I are so aligned in what interests us and what we feel needs to be discussed and better understood!

Here is where I come out:

All activities - and related expenses -- associated with ongoing maintenance, support, satisfaction and ultimately renewal of existing customers -- even if the CSM is spiffed on the renewal -- should be in COGS. I suspect in most companies this is 80% or more of the CSM expense.

All activities focused on upsell/expansion should be in S&M. I’d be ok if we only put commissions paid to CSMs associated with such upsells -- although you could argue that if substantial time was dedicated to such activities that you should allocate some of their base salary to the S&M line.

So -- it should be split in most cases. Not 100% in one bucket of the other.