Is SaaS Math Broken?

Cloud isn’t dead but companies need to adjust to the new realities if they want to be successful.

Today’s Sponsor: Vertice

Did you know – businesses are wasting 385 hours every year in meetings alone to renew software contracts?

Senior leaders in finance are bearing the brunt of this software burden. Finance departments have the highest share of software contract owners (36%).

Vertice analyzed data from 1000 companies to understand the time they put into SaaS and cloud spend management. Read more of the insights here.

SaaS Math

TLDR: SaaS isn’t dead, but companies must adapt for the new unit economics to work. Those who don’t adapt (keep reading for what must change) will be the ones that die because the math will break.

The critical assumption that has made SaaS unit economics work is strong customer retention rates. Without continued strong retention the math for most VC-backed cloud companies breaks.

The math breaks because it depends on the high margins associated with the recurring revenue from existing customers to generate huge free cash flows as a business matures. The only way to get to the juicy 25%+ FCF margins is through strong customer retention (and expansion).

We can understand this better by starting with the CAC payback period. The CAC payback period is a risk metric that shows how long it takes for a company to return its sales and marketing (S&M) cost (i.e. the point a company breaks even on the cost to acquire a customer).

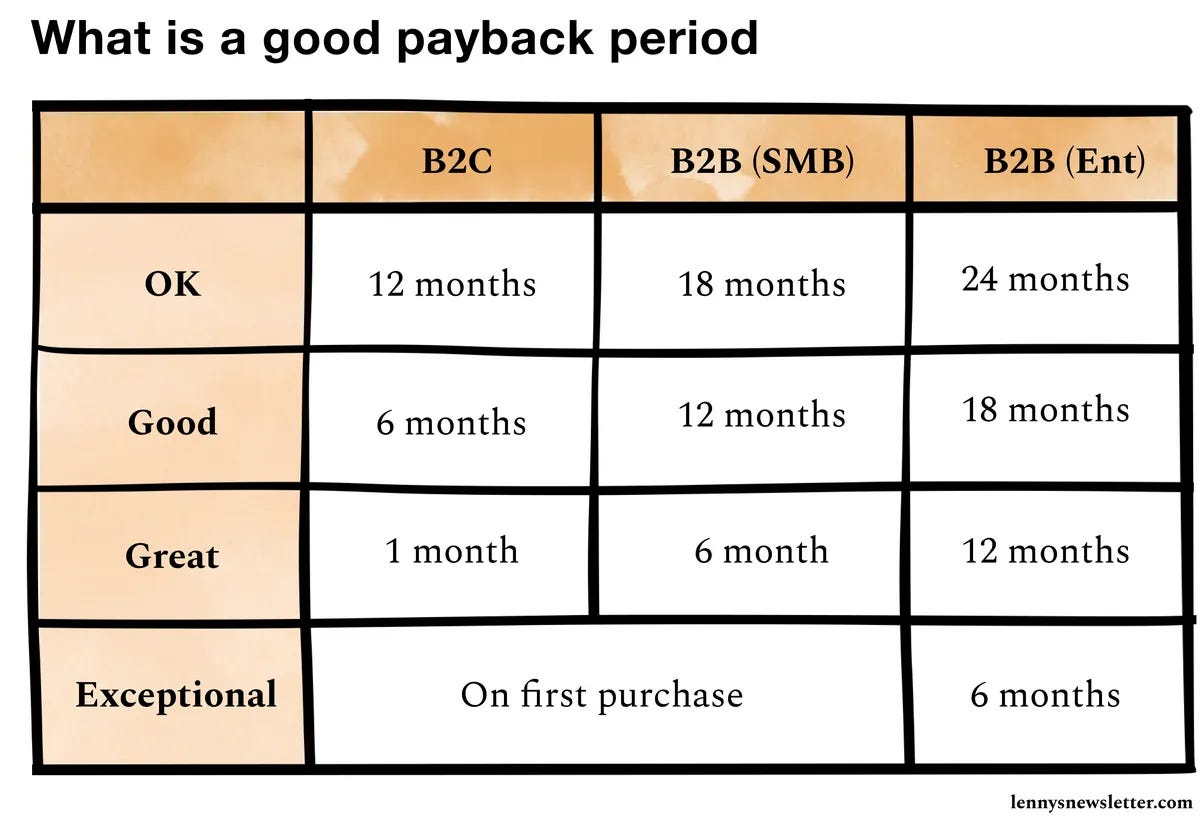

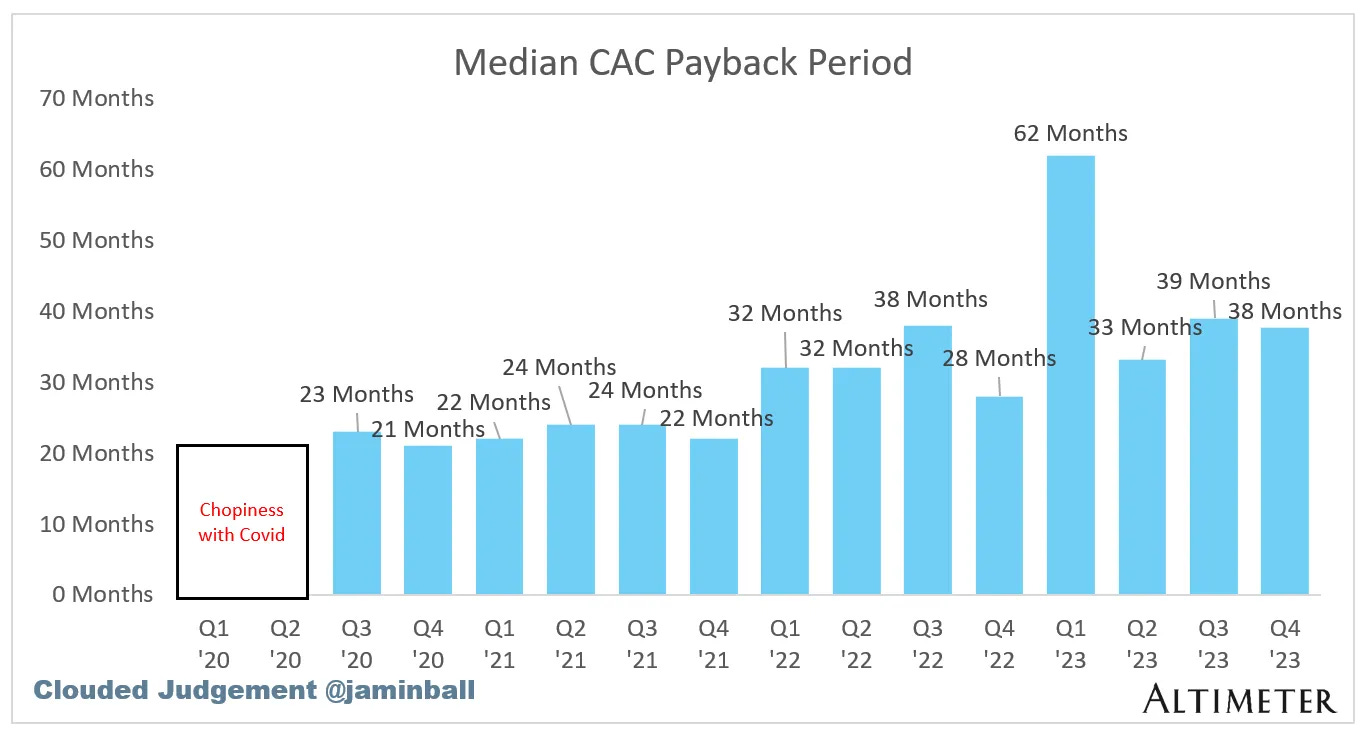

Lenny Rachitskyhas a great summary on what good CAC payback periods look like. My only caveat is that for many companies these payback periods have deteriorated significantly in the past two years as growth has slowed while costs remain high.

Public companies generally have an even higher CAC payback period than private companies because they have the cash to absorb a longer payback period. Also, similar to the private market, public company CAC payback periods have gotten worse in the past couple of years.

These high payback periods are not sustainable for most cloud companies unless revenue retention remains incredibly high….But revenue retention is likely coming down from historical levels for most companies.

It’s also important to note that the CAC payback period only shows the time required to payback S&M expenses and does not address R&D (research & development) or G&A (general and administrative) expenses.

Companies with a significant amount of revenue are already covering most of their R&D and G&A expenses from existing customers so incremental revenue mostly just needs to cover the acquisition costs from S&M to be profitable. There might be some additional R&D and G&A costs with the incremental revenue but it is likely small and/or moves more on a step function (i.e. one customer adds basically nothing but 50 more customers requires more costs).

However….high churn will still eventually destroy the economics of even large mature companies.

Below are the public cloud companies with the highest free cash flow (FCF) margins. While all of these companies have amazing FCF margins, not all of them are still efficient and increasing churn could eventually break them.

Let’s look at ZoomInfo’s CAC payback period for their most recent quarter.

ZoomInfo increased revenue by only $2.6M in Q4 and they spent a whopping $102.3M on S&M in the prior quarter to get there 🤯. This equates to a 138 month (or 11.5 years) payback period!

ZoomInfo’s revenue growth has slowed dramatically over the past couple of years, but churn has also increased. A big contributor to the slowed revenue growth is from churn — net revenue retention (NRR) was only 87%, which is pretty low given ZoomInfo’s blended customer base.

The high churn and slower growth combined with the still high S&M costs, has caused the economics on new customers to appear broken. A nearly 12 year payback period will never make sense.

ZoomInfo still has amazing FCF margins though because of the existing customers that are so profitable. If churn stays elevated or increases, then all the highly profitable customers will get replaced with new customers that take a decade to just breakeven on.

ZoomInfo might be just fine and in fact it has a long history of being extremely efficient so they may adapt better than many to the new reality. Or perhaps Q4 was just particularly bad and/or churn will decrease in the future…But the point is that churn destroys the unit economics of SaaS if no adjustments are made.

The Cost of Churn

High churn does two things to break unit economics:

Direct cost of churn

Indirect cost of churn

Direct Cost of Churn

Profits from keeping an incremental customer is HUGE for cloud business because of low recurring costs associated with the revenue.

Example: Let’s say you have a $100k per year customer. After the S&M is paid back the ongoing costs is incredibly low. The main recurring costs include:

Gross margins: let’s say are fairly standard at 75%, which means $75k of the $100k revenue is kept.

Account management and/or CSM: let’s assume is at most $10k so $65k profit so far.

Customer marketing: while there is a cost here, there should be a pretty fast payback through expansion revenue.

Everything else (R&D and G&A) is more of a step function in costs. In other words, each incremental customer adds little or no immediate costs but eventually more cost will need to be added (but they should be relatively small)

In other words, the recurring profit margins on retaining a customer is nearly 65%. It’s not just a one-time 65% profit but an annual recurring loss of that revenue when they churn!

Let’s say there are two companies with the same economics above but different churn rates: Company A has a lifetime of 4 years while Company B has a lifetime of 7 years. The difference is $195k (3 years * $65k) for a single customer!

If companies don’t have enough time to generate the high profits on the other side of the CAC payback period, then getting to the 20%+ FCF margins will be impossible

Indirect Impact of Churn

If churn ticks up, then companies also have less opportunity/time for expansion revenue. Expansion revenue is significantly cheaper than new logo revenue (nearly 1/3 the acquisition costs based on most benchmark data).

In addition to the high profits associated with keeping customers, expanding revenue at those existing customers becomes very profitable as well. And expansion becomes the vast majority of revenue at a high revenue scale.

If companies want to grow at the same rates, then new business revenue will be a bigger percentage of total revenue….and new business revenue is ~3x more expensive.

How do we fix it?

Short answer: Be more efficient

The same things that will make companies more efficient will drive higher churn in the future. As more tools enter the market, AI makes it even easier to build competing products, switching costs decrease, etc…the vast majority of companies will experience higher churn in the future.

Many think that because they can be more efficient that they have more budget to spend elsewhere (because they spent that much in the past and that is what the benchmarks say).

A lot of companies are still operating under the assumption that prior SaaS math still applies today — i.e. what you can spend on S&M to acquire customers.

Not the case.

If churn ticks up (which it will for most companies), then the only way for the unit economics to work is for companies to be dramatically more efficient today.

Companies need to maximize the time they keep their customer past the CAC payback period because that is when the profits really accumulate. With higher churn coming for everyone, the best way to do that is to shorten the payback period (i.e. more efficient S&M). Focusing on customer success to maximize customer life is also important, but de-risking things with a low CAC payback period is critical.

Key Takeaways

The same things that have enabled cloud companies to become much more efficient (like AI), is what is breaking traditional SaaS math.

Cloud isn’t dead. The math just changes. Those that adapt will be just fine, but those slow to change will die.

CAC payback periods must be shorter if customer lifetimes decrease (which is likely the case).

Companies need to get more efficient and let that efficiency hit profits now. They can’t rely on old benchmark data to justify higher spend because the lifetime value of customers in the future is likely materially lower for most companies.

Companies need more efficiency right now to make the new math work.

Footnotes:

Check out the Hidden Cost of SaaS and Cloud

Join the community by becoming a paying subscriber and get access to me and other finance leaders in software companies! Ask questions, get answers, and communicate with your peers.

Sponsor OnlyCFO Newsletter and reach 18k+ CFOs, CEO, and other leaders in the software industry.

Interesting article - coincides with what we see out there as well

FYI: we run a substack (https://resources.thrivestack.ai) and some of our guests mentioned about this post.

Quick question:

Do you see any evidence of Product-Led GTM reducing CAC Payback and/or reducing S&M spend?

How do you think this changes depending on the business model. Ex: Module Based, Consumption, Per Seat licenses etc.?

The seat expansion is obviously a great driver of upsell when things are good but when tough times hit, NRR can quickly drop. Whereas it is tougher to add new modules but likely harder to remove/drop entirely.