M&A in 2025 w/ Art Levy

Whether buying or hoping to be bought...here is what you need to know about M&A

Meet your AI mandate faster.

Facing more pressure to accelerate AI’s impact on your finance operations? The CFO’s Guide to AI Strategy is your free roadmap. You’ll get 5 best practices to fast-track AI adoption and turn high expectations into big results. Like “eliminate 60% of manual finance work” big.

It has been a wild first few months in 2025 — and M&A has certainly been impacted by all the chaos.

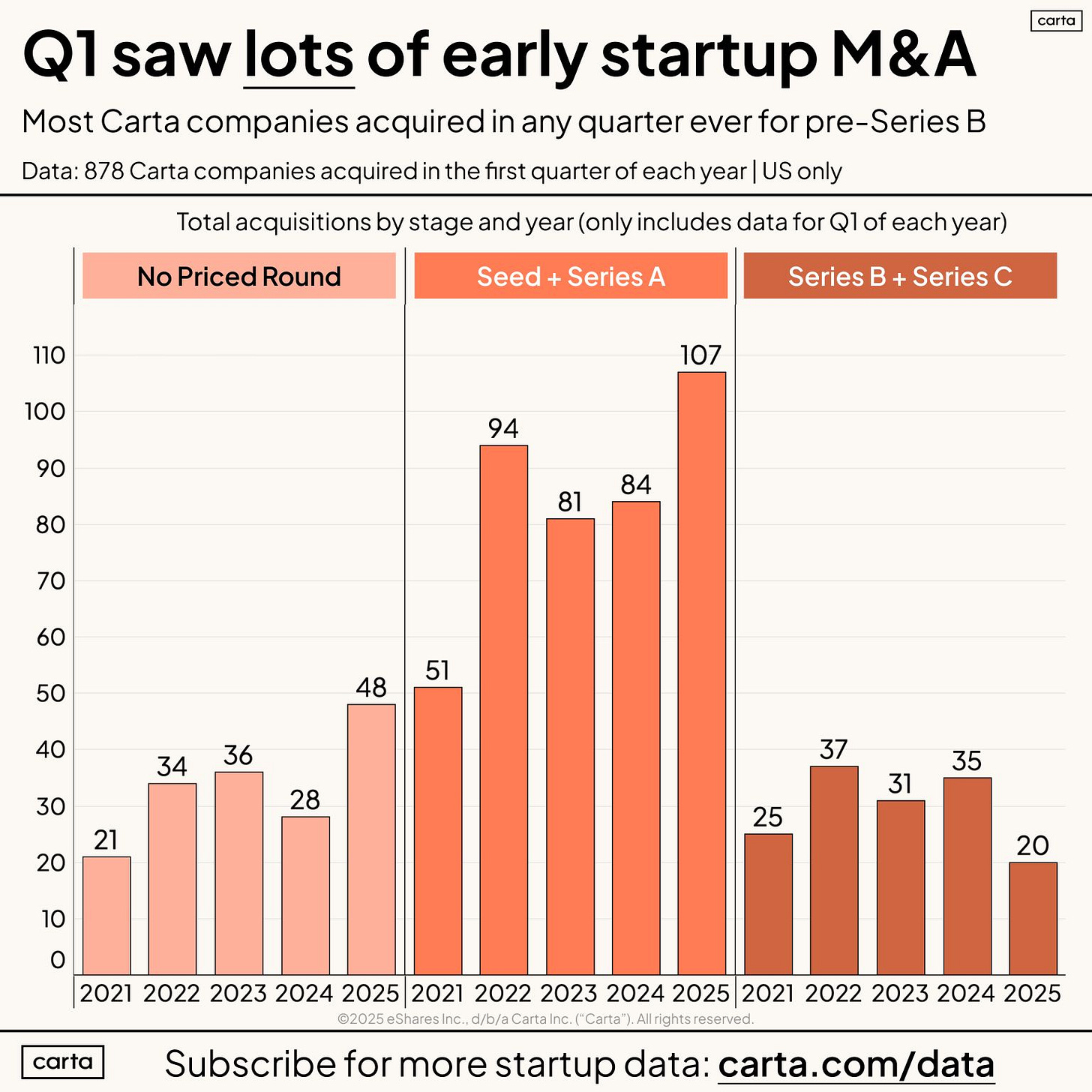

M&A activity started off really strong in Q1 2025 based on Carta data (see below). But…remember that M&A activity does NOT mean good outcomes.

Many of these acquisitions were probably acquihires or fairly small outcomes for founders/employees. While overall M&A quantity is up, it’s coming from very early stage companies where the outcomes are not that big. The M&A activity in the messy middle (Series B + C) is down. And I know quite a few of those deals are not great exits.

Nonetheless, it was great to see the uptick in M&A in Q1.

But then all the tariff stuff hit…stock market tanked, uncertainty skyrocketed, etc,

Do you know what CFOs do during times of uncertainty and volatility? They tighten spend, freeze hiring, and they avoid high-risk purchases (like M&A). This CFO survey gets into this at length, specifically the shifting sentiment around M&A and potential IPOs.

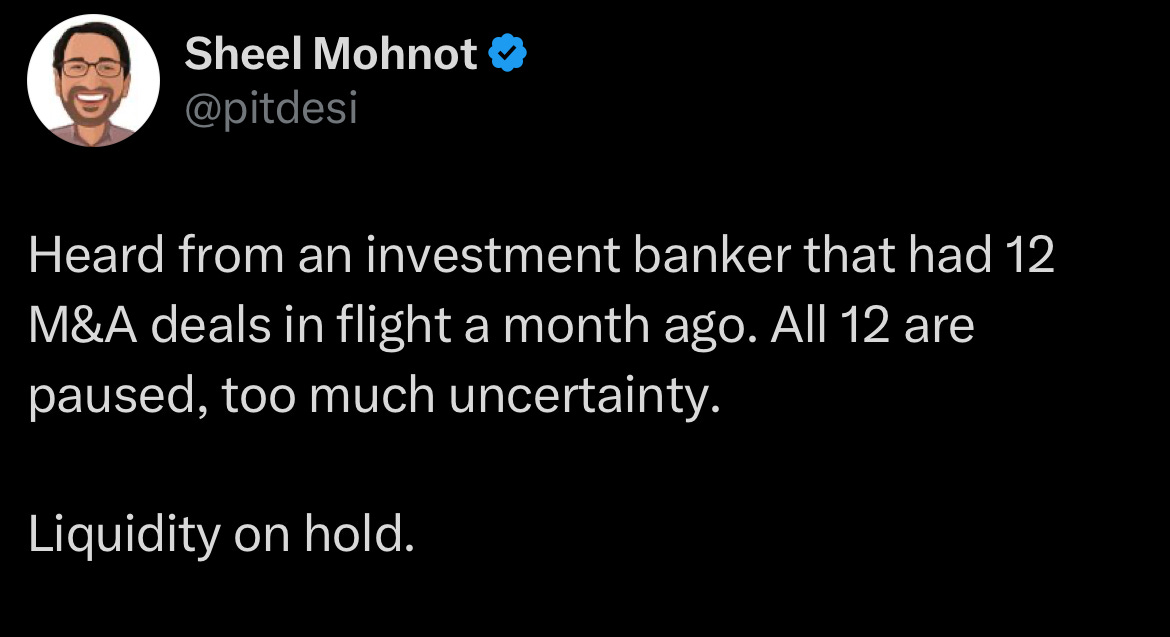

And this is exactly what happened when the tariff chaos started. I heard of lots of M&A deals being paused or completely dropped. It turned to a risk-off environment REALLY quick.

But what does the rest of 2025 look like? The stock market came roaring back (near all-time highs), volatility is down (certainly not over though), and there is a bit more risk taking now…

To dive deeper on M&A, I spoke with Art Levy (Chief Business Officer at Brex) about his views of M&A in 2025. Art started off in investment banking, moved to venture capital, and now leads corporate development at Brex, so he has seen it from all sides.

If you want to be eventually acquired (95%+ of exit outcomes) then keep reading…

M&A in 2025 with Art Levy

What's the outlook for M&A for the rest of 2025?

I think M&A in 2025 has heated up meaningfully, and it’s only going to get more interesting from here. I actually do not think folks are being conservative with cash, and now that the stock market has gotten a bit less volatile, I think the rest of 2025 will be where we enter a Golden Age of M&A. Specifically what I’d call “tuck-in M&A.” My definition of tuck-in may well surprise you though. It doesn’t mean the deal sizes have to be small.

Let’s take a look at Brex’s space (sleepy corporate card + spend management). In the past 12 months, there have been a number of tuck-in M&A deals, including Amex-Center, Paylocity-Airbase, Paystand-Teampay, and TravelPerk-Yokoy. These were all deals where a larger market leader came in and scooped up a subscale player to fill what I call a “Product M&A” gap.

But it is not just in spend management. In the broader realm of AI, you’re seeing the clear market leaders doing their own M&A to plug gaps. We are entering an age of massive consolidation, where the largest companies in each sector will keep compounding their moats and snap up smaller players. Especially in a world where the regulatory landscape is favorable.

When considering the biggest technology deals in the last 12 months, I would argue most of them were “tuck-ins” when considering the relative size of Seller vs. Acquirer (excluding recent Cox-Charter and X-xAI mergers):

Google-Wiz — though large in size, on a relative basis, $32B/2,000T is 1.6%

Same with OpenAI’s $3B acquisition of Windsurf (1% of $300B)

Databricks’ ($62B) recent $1B acquisition of Neon (shout out to my boy Nikita!)

Stripe-Bridge at $1B, approximately ~1% of Stripe’s latest market cap ($92B)

Moveworks-ServiceNow →$3B / $215B for NOW

I would not characterize any of these deals as “transformational” M&A. These are all big players making a strategic bet on extremely talented teams and products. They just happen to be SUPER big players that are buying in all cases. But these aren’t “bet the company” moves for the acquirers.

Will there be “good” M&A deals in 2025?

I don’t really think there is such a thing as a “good M&A” deal.

You are either buying:

A bad business that has some strategic value, and both sides know that and will fight tooth and nail for every last dollar, create indemnifications, etc.

Or you are bidding aggressively for a top asset that plugs a gap in your core offering, that does not need to sell now but will do so for the right price. In which situation, you have less leverage.

I don’t really subscribe to Warren Buffett’s “cigarette butt” theory, at least not in technology.

Cigar Butt approach to investing is where you try and find a really kind of pathetic company but it sells so cheap that you think there is one good puff left in it — Warren Buffett

Things are moving too fast in tech. As Sarah Guo (Managing Partner at VC firm Conviction) said recently:

The most undervalued trait in startup hiring is pace. This is especially true today, when the floor is lava.

How do you find good M&A deals?

Even with the above, you still need to work to get in front of the best founders. You need to constantly be in the market, talking to founders, corporate partners, and VCs. You need to deeply understand what is happening at your competition, in your market, and at whoever will be your competition in 10 years. That’s why some founders are so famously good at M&A (see Zuck).

They see where the puck is going and therefore know where to plug and acquire before that threat gets too big (ie, WhatsApp). To be very good at corporate development at a growing startup, I recommend you spend as much time as you can with your founder to understand the nuances of his/her long-term vision to help you source deals.

One great example of a top M&A shop seems to be Databricks. I don't know the team there, but they’ve made some prescient acquisitions over the past two years. Their co-founder and CEO Ali Ghodsi also smartly just put a public word on the street that he is ready to acquire the best founders. In a recent interview, he did a great job of counterpositioning working at Big Tech vs. working at Databricks. He’s telling folks, “If you're entrepreneurial and want to change the world … don't go to one of the giants."

Left unsaid is that Databricks itself isn’t exactly five dudes in a garage! But this is exactly the culture you have to cultivate to bring in the best founders and convince them to work for you. At Brex, we’ve acquired five companies, and the longest conversations in the process are never about the price, but rather about what the founder’s role will be inside of “this big company.”

What about mergers of equals?

I am pretty bearish on zombiecorns merging and that leading to a strong outcome. One of my close confidants recently told me the following:

If you put two C+ management teams together…why would you ever get an A outcome?

And I think he is totally right.

Zombiecorns are not run by folks who know how to cut to the bone and make the hard decisions — that’s why they’ve become zombiecorns. They are run by founders who made some mistakes and are working hard to turn it around. What I do think should happen is for PE to come in, buy a bunch of zombiecorns, and then dramatically cut the fat. But in that case, the PE should bring in their own management team that specializes in turnarounds.

How do you prepare to be acquired?

This is a tough one. I think I would say consolidators want to see fast growth and great execution. The scariest thing for a potential buyer is a new company coming out of nowhere, growing 100 mph. And in the age of AI, that will happen more and more. So I would say grow as fast as possible (within your capital constraints, of course).

I also think focusing on a super niche vertical or set of customers and making your NPS as strong as possible matters. The large consolidators want to plug a hole, just like in Big Pharma+biotech M&A. If you’re going after a horizontal market, kudos to you, but then gear up to build this company for 10+ years and don’t be thinking about getting snapped up. Buyers need a clean story for their board and management team. “We’ve bought X to fill Y gap, and it’s only costing us 1% of our market cap.”

One thing to do is to try to get as much leverage as you can and speed up the processes. That leverage comes in the form of multiple offers (M&A or fundraising) and subtly letting people know about them. The more you get, the more you can bargain. And to be clear, those offers don’t have to come from the firm(s) you’re spending the most time with, either. Time kills all deals.

Any lessons learned that you can share?

On deals that have gone well, the selling founder and I have been super open and honest with each other on what matters and what it would take to get a deal done. The focus has been on 1+1=3, why Brex is the right platform for the founder to take his product and company to the next level. There has been an understanding of a “fair” price and a focus on “the day after closing” and setting them up for long-term success as part of the Brex organization. In our more successful M&As, the founders have all stayed 3+ years at Brex, which is hugely impactful.

Lessons where it didn’t go well, there was a constant re-trading during negotiations around pricing and terms, there was deep involvement of the selling investors (which I see as a red flag) vs. understanding what the founder wanted. There was a desire for the majority of consideration upfront vs. a fairly spread-out M&A consideration based on joint milestones.

Being nice doesn’t get you very far in M&A — and that goes for selling founders as well. I just spoke to a founder who was worried about a large buyer in his space “tire-kicking” and spinning cycles. He wasn’t sure how to handle saying no to another meeting without seeming rude.

My advice was to be super direct. Ask — “Are you actually looking to acquire us, or not? Or are you just trying to learn about the market? (Implying, are you just wasting my time?)

It’s uncomfortable, but it speeds up the process and lets people know you have other things to do. If the buyer is serious, believe me, talks will speed up. If they aren’t, they won’t.

As a buyer, the best way to become successful at early-stage M&A is to send things in writing extremely early. People tend to take things more seriously when they’re staring at a piece of paper with $100,000,000+ on it for them.

Top 3 M&A Screw ups

Greediness

Not asking for what you want

Dishonesty

I’m all for hard charging, hard-negotiating founders who might be viewed as jerks. As long as they tell me what they want. The challenge becomes when they are passive, don’t say what they mean, don’t tell me the whole story, and then the deal breaks down because of the complexity of an M&A.

You need everyone rowing in the same direction, even if they push you hard for what they want.

OnlyCFO Musings

The vast majority of VC-backed exits will be acquisitions but most will tell you that they are chasing an IPO. That is great to have as a goal, but don’t neglect M&A because that is MUCH more likely.

The most important step is building a killer product that has strong growth. That’s priority #1.

After that, build the right relationships early. M&A can take a long time to actually happen and the relationship often starts months or years before M&A is actually on the table.

Footnotes:

Check out Brex’s guide on how to automate finance busywork

Join the next OnlyCFO Webinar on how the definition of ARR is change and how you should adapt. You won’t want to miss it!

Check out OnlyExperts to find offshore accounting resources. They have some amazing talent for 20% the cost of a U.S. hire