Reddit IPO Breakdown

Is Reddit a winner or loser? Deep-dive into Reddit’s S-1, metrics, comps, interesting learnings, and my thoughts

Join 17k+ subscribers learning about the software industry

The last two years have been really hard for nerds like me because the “IPO Window” has essentially been completely shut since 2021 with the exception of a couple tech IPOs in 2023 (Klaviyo and Instacart). So with Reddit publicly filing its S-1 it is likely we will at least have one more IPO coming fairly soon. If the Reddit IPO goes well, then more tech IPOs will likely follow….

Outline:

Timeline & IPO Preparation

Valuation

Rule of 40 and Rule of X

IPO Float

Reddit Users Can Buy the IPO

Executive Compensation

Market Opportunity

Revenue

Revenue Growth Endurance

Expenses

Strong Balance Sheet

Learnings from 409A Valuations

My Thoughts on Reddit

Timeline & IPO Preparation

Initial S-1: Typically after publicly filing an S-1 a company is aiming to go public in about 3 weeks, so Reddit is looking at a March IPO.

Roadshow: The roadshow takes ~2 weeks and is where the company executives fly around the world and pitch institutional investors on the IPO.

At the time an S-1 is publicly filed most of the hard work is done. The previous 8-12 months are where most of the heavy work actually takes place. In Reddit’s case they have been hoping to go public as early as the first half of 2022. Reddit hired bankers in late 2021 but paused plans after tech stocks started to crumble and the IPO window shut.

Companies can’t (or at least shouldn’t) be able to snap their fingers and go public. This was part of why SPACs were such a bad idea….

Below are some of the things that must be done from a finance perspective in preparation of an IPO:

Build out public company team for finance, accounting, etc. You need people with the right experience leading up to the IPO.

Auditors must review all quarterly and annual financial statements

S-1 document must be written and reviewed. This isn’t as easy as it sounds. Reddit’s S-1 is about 300 pages. Most numbers in there have to be carefully reviewed by Reddit, the auditors, and legal. The team must carefully craft their message and choose the right key metrics.

Act like a public company for 4+ quarters. Companies preparing to go public need to get some reps in before actually going public. Ensuring they can accurately forecast with a “beat & raise”, perform mock earnings calls so inexperienced execs are prepared, etc.

Prepare the roadshow deck

Build the forward financial model. It’s important to go public with confidence in forecasting and during period of expected strong revenue growth and endurance.

Valuation

Reddit most recent fundraising was $410M in 2021 at a valuation of ~$10B. In the initial public S-1 it is standard to leave out the deal specific terms such as price and number of shares being issued (which would provide valuation) so we don’t know yet what the valuation will be yet.

However, it is reported that the bankers are seeking at least $5B in the IPO (half of their last private valuation), which likely means they will try to push that a bit higher toward the end of their roadshow if there is decent interest.

Rule of 40 and Rule of X

The “Rule of 40” and “Rule of X” are shorthand metrics for helping investors determine valuation and health of a business. The Rule of 40 has become well-known in the software community while the Rule of X is a relatively new iteration of the Rule of 40.

Rule of 40 = Growth Rate + FCF Margin

Rule of X = (Growth Rate * Multiplier) + FCF Margin

The difference between these two metrics is that the Rule of X assigns a multiplier to revenue growth under the premise that revenue growth is more valuable than current profits — for a deeper dive on this check out my previous post on the Rule of X. The multiplier I am using in the analysis below is 2x, which is the current multiplier that has the highest correlation with revenue valuation multiples of public companies.

While the Rule of X was primarily developed for cloud companies, we can also apply it to Reddit and see how it compares.

Reddit’s Rule of X score on an LTM basis is a score of 31, which is bottom quartile compared to cloud companies.

31 = (21% rev growth * 2) + -11% FCF Margin

Reddit’s Rule of 40 score is also pretty bad compared to other public companies as well. Its Rule of 40 score ranks #67 (out of 80) of the public cloud companies. The companies grouped near Reddit’s Rule of 40 have fairly low revenue multiples

While Reddit is on the higher end for revenue growth it loses more money than any of these companies with similar Rule of 40 scores.

IPO Float

The float represents the number of tradable shares. Most IPOs have a tiny float for the first 6 months because previous equity holders are locked up for 6 months of being public before they are tradable.

Below is a great chart that shows the tradable shares before the lockup expires. The average float is only 12%, but even this misrepresents the number of shares that are actually tradable because many IPO investors are invested for the long-term. These tiny floats are what can create a highly volatile IPO stock.

Reddit Users Can Buy the IPO

Reddit is reserving some amount of IPO shares for 75,000 of its users. These users will be given the chance to buy shares of Reddit at its IPO price before the stock begins trading. Typically the IPO price is reserved for large institutional investors and not the average retail investor. The normal individual investors typically can only buy on the open market, which is after the normal “IPO pop”.

So should Reddit users buy the IPO?

Are the r/WallStreetBets (guys who made Game Stop stock go parabolic) guys buying?

Of the ~80 cloud companies I am tracking only 7 of them declined on the first day of the IPO. In other words, ~90% of IPOs had a gain on the close of the first day of IPO trading. Not terrible odds if you can get in at the IPO pricing.

The IPOs with the largest 1st day IPO gains did *really* well. But remember, you only get these returns if you got to buy the stock at the IPO price, which the average investor typically doesn’t get.

However, if you look at what these IPO stocks do over the next 6 months, then things look A LOT different. If you were to buy an equal amount of all cloud stocks at the IPO price and sell 6 months later, then you would have a loss of 3%!!

Maybe you think this average 6 month loss is because of the market downturn in 2022 and a lot of cloud stocks went public in 2021?

If I exclude all IPOs where 6 months later is in 2022 then you would have a gain of 7%. Not a bad gain but if you dumped the stock on the first day of the IPO then your gain is 41%…. the average IPO declines a lot after the IPO first day so on average IPO investors would have been better off selling on the market close of the first day.

Executive Compensation

There have been a lot of social media memes about the CEO’s pay package that was disclosed in their S-1.

The CEO had disclosed compensation of $193M in 2023 but meanwhile in Reddit’s business risk section…

We rely on an approach to content moderation that depends on Redditors who volunteer to be moderators of their communities.

Below is the relevant table that shows the CEO, COO, and CFO’s compensation for the past two years.

There are an important couple of notes about this compensation:

$192M of this compensation was in equity so it has nothing to do with how much cash Reddit is burning.

The $192M of equity awards is the grant date fair value of all the awards given to the CEO within 2023. These awards still have to vest over several years.

Some of the equity awards only vest (i.e. have value) if certain price targets are met. As seen below, a lot of the stock options given to the CEO are “premium-priced” so the market value of the company has to increase significantly to have value.

Yes, it’s a lot of money, but it isn’t as simple as just looking at the total dollar amount.

Market Opportunity

Reddit discussed its market opportunity as the following three areas:

Advertising

Data licensing (LLMs and AI stuff)

User Economy

Reddit discloses that each of these three are $1+ trillion opportunities for them. Reddit is counting on #2 and #3 to propel its growth in the future.

Revenue

Revenue growth was 37% in 2022 and dropped to 21% in 2023. 98% of Reddit’s revenue is currently from advertising so the potential opportunity with data licensing and user economy is mostly unproven.

In the S-1, Reddit discussed its opportunity to license its data to LLMs and AI companies. On the same week of the S-1 being publicly released, it was announced that Reddit made a deal with Google for $60M/year to license Reddit’s data to train Google’s AI.

Not a coincidence between this announcement and the IPO timing — things will go much better if Reddit is involved in AI. It’s also a sizable revenue boost for Reddit (representing 7.5% of 2023 revenue) that will help keep its revenue growth higher.

Investors really care about future strong revenue growth so this data licensing story is critical for Reddit. They wanted to prove they could monetize it to support its growth story to IPO investors.

The big question is if they can continue to capture significant amounts of revenue from these types data licensing deals and how durable is that revenue (i.e. how recurring is it)?

Revenue Growth Endurance

Reddit has a YoY growth endurance of 55% in 2023 (from 37% in 2022 to 21% in 2023), which would be the 57th ranking of the 80 cloud companies I am tracking — not particularly great.

Growth Endurance = the ratio of this year's growth rate to last year's growth rate

Of the companies with worst growth endurance, 9 of them had meaningfully higher revenue growth than Reddit in the prior year so slowing down a lot is more expected.

High growth endurance is critical in order to justify high valuation premiums.

While a margin increase has a linear impact on value, a growth rate increase can have a compounding impact on value. — Byron Deeter @ Bessemer

Reddit was originally expecting to go public in early 2022 and likely was timing that with strong revenue. But at this point, its revenue growth is falling pretty quickly.

Can Reddit hold revenue growth close to its 2023 growth of 21%?

Reddit is counting on the LLM and AI data partnership revenue to keep growth rates higher. If Reddit is unable to execute on its data licensing monetization strategy then revenue growth will likely continue to quickly deteriorate. It is still early days to be able to meaninfully monetize their data so there certainly is risk if that is going to be the primary driver of growth going forward.

Expenses

Gross Margins

Gross margins have been a super important metric for investors because it represents a ceiling on how profitable the overall business can become.

Gross Margins = (Revenue - cost of sales) / revenue

Gross margins are really sticky because the cost of sales piece (hosting costs, customer support, etc) generally moves linearly with revenue. In other words if you have 80% gross margins today, investors also expect that you will have around 80% gross margins in a few years. But there is also an expectation that there is leverage in operating expenses as a company scales so all of those expenses can decrease significantly as revenue increases.

A lot of companies talk about their gross margins being really amazing so they will be able to print tons of money at scale like Reddit implies in their S-1 below:

Our high gross margin and capital-efficient business model is simple and scalable and allows us to invest deliberately in our global opportunity.

But here is the thing…there are a lot of high gross margin tech companies that struggle to ever turn a meaningful free cash flow margin because their operating expenses are much harder to reduce as a percentage of revenue than they think. The common expectation is that there is a lot of operating leverage in operating expenses so that at some point these companies can print 25%+ free cash flow margins.

Gross margin is both one of the most important financial metrics and one of the most deceiving investor metrics.

MANY cloud companies will never be able to generate huge 25%+ free cash margins. This is the major caveat/flaw with the Rule of 40 and it is amplified by the Rule of X.

So the major question is how profitable can Reddit actually become?

Reddit has been at this for almost 20 years and hasn’t managed to become profitable. I am not saying that Reddit is a bad business because it loses money, but rather I have concerns about their ability to generate strong profits considering how much they are still burning with their slowing growth and the length of time they have been doing this.

Most software companies lose money, but they are growing faster and are often younger than Reddit so they haven’t had the time to prove they can get profitable like Reddit has had.

Will the data licensing revenue stream potentially enable Reddit to generate high profit margins?

It certainly has the potential because it should require little additional investment from Reddit.

But is the data valuable enough to get others like Google to license it?

And how long will it be valuable to companies like Google?

Expenses:

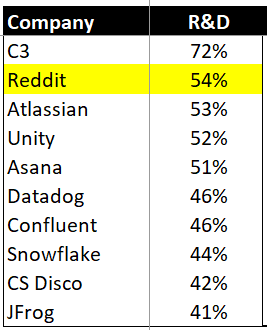

Research & Development (R&D) - Reddit spent $438M (or 54% of revenue) on R&D. This is REALLY high relative to their growth of just 20%. While Reddit is not a software company, Reddit spends the second highest on R&D as a % of revenue than any other public software company.

Reddit increased R&D spend by as much as revenue growth in the past year (20%). Doesn’t appear to be getting much leverage on its operating expenses yet…

You can tell from their quarterly income statement that their R&D percentage of revenue is starting to decline but it is still really high. Reddit either needs to show they are going to accelerate revenue growth from the R&D investments or it needs to be cut way back.

The rest of their expenses (S&M and R&D) are fairly in line with benchmarks for their growth rate.

Strong Balance Sheet

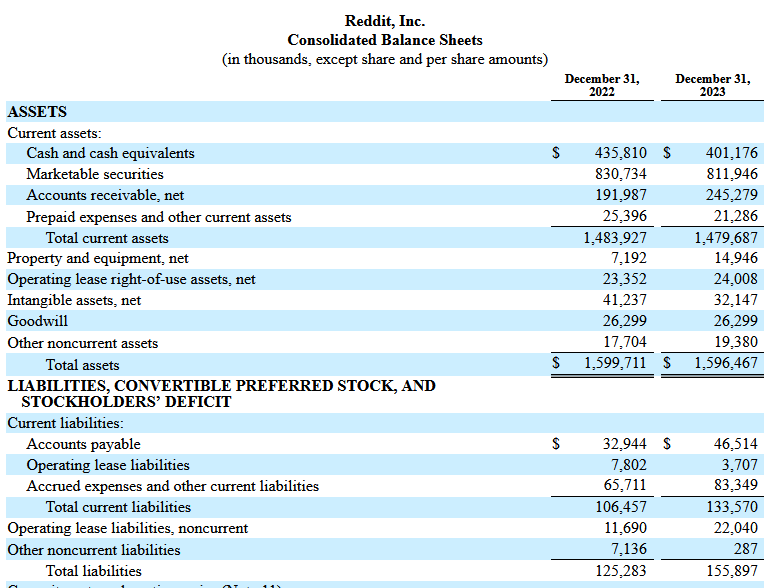

While Reddit is still burning a lot of cash ($85M in 2023), Reddit has plenty of cash ($1.2B) and no debt on the balance sheet. Reddit will also likely be raising a few hundred million dollars in its IPO. And they also have a ton of accounts receivable ($245M) that should turn to cash soon.

Reddit will be very well capitalized and has a lot of potential opportunities it can take advantage of because of its strong balance sheet position. They do not need the money from the IPO, but they likely want to provide liquidity for shareholders and employees.

While the income statement unit economics (revenue, efficiency, unit economics) may not be best-in-class currently, Reddit will have one of the stronger balance sheet positions which can be a strategic advantage for them to capitalize on future opportunities.

Private Company Valuations

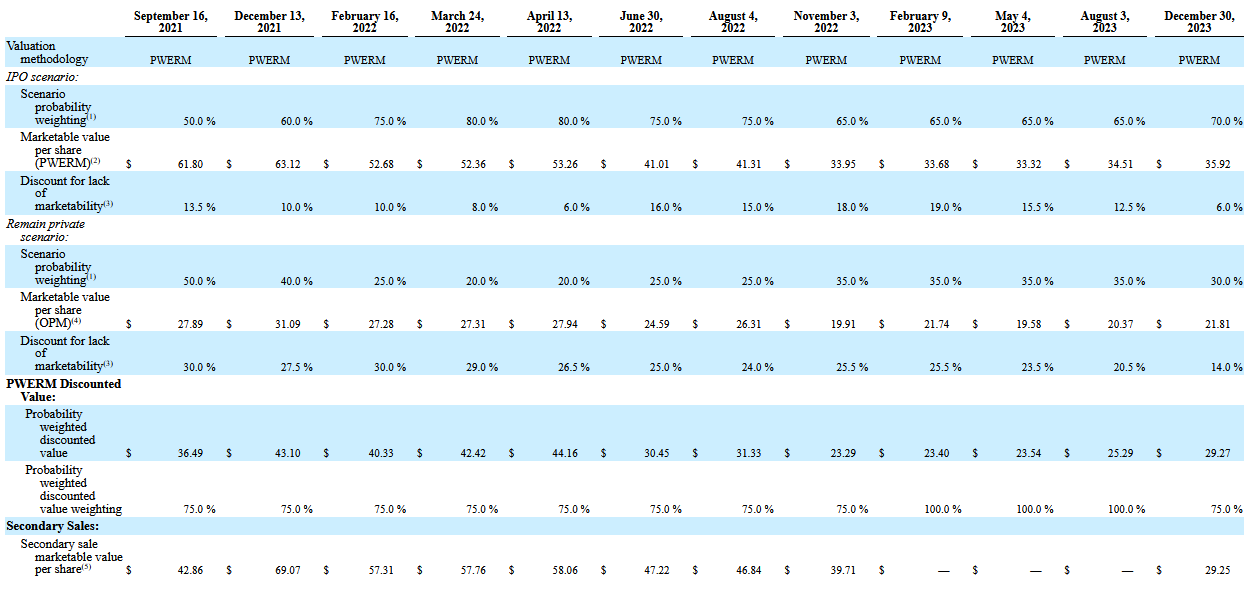

All private companies must perform a 409A valuation report to issue stock options. These valuation reports must be performed at least annually as required by the IRS, but as a company approaches an IPO they are typically performed quarterly. Note these valuation reports are just for employee stock options and NOT for raising money and it is never used externally as an indicator of valuation.

Most IPOs don’t disclose the level of detail that Reddit provides of how they determined their previous common stock fair values while private. You can actually learn a lot from the changes in these inputs.

The method companies always start using shortly before an IPO (typically at least a year before) to value their company for employee stock option purposes is called PWERM (Probability-Weighted Expected Return Method). These 409A reports are done quarterly before an IPO to avoid any “cheap stock” concerns.

IPO weighting: They had an 80% probability of an IPO in Q1 and early Q2 of 2022, but that later dropped to 65% until it increased again in late 2023. This tracks to what happened - Reddit hired bankers in 2021 to go public in 2022 but then abandoned plans given the market and Reddit’s less than ideal financials.

Secondary Sales: These are stock sales directly between employees (or other stockholders) and purchasers. Most auditors insist on a fairly large % weighting on secondaries — Reddit is using 25%. As long as there was a secondary transaction within the past 12 months then Reddit weighted it. But they would adjust the secondary price per share for the general change in condition and peer company valuation metrics.

Thoughts on Reddit

Reddit’s growth dreams and valuation ride mostly on its ability to do something great with AI and LLMs. Otherwise it appears to be just another social media company with quickly declining revenue growth and high losses. The deal with Google is an early positive signal that there is potential there, which is why the timing of the IPO and Reddit’s Google deal announcement are not coincidental.

Based on its historical financials Reddit should not receive a high valuation premium. It is middle of the pack at best with many metrics at bottom quartile. But Reddit will push its AI/LLM growth story (and many investors will love it).

Question is if it is real and how sustaining the related growth will be.

Reddit will likely do well in its IPO because of IPO FOMO (and related IPO drought), and because 90% tech IPOs do really well on the first day. But there is no rush for retail investors to buy an IPO on day 1. Most IPO stocks have historically been down 6 months later.

If it is a buy now, then it will also be a buy later. With much of Reddit’s fate relying on its ability to monetize its data with LLMs/AI many folks may want to wait to see how that starts plays out and not get caught in FOMO

Don’t forget that if Reddit’s IPO is successful then it might open the window for more to follow. After all we have a few companies in the pipeline who will want to IPO soon…

"Reddit has been at this for almost 20 years and hasn’t managed to become profitable."

That's assuming Reddit was the same team for that 20 years with the same goals. Reddit was acquired soon after they received seed funding, and essentially ran on fumes under Conde Nast. It wasn't until 2015 when they started hiring ex-Paypal and ex-Facebook folks to come in and start turning it into a business.