Sales Capacity Model | Annual Planning (Part 2)

The biggest mistakes in sales capacity planning. Plus a free sales capacity model template

Sponsor: Redefine planning with Abacum’s AI-native FP&A platform.

Most teams waste 70% of their time wrangling data. Top finance teams use Abacum Intelligence to automate the grunt work and unlock better, faster decisions through scenarios and forecasting.

Get our AI in Finance guide, packed with actionable and tactical real-world examples and proven frameworks.

What is Sales Capacity Planning?

The process where you try to match the potential revenue (demand) with the optimal number of reps (supply).

It’s the most critical step in the bottoms up planning.

The optimal balance includes tradeoffs with your goals, key initiatives, and efficiency targets. The actual Excel modeling is the easy part.

The difficulty in this exercise is correlated with the company’s scale. The smaller the scale (the less historical data), the harder it generally becomes.

💡 Want my free sales capacity model? Keep reading to the end to get it…

Join 35K other subscribers and get the weekly OnlyCFO newsletter in your inbox. Get smarter on finance and stay up-to-date on the latest trends, benchmarks, AI stuff, etc.

Align on Definitions

This is not discussed enough. Make sure everyone is aligned on definitions. Below are three of the basic definitions used in sales capacity planning:

Capacity: Expected annualized contribution of a ramped AE

Productivity: Actual average productivity of your ramped (and separately ramping) AEs. This is usually measured by last quarter or on an LTM basis

Quota: The number created that determines AE compensation that the CRO and CFO agree will drive the right motivation and incentives while balancing cost to plan

But also make sure everyone is aligned on all the other related definitions (especially if there have been changes). You may be surprised how misunderstood the basics are: Bookings, ARR, pipeline, etc

Also, align on the source of truth for these definitions to avoid later debates over which system is correct.

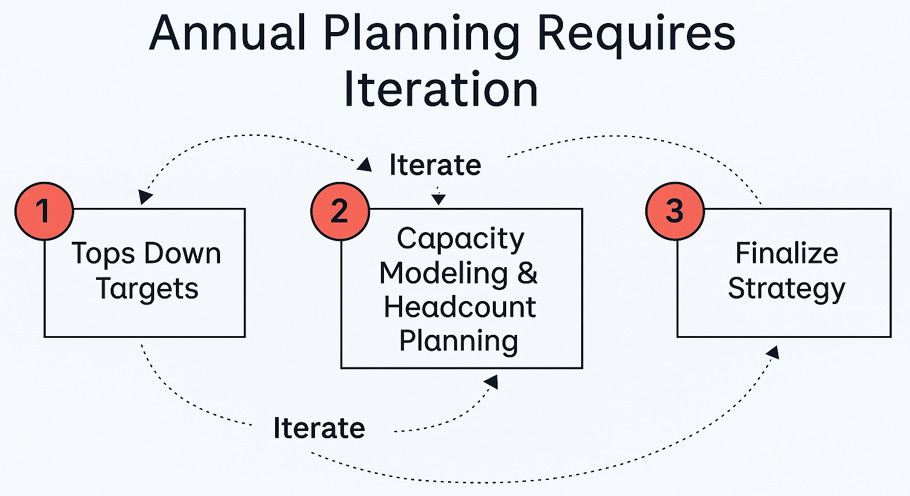

Tops Down Targets

Annual planning starts with the Tops Down targets set by the CEO and CFO. And then this is handed off to a cross-functional group (FP&A, RevOps, Marketing, Sales) to figure out how to make it work

The game begins.

CRO says the target is too high, CFO says we have to make reps more efficient so productive capacity must increase, CMO says they need more budget to hit the pipeline target, etc…

What starts as the Tops Down target rarely ends up as the final revenue target. Iteration is a key part of the entire planning process, especially in the sales target setting.

Who Owns What?

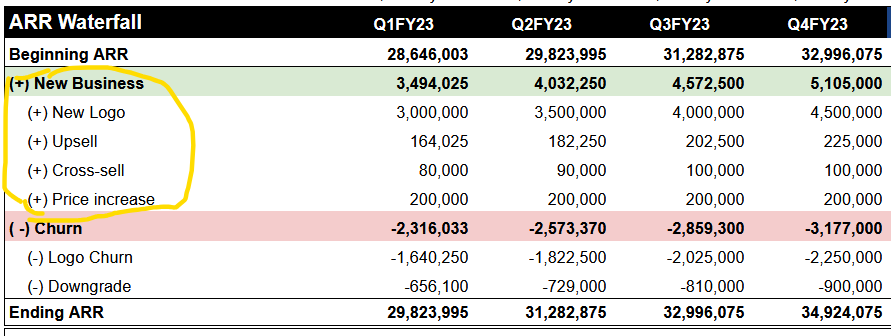

I break the ARR waterfall into two primary sections (guided by which exec gets fired if the plan is missed):

New Business (Chief Revenue Officer): The Sales Capacity Model

Churn (Head of Customer Success): Churn Analysis

Every ARR component that is broken out in the Plan needs an owner. I have frequently seen companies fail to really hold someone accountable for some ARR lines within “New Business” (like price increase or usage) and then it gets ignored. If you rely on those lines to hit the plan, then they need an owner.

Caveat: Expansion is often a joint target with Customer Success. You can’t expand churned customers…But I am still holding Sales accountable for total bookings.

Building the Sales Capacity Plan

I always have the sales capacity plan account for all the stuff in the “new business” section.

Four steps to building the sales capacity model:

Revenue goal

Assumption changes

Productive capacity

Ramping

Linearity

Sales rep attrition

Current sales capacity

Hiring needed to fill gap to target

Step 1: The Revenue Goal

In my previous post I discussed revenue target setting in more detail (there is a lot to discuss on this topic). But the one thing I will reiterate is the importance of creating alignment.

If your revenue targets look like the meme below when the plan is approved, then next year’s plan is already doomed.

There is obviously going to be some back and forth on what can be done after considering next year’s goals and all the various inputs to getting to a sales target, but there MUST be alignment in leadership…especially when the plan is finalized.

Every leader needs to be aligned and bought-in.

Determine a tops down revenue goal

Build a bottoms up to support that goal

Reassess if the goal is reasonable.

Repeat until the exec team is aligned.

Step 2: Assumption Changes

Be VERY clear on what assumption changes you’re making. What are you assuming gets worse, stays the same, or gets better.

It’s easy to model small improvements that blow up in reality…

Productive Capacity

Sales reps should bank on two things always being true for a growing and successful company:

Territories will shrink - company hires more reps

Quotas will increase - higher as brand matures, multiple products to sell, etc

Productive capacity is what you expect sales reps to sell while Quota is what you ask them to sell. Raising sales quotas does NOT mean productive capacity will increase. It’s easy to raise quotas. Harder to raise productive capacity.

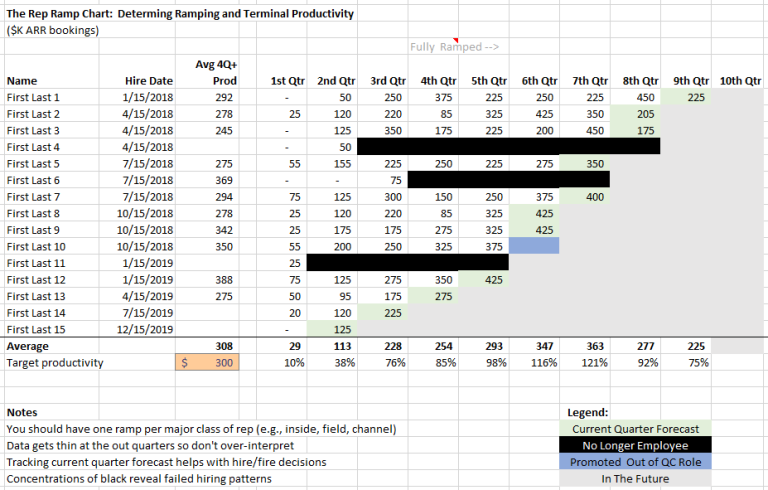

You need to build a chart like the example below (from Dave Kellogg). And not just once a year. Build it, maintain it, and evaluate changes to support hiring more reps or understand when/where things go wrong.

But there are a number of factors that you should also consider that require a bit more judgement in how it may impact sales capacity or ability to hire more reps and make them productive, such as:

market conditions

product roadmap (new products and features)

pricing changes

territory changes and segmentation changes

new markets/geos

increased channel investment leading to revenue contribution

Common Modeling Mistake

Many companies start with quota as their starting point and haircut it by an “overassign” percentage.

What often happens is someone decides quotas should be raised by 10-15% but there is nothing to suggest that productive capacity will also increase. And it doesn’t. Sales targets are missed (because sales planning is based on quotas and overassign isn’t adjusted). Reps are pissed because attainment tanks, good reps leave, and a vicious cycle starts…

Focus on productive capacity for sales planning and then you can worry about attainment, quotas, etc in your sales comp planning.

Sales Rep Ramping

There is a strong temptation to make ramping assumptions more aggressive in order to fill the gap to the revenue target while also becoming more efficient.

Don’t do this.

Use historical ramping rates as the base and maybe you can slightly improve them if there is a strong reason (but the change should likely be small, if any).

Linearity

In my world of enterprise software, sales are more back-end loaded in the year. 60%+ are in H2, 60% of that in Q4, and 60% of that in January (my fiscal year-end).

Look at historical linearity and use that as a baseline.

Overall new revenue linearity is caused by two separate things. A lot of people confuse these two and lump them together, but separating them out is important.

Buying cycles of the industry. For example, enterprise software is very Q4 heavy.

Ramping of sales reps. A lot of reps tend to get hired in Q4 and Q1 based on next year’s sales plan. They are fully ramped in Q3/Q4 so sales are higher at year end.

I have seen CFOs screw this up by looking at overall linearity (i.e. Q4 sales / total sales = Q4 linearity). Then they effectively double count the impact in their linearity assumption.

Figure out #1 by looking at historical sales attainment for your fully ramped reps and let your ramping assumption work separately by itself in the model.

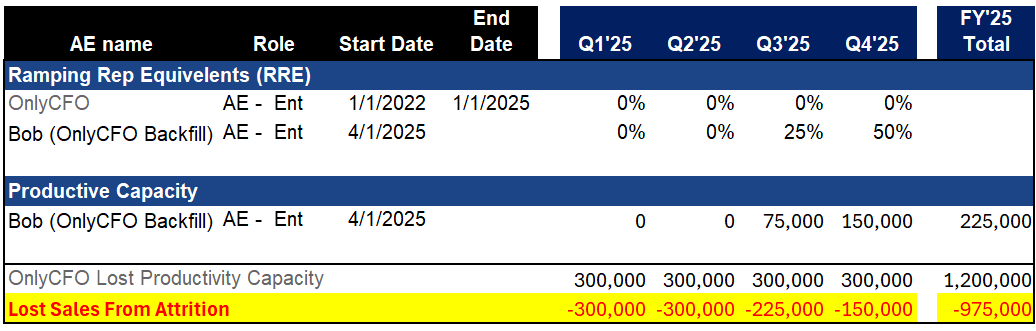

Attrition

Some of the biggest misses in sales targets I have seen come from not properly forecasting sales rep attrition. For the rest of the business I am OK with not forecasting attrition because the gap period between when an employee leaves and the backfill starts can be upside (less expenses) to the plan.

This is not true for sales reps.

New sales reps have to ramp before they are productive (see ramping assumptions below). That means lost sales from the period a sales rep terminates until a new sales rep is fully productive. The lost sales from a single rep can be massive…

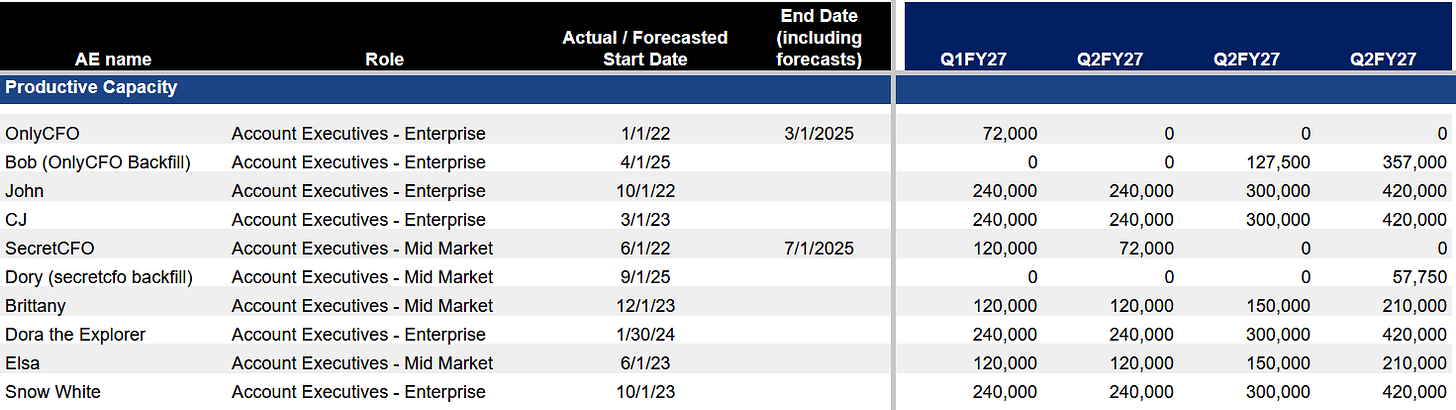

Example: Lost Revenue From Rep Turnover

OnlyCFO (enterprise sales rep) quit on the first day of the new year to move to Tahiti after collecting his accelerators on his 800% quota attainment. It took 3 months to hire a replacement AE (Bob) with a $1.2M productive capacity. Because of long sales cycles Bob and ramping, Bob only closed $225K in the year.

OnlyCFO would have closed at least $1.2M if he had stayed (probably more since he was one of the best sales rep). Lost sales from attrition was at least $975K.

The sales capacity model almost never properly accounts for losing the best reps. You just lose the average productivity in the model and you gain the average productivity when you hire a new rep. That’s not how life actually works tho…You actually lost a known, trusted rep that was closing well above-average attainment and swapped them for an unknown, riskier rep.

How much attrition should we forecast?

Hard to say exactly. This is where some judgment will need to be used based on things like:

Job market (it’s pretty tough in 2025)

Need to manage people out (how many low performers do you have?)

Are reps hitting quota? How happy are they?

Leadership changes (CRO leaving usually means more reps leave too)

Momentum (or lack thereof) in the business

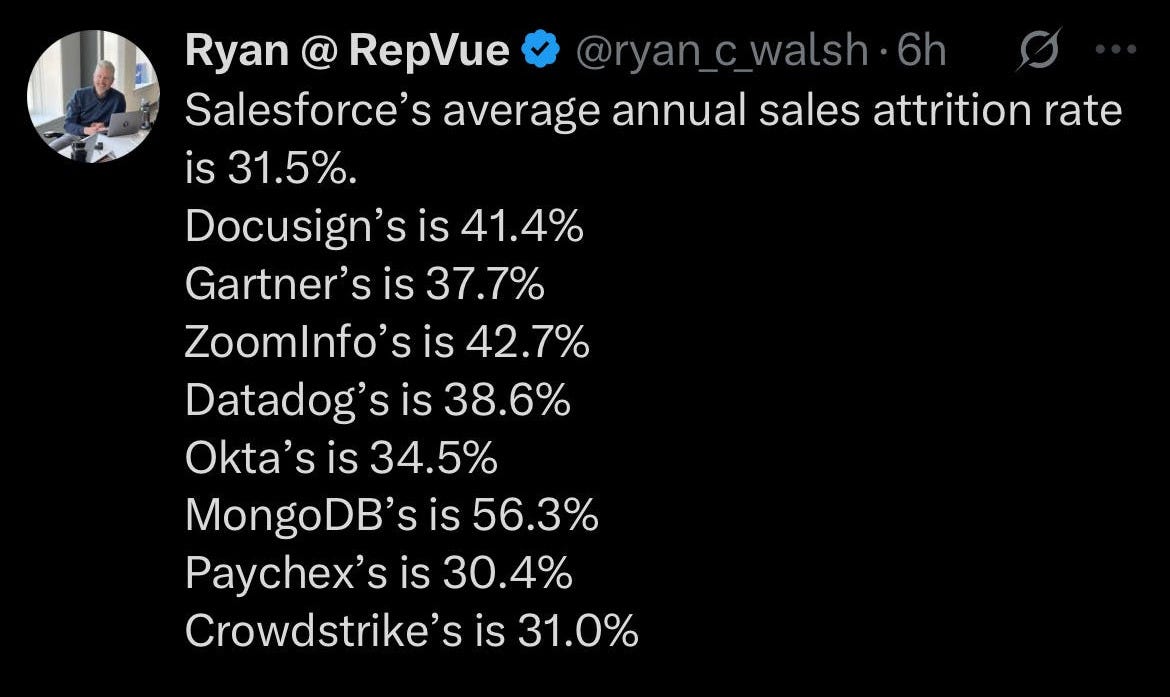

Regardless though, sales reps usually have one of the highest attrition rates at the company. In my experience something around 30% annual attrition is pretty normal. Larger companies will have more data to use while smaller companies will have to do a bit more guessing.

For lots of even larger, more established companies it’s even higher…

Attrition of nearly 50% is obviously crazy high. If you have a long ramping period then the unit economics start to just not make sense if sales rep attrition is too high.

Step 3: Current Sales Capacity

Now we have figured out the assumptions, the next step is to determine our existing productive capacity.

Assuming we don’t hire anyone else, what is our productive capacity?

Step 4: Hiring Needed

After the first three steps are done you can determine the gap between the revenue target and your current sales capacity.

New sales rep hiring will hopefully fill the gap.

How many reps do you need to hire and when do you need to hire them to hit the sales target?

Hiring in the second half of the current year determines a lot of the incremental sales capacity for next year

Hiring in the second half of next year should bake in hiring to meet the following year’s high-level targets. Don’t build a plan that appears efficient but assumes no hiring in the 2nd half. Unless you plan for growth to flatline…

There is major risk in hiring a lot of reps at the beginning of the year, so they become productive in the current year. Seen multiple layoffs happen because of this.

Hiring usually takes longer than you expect.

Other Common Mistakes

Holding onto bad performers because the excel model says that’s the only way to hit targets

“Small” assumption changes to hit target. These incremental improvements are multiplicative and can sneakily compound to cause very large sales targets.

Not getting alignment. Make sure all relevant leadership stakeholders are aligned and bought into the plan

Bad sales culture or comp plans. Everything blows up if this isn’t right. See my post on sales comp planning

Incorrectly assuming you have a repeatable sales motion after some success. Applies to all sizes of companies (new product, new geo, early company with friends/family buying, etc)

Not building sales capacity for the following year. It’s a lot easier to be efficient in GTM if you don’t plan at all for the following year.

In Summary

Don’t let some Excel-model wiz kid drive the sales capacity planning discussions. It needs to be strategic (art and a science). Not just Excel magic.

Make sure the leaders (and the board) understand the changes in the model drivers (ramping, productive capacity, etc). What are the changes in assumptions?

Use the sales capacity model to create guardrails and monitor progress. Continually throwing bodies won’t fix a sales growth problem. It often makes it worse…when supply (sales reps) is high, but demand (sales) is low, the good sales reps won’t hit quota and leave to somewhere else.

Footnotes:

Thanks to those who reviewed and provided feedback: Javier Molina, David Ma, Meir Rotenberg, and Thomas Robb

Here is the my Sales Capacity Model template

Get the AI in Finance guide (from Abacum), packed with actionable and tactical real-world examples

Check out the newly launched OnlyLawyer newsletter