Answering the AI Gross Margin Debate

Defining gross margins, when they matter, and if AI has a gross margin problem

Today’s Sponsor: Tropic

Q4 is almost here. And so are the renewals.

Over 30% of SaaS contracts renew in Q4, right in the middle of budgeting season. Tropic’s free Slack and Gong playbooks give you insider benchmarks, sharp negotiation tips, and contract gotchas from our procurement pros.

Three more guides (HubSpot, 1Password, ZoomInfo) are on the way. One sign-up gets them all. We’ve already helped customers save $56M in H1. Grab your playbooks and breathe easier this Q4.

The Big Gross Margin Debate

There has been A LOT of discussion (especially amongst VCs defending their investments :) around low/negative AI gross margins and if these businesses can ever generate meaningful profits.

If AI companies are selling $1 for $0.90 then of course they can grow revenue really fast!

Subsidizing a product can create enormous demand — Uber, Doordash, ChatGPT, “AI wrappers”, etc. These subsidized products can be cash burning machines so the question is…

Can these cash burning machines develop long-term sustainable and profitable growth by the time the subsidies must end?

At least one of two things (ideally both) must be true for low/negative gross margins to make sense:

Customer lifetime value needs to be high. This can happen from 1) high retention (with decent gross margins) and/or 2) pricing power to raise prices (or sell more profitable products) in the future.

Falling cost of sales so the products will be highly profitable in the future as costs come down. **This will be a trap for many AI companies (keep reading)

This is where venture capital steps in — high upfront costs are required so the company can burn money for a while until they become very profitable.

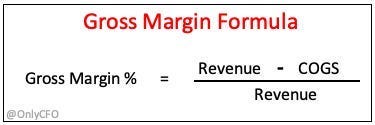

Before we get into whether subsidizing AI products (and low/negative gross margin AI products) is a good idea let’s define gross margins:

What is “Gross Margins”?

Gross margins represent the ceiling on profitability *today*.

Gross margins show how profitable you can be if everything else was shutdown (stop developing products, don’t need sales, AI takes over accounting, etc.). But it does not show the profit potential over the customer lifetime (from higher prices and/or lower costs in the future).

Gross margin is calculated by taking revenue less all the costs to deliver the product. Below are the typical expenses that are included in COGS (cost of goods sold) and therefore impacts gross margins:

AI Stuff — LLM inference, training, model hosting, 3rd-party API costs, customer model training, user prompting, licensing fees for training, etc

Customer support

Customer Success Management (check out: Is Customer Success COGS or OpEx?)

Infrastructure/hosting costs

DevOps

“Negative Gross Margins” is NOT the same as “Negative Net Margin”

A lot of folks don’t really understand the distinction here and Patrick Mathieson explained it nicely in his newsletter last week:

The former means that the product is being sold at below the variable cost required to deliver that product; the latter means that the enterprise as a whole loses money even if the next widget sold provides marginal cash to the company

Almost all VC-backed SaaS companies have negative net margins (and often very negative) for a long time, but RARELY do you see one (even bad SaaS companies) with negative gross margins.

Negative net margins is solved through scale and/or slower growth — operating expenses decline as a % of revenue and less upfront costs are required so the SaaS cash flow machine starts humming.

Negative gross margins are default broken businesses *today* that scale alone won’t solve because the direct variable costs to actually deliver the product exceeds the sales price. These companies only succeed IF gross margins improve (pricing power, falling costs, etc)

How bad are AI Gross Margins?

Historical SaaS gross margins have been glorious (75%+ on average). And that has been a primary driver of why SaaS attracted high valuations — they grow quickly, customer retention is high, and they have the potential to be very profitable.

Most AI products however have much lower gross margins. Instead of ~25% COGS, a lot of these AI products are closer to 50% COGS (and therefore 50% gross margins).

You are shaving off another 25% from the ceiling of profitability!

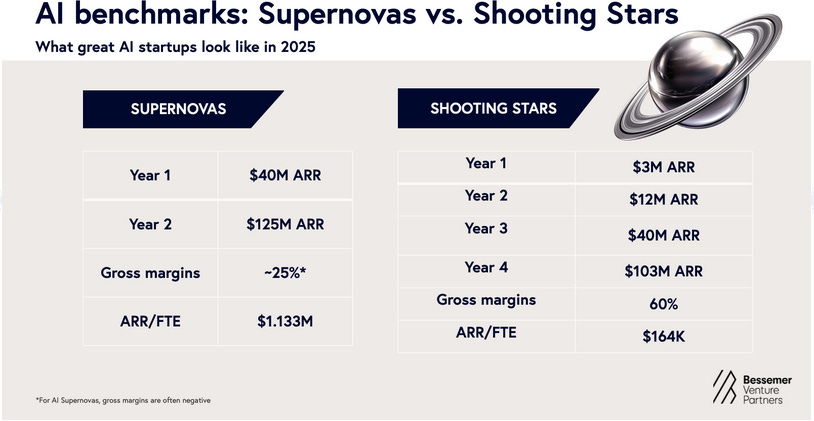

Bessemer just released a report showcasing two classes of AI benchmarks. Most of the crazy ARR growth rates you read about in the headlines are what Bessemer refers to as “Supernovas” and they have really low or even negative gross margins. While the “Shooting Stars” grow at more “normal” speeds and have ~60% gross margins.

In reference to Supernovas, Bessemer said the following:

These numbers arise from circumstances where revenue may appear vulnerable. They involve fast adoption that either belies low switching costs, or signals massive novelty that may not align with long-term value. These applications are often so close to the functionality of core foundation models that “thin wrapper” labels could be thrown.

Bessemer has a bias toward “Shooting Stars” while VC firm Andreessen Horowitz also just released a blog post on gross margins that makes a case for “Supernovas”.

Who is right?!?!

Me of course. And my answer is it depends…

Driving Business Value

I am not sure gross margin is the right thing to focus on in a business, especially early on. What you want to be thinking about is EBITDA margin, particularly terminal EBITDA margin. Terminal EBITDA margin is ultimately determined by how much of a monopoly a company can be in the long-term

— Delian Asparouhov, Founders Fund

Strong (and growing) long-term free cash flow per share is what ultimately drives valuations. A company that generates $0 profits will eventually be worth $0 in the long-term. So yes…eventually companies have to make money.

But both “Supernovas” and “Shooting Stars” are capable of building valuable long-term businesses. During the early company phases (particularly during high-growth) gross margins can be an indicator of MANY contradictory things.

Low gross margins = bad

Gross margins and unit economics are sticky (it’s not going to get better for them)

They rely on VC money to sustain growth so a market downturn could kill them

No moat (“thin wrappers”) so if costs do fall the competition will kill them

Low gross margins TODAY = fine:

They are capturing distribution. Instead of spending a lot of money on sales & marketing (like SaaS) they are subsidizing the product to get distribution.

They will build a moat as they scale

They are building something hard so gross margins are weak at first, but they will have a moat.

AI costs will come down and then gross margins will improve.

All of these are potentially valid arguments on both sides, but the primary question to answer is…

Is the business creating sustainable growth that will deliver high terminal free cash flow?

Build Something HARD

Forget about your gross margins because if you aren’t building something actually HARD then you are “cooked” (as the kids say) anyways.

Many “Supernovas” are achieving massive amounts of revenue by being early and/or subsidized, but that doesn’t necessarily equate to “hard to copy”.

Delusion of “hard”: Achieving high “ARR” doesn’t necessarily mean “hard”. They have gained a distribution advantage (which is awesome) but you NEED those customers to stick around! Low current gross margins and weak revenue endurance won’t build a long-term valuable company.

Falling AI costs won’t save you: LOTS of companies have delusions that gross margins will be glorious as AI costs decrease another 90%. If a company is truly a “thin wrapper” kept alive by product subsidies then falling costs will actually kill you….There is no longer a barrier to entry (capital required to subsidize it) so the new competition will eat you alive.

Final Thoughts

All else being equal…higher gross margins are obviously better.

Most “Supernovas” are starting from a position of weakness — must subsidize their products and highly dependent on VC capital. But if these Supernovas can grow quickly and simultaneously build something “hard” then they may be worth a lot of money.

It’s easy to make friends when you give them money, but will they continue to be your friend once you start asking them for money?

Gross margins matter! But when, how, and why are important to the story.

Footnotes:

SPONSORS: I am opening up sponsorship slots for next year. Email onlycfo@onlycfo.io to make your wildest marketing dreams come true

Get the playbook on how to save on popular vendors like: Slack, Hubspot, 1Password, ZoomInfo, and Gong (from Tropic)

I recently partnered with one of the best in-house tech lawyers I know to launch OnlyLawyer. Check out recent posts AI’s impact on contracts and how EU is making business difficult (again!)

**Bonus Content**

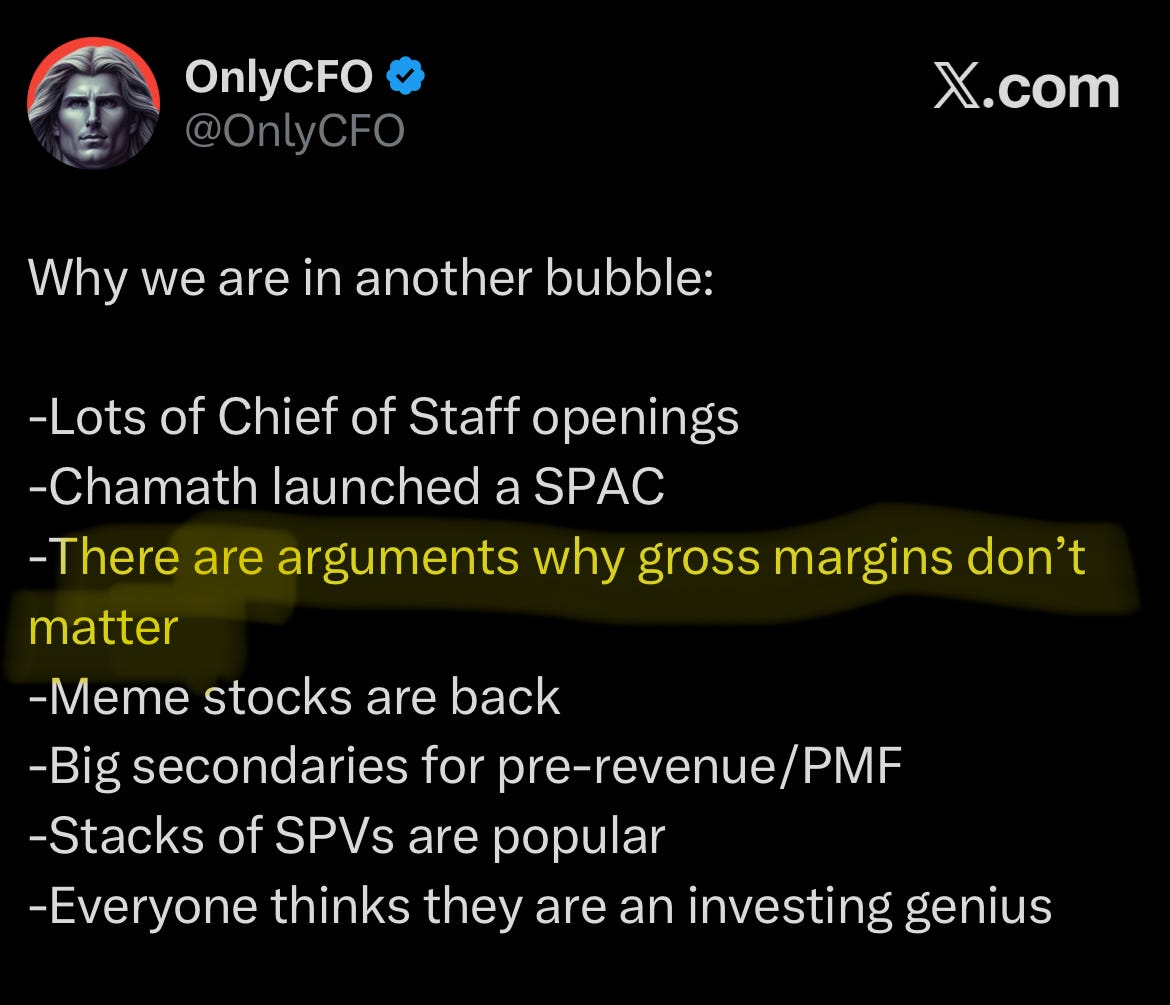

Are we in a bubble?

Lack of Comparability:

The problem with benchmarks for gross margins (and other areas) is comparability. Gross margins can vary wildly, especially for early stage companies, depending on what the accountants do. There are a few places I see major diversity:

DevOps is often kept in R&D for way too long. If you have people dedicated to managing customer uptime and their instances then that is COGS.

The AI stuff is new so pay attention and make sure your accountants are doing what you would expect. I have already seen this get hidden in R&D a lot.

Customer Success. Read the article I listed above. I see a lot of “CSMs” that are just glorified customer support with a sexier title.

The AI Growth Scam

The other potential option is founders are just playing a “get rich quick” scheme by raising more money, creating hype, and scamming investors by selling a lot of secondaries to dumb investors who don’t know the business is destined to fail but it looks awesome because of the “ARR” growth.

FWIW I think this is a pretty small percentage, but…anytime you have overly excited investors (and dare I say approaching bubble territory) you are going to find folks who just want to make a quick buck. And there are investors willing to take that gamble.