Snowflake's Stock Crash | Software Multiple Update

Snowflake is down ~30% after disappointing forecasts and their legendary CEO stepped down.

Brought to you by: NetSuite

Learn what CEOs want in a CFO

We have talked to a dozen chief executives about what makes a top finance partner. Today's CFOs need to be more than numbers people, they also need to know how to navigate the business.

Since Snowflake went public it has held one of the top spots for the highest valuation premium. It hasn’t always been #1, but it has held steady in the top 3 for a really long time.

Snowflake now sits at the 7th highest software revenue multiple, which I believe is the lowest it has ever been (at least for any meaningful amount of time). Being 7th place out of ~90 public software companies is still great….but we are used to it being #1 (or close to it).

The below image shows the current top 10 public software revenue multiples and their changes over the past 12 months.

So what happened to Snowflake’s stock price?

Two major things happened when Snowflake announced earnings last month:

Frank Slootman, Snowflake CEO, stepped down with Sridhar Ramaswamy, the former head of Snowflake AI, taking over as CEO. Investors loved Slootman given his track record and are likely a bit hesitant with a new CEO.

Disappointing guidance and bad communications.

CEO Changes

CEO changes seem to be becoming a lot more frequent these days, especially in the private markets. The uptick in CEO changes might be attributed to Boards being less founder friendly today, the CEO job being harder in today’s environment (burn out), technology shift with AI requiring a different type of leader, etc.

Slootman was a very respected CEO and had an amazing track record. Slootman attributed his stepping down to the fact that he believes Sridhar’s experience (specifically with AI) is what Snowflake needs today.

Slootman is a business guy and does not have a technical background, but he does have one of the most impressive career backgrounds ever.

Whatever the true reason for his departure, Snowflake does seem to be a bit behind in AI so putting their top AI person in the CEO role should help speed things up. But there is no doubt that investors loved Slootman and there is risk with a new CEO.

Snowflake’s Earnings Report

The quick highlight of Snowflake’s earnings report is they had a great quarter but gave pretty bad guidance.

The below is a fantastic summary from Brad Freeman on Snowflake’s Q4:

The key to a great quarter is a “beat” of current quarter consensus and “raise” on forecast. Snowflake had a nice Q4 beat, but missed guidance for revenue and profitability pretty badly — 6% miss on revenue and 3.2% on EBIT margins.

The guidance matters A LOT for stock price reactions to an earnings release and this is the main reason why Snowflake got crushed.

Slootman or Bad Guidance?

A lot of people were quick to say that Slootman leaving Snowflake caused its valuation to plummet by $15B (stock price decline of 20%). While I am sure Slootman stepping down had an impact, it isn’t the cause of the full $15B drop…

As mentioned earlier, forward looking guidance was pretty bad as well and definitely played a big part in the stock crash. But…these two events might be somewhat intertwined.

Bull case:

The guidance is very conservative to set up the new CEO to win. Setting a new leader to beat expectations is fairly expected for both a new CEO and a new CFO. You want to set the new leaders up to start off strong with a beat on the first few quarterly results. This not only builds the new leader’s confidence but can build investors’ confidence in them as well.

I recently called this out in a prior post about Confluent’s new CFO:

Confluent named a new CFO in early August, so the potentially conservative Q4 and 2024 forecast is tied to him. Trust me when I say that the last thing a new public company CFO wants to do is not revise revenue targets down enough and the company misses targets again (bad way for a new CFO to start).

Confluent provided disappointing guidance during its Q3 earnings release that sent the stock tumbling. But the call out I made was that it was the new CFO’s first quarter forecast so it could be a bit conservative.

Confluent blew out guidance with a 4% beat on revenue so the stock went soaring back.

Obviously there is more to it than just a conservative guide. Other things went right for Confluent, but the previous revenue guide may have been a bit conservative as well.

The below quote is from Snowflake’s CFO on their recent earnings call:

“I think we are definitely being more conservative this year.” – Snowflake CFO Michael Scarpelli

It definitely seems like Slootman is setting up the new CEO to knock it out of the park with a strong “beat and raise” in Sridhar’s first quarter as CEO.

Question is how much of this is now baked in to the current stock price? Presumably many other investors think it’s a conservative guide as well…

Bear case:

While some of the bull case noted above might be true, Snowflake has certainly been facing some headwinds.

Revenue growth has come down rapidly — revenue guidance missed expectations by 6%, which seems to be too conservative to just be setting up the new CEO to beat. Profit margin guidance is also not great.

The change in CEO, competitive pressures, and other headwinds are all creating doubt in Snowflakes ability to remain a high-growth company.

One of the big concerns is around Snowflake’s revenue growth endurance (see next section) and its ability to reaccelerate revenue growth. Once a company falls out of the high growth bucket the type of investors and valuation multiples can change dramatically.

Revenue Growth Endurance

Snowflake’s revenue growth endurance (current year growth rate / prior year revenue growth rate) has been fairly low relative to other companies. A big part of this is due to Snowflake’s crazy high revenue growth a few years ago…3 years of more than doubling revenue each year🤯! Doing that at $25M of revenue is hard and Snowflake was doing that at nearly $1B in revenue.

The problem is that as growth rates have slowed dramatically, the revenue growth endurance continues to be fairly low.

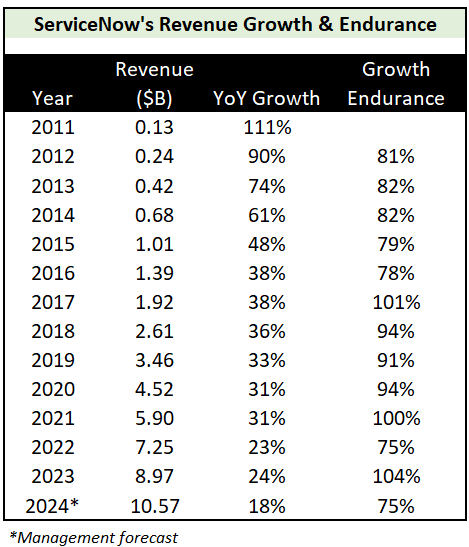

Let’s compare Snowflake’s growth endurance to ServiceNow below:

ServiceNow didn’t have as high of revenue growth as Snowflake in the early years, but it has had world class growth endurance over the past decade — there probably aren’t many other software companies in the world that have (or will ever have) as strong growth endurance as ServiceNow for such a long period of time.

A couple of years of high growth endurance is great, but companies that can sustain high endurance over a long period of time will grow exponentially faster.

Janelle Teng published a post yesterday with an updated look on growth endurance for public cloud companies.

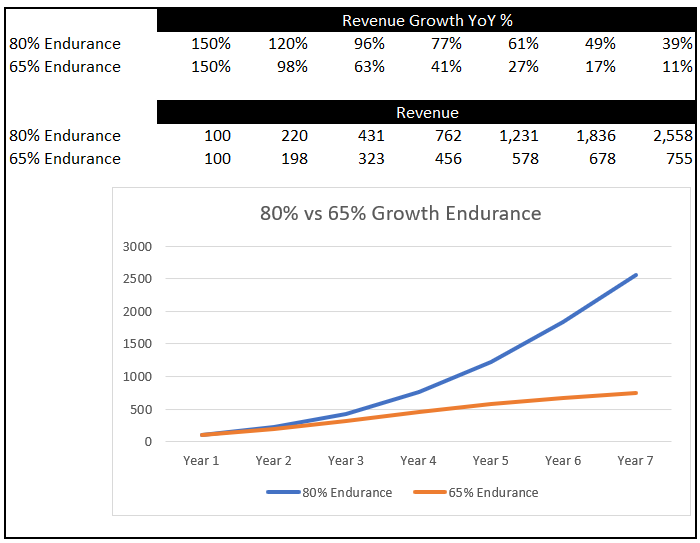

When Bessemer ran this analysis in 2021 the growth endurance was 80% and today it has fallen to 65%. That might not seem like a big drop, but over a longer period of time it is HUGE!

Below is an illustration between two companies: One with 80% revenue growth endurance and one with 65% growth endurance over a 7 year period. While they both start off at $100M in revenue and 150% growth rate, the one with 80% growth endurance ends up with 3.4x more annual revenue 🚀!

While growth endurance rates have certainly come down for most cloud companies, Snowflake is below average. Hopefully the bulls are right and that the guidance is low and AI will help reaccelerate revenue for Snowflake to get back to high growth.

Review of Valuation Multiple Changes

Below are the top 10 increases in revenue multiple ranking for software companies over the past year. JFrog is leaping ahead of everyone with its stock up 134% in the past year.

Below are the top 10 largest revenue multiple drops in the past year. Paycom has gotten crushed falling from a top 10 to the bottom half of public software company multiples.

Footnotes:

Join the community by becoming a paying subscriber and get access to me and other finance leaders in software companies! Ask questions, get answers, and communicate with your peers.

Sponsor OnlyCFO Newsletter and reach 17k+ CFOs, CEO, and other leaders in the software industry.

What makes a top finance partner: Check out this great article from our sponsor.

**For educational purposes only. Nothing here should be considered investment, legal, or tax advice

I was not familiar with the Revenue Growth Endurance term, the 80/65 diff is very surprising. Intuitively I would have guessed different numbers.

I’m curious to know what’s next for Slootman. His “Amp It Up” is one of the best books I’ve read this year.