Software's Biggest Winners & Losers

Lessons from valuation changes over the past year

Today’s Sponsor: NetSuite

I published a SaaS Chart of Accounts Guide in collaboration with NetSuite. A good chart of accounts is the foundation for all financial reporting so make sure your company is set up properly!

This guide includes a full sample chart of accounts and department listing. It is exactly what I use as a finance leader at software companies.

How have cloud valuations changed over the past year and what can we learn?

There are interesting insights from relative valuation changes over time.

Basically every public cloud company’s revenue multiple has come down since the peak of 2021. An individual company’s valuation multiple change may not be that interesting because of general market multiple expansion or compression.

But the relative valuation multiple changes can be interesting…

Top 10 Highest Revenue Multiples

Below is a list of the cloud companies with the highest revenue multiples as of today. It also shows the relative revenue multiple change from one year ago.

5 of the above top 10 are different from last year

CrowdStrike climbed to the #1 spot by passing 19 other companies!

Its stock price is up nearly 150% since last year. Check out my write up on CrowdStrike from a couple of months ago - Winners Keep Winning

Snowflake has fallen 6 spots. For a long time Snowflake dominated with the #1 or #2 spot, but Snowflake has had a bit of a rough year with their investors (new CEO, huge security issue, growth slowing, etc)

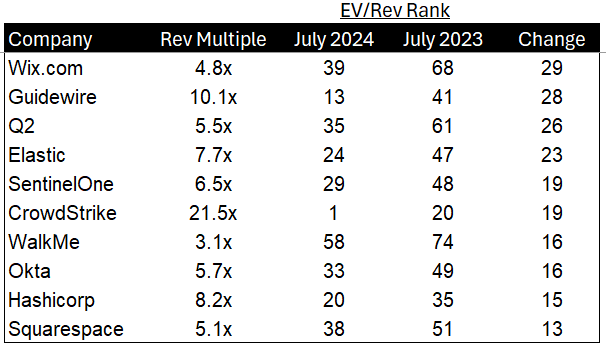

Top 10 Multiple Winners

Below are the companies with the biggest relative ranking increase in revenue multiples.

Wix leads the pack after jumping 29 spots. There are likely other factors, but their ability to keep their growth rate flat at 13% while massively increasing FCF margins from 16% to 26% is impressive…Guessing investors are rewarding them for that.

Almost all of these companies are significantly improving FCF margins and some are also improving revenue growth at the same time. Investors are loving that….revenue growth AND efficiency

SentinelOne was the fastest growing public company for a long time, but it was also burning TONS of money. While their growth rate has fallen a lot (down to 28% NTM), they are finally going to be FCF positive next year so the market is rewarding them after a long time of burning enormous amounts of money.

Biggest Valuation Losers

Below are the biggest losers in valuation multiples.

Missing expectations is what sent a ton of these stocks crashing downwards. Paycom had the 15th highest revenue multiple last year with an expected NTM growth of 23%, but its actual revenue growth was only 18% and now expected NTM growth is only 11%….

Bill.com is the biggest valuation loser. If we go back 3 years to the glory days of 2021, Bill.com held the #1 revenue multiple spot at 57x multiple! Revenue multiple compression from market conditions is hard enough, but then dropping to nearly the bottom quartile of revenue multiples for all of software is really tough…Bill.com will have to generate A LOT more revenue to get back to its prior valuation if its revenue multiple doesn’t change.

Friday Fun

Jim Cramer has provided social media with an endless supply of memes.

If you are unaware, Jim Cramer is a popular TV personality that covers the stock market and gives lots of opinions on various stocks. Unfortunately for him, many of his stock picks seem to have been timed perfectly wrong…(even if he has had many good picks as well)

It became such a big joke, that someone created a “inverse Jim Cramer” ETF that did the opposite of everything Jim Cramer recommended.

Here are some of the best Jim Cramer memes:

Footnotes:

Check out OnlyExperts if you need offshore accountants. I am partnered with them to help CFOs and finance teams hire better finance talent for less.

Grab my SaaS Chart of Accounts Guide and get your books set up the right way

A few of the relative ranking increases are due to premiums from take-private offers. WalkMe, Hashicorp and Squarespace are all being acquired. That probably also helps explain the jump in Wix, a direct competitor to Squarespace.

Do you feel that the current global outages on windows 10 (major airlines, governments etc.) will have a big impact on the valuation of Crowdstrike?