Winners Keep Winning | CrowdStrike

Breakdown of CrowdStrike and why it has the highest revenue multiple of all public cloud companies

Today’s Sponsor: The F Suite

The time you spend choosing the ideal ERP system could be spent on… well, anything else. Pack weeks of research into a single day: join The F Suite on June 20 for our virtual ERP Demo Day with Oracle Netsuite, Sage and Rillet, led by CFOs including Donna Person Taylor (CFO, MentorcliQ), Brian Weisberg (CFO, Tidelift), and Gary Vecchiarelli (CFO, Cleanspark).

The event combines real-world case studies and candid closed-door CFO discussions to make your ERP decision easy.

RSVP for The F Suite’s ERP Demo Day

Winners Keep Winning

CrowdStrike reported earnings this week and it continues to hold the #1 spot for the highest revenue multiple amongst public cloud companies. While many software companies are struggling, CrowdStrike keeps finding ways to raise expectations.

1 year ago CrowdStrike wasn’t even in the top 10 highest revenue multiples. They had a revenue multiple ranking of #15 in June of last year. So CrowdStrike jumped 14 other companies in the past 12 months.

What does it mean to have a high revenue multiple?

When I say revenue multiple, I am referring to EV/NTM revenue, which looks at the valuation of the company compared to its next twelve months (NTM) expected annual revenue.

A high revenue multiple means that investors are valuing each dollar of revenue more relative to other companies. Investors will do this because of a combination of the following:

Investors expect higher and more durable revenue growth

Investors expect higher profit margins

Investors are either a) overpaying for high revenue multiple stocks and future expectations are unrealistic or b) the high expectations are warranted and the company beats those expectations so investors are rewarded with a higher stock price.

Winners Keep Winning

CrowdStrike has been pretty consistently great since its IPO in 2019 and its Q1 results announced this week were no different.

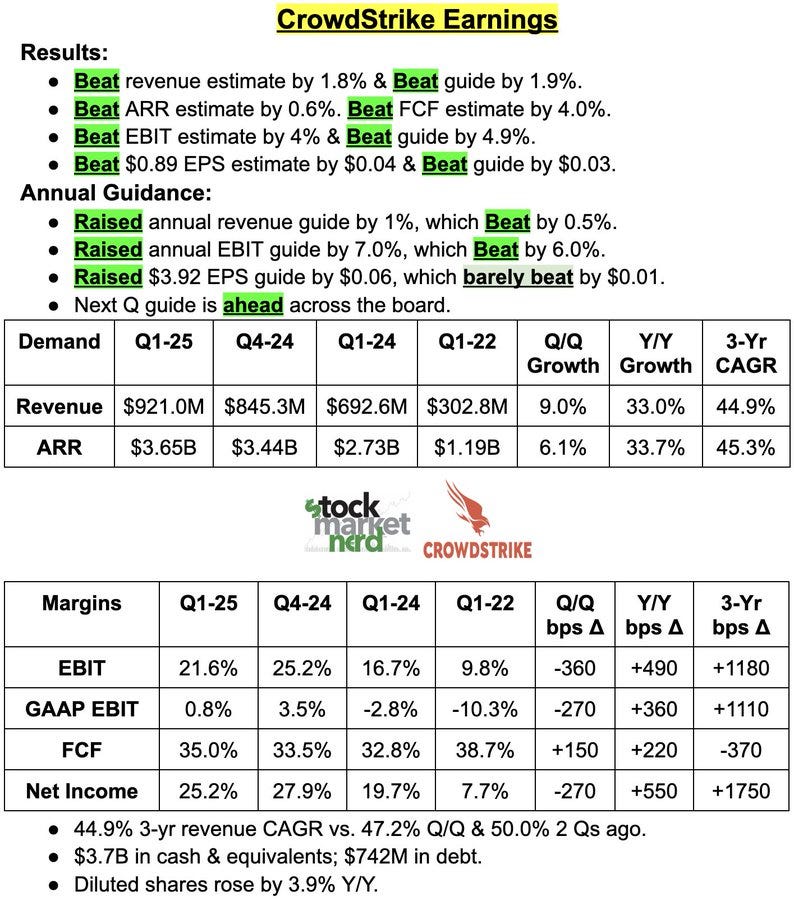

Below is a great snapshot of CrowdStrike’s earnings from Brad Freeman. CrowdStrike beat and raised on every metric, which is the definition of an excellent quarter.

CrowdStrike’s Revenue

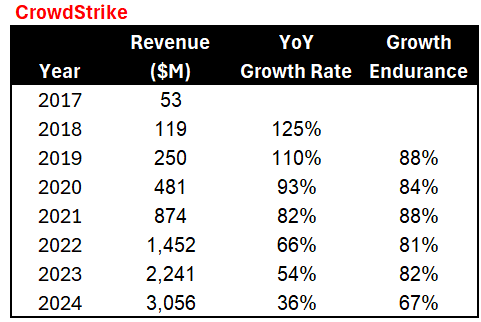

The most important factor for a high revenue multiple company is strong, durable revenue growth. CrowdStrike has had phenomenal revenue growth since the early days but in the last 12 months it has been exceptionally strong relative to its peers. This is what has enabled CrowdStrike to leapfrog to the #1 revenue multiple spot.

CrowdStrike has the highest expected next twelve month (NTM) revenue of any other public cloud company at 30% revenue growth.

CrowdStrike’s Profitability

CrowdStrike also has world class free cash flow (FCF) margins and it continued to deliver in Q1 with 35% FCF margins. These are the types of margins that have been expected of top tier cloud companies but very few have actually achieved them.

Many cloud companies have really struggled to generate meaningful profit margins (and sustain them). 15x+ revenue multiples only make sense if these companies can generate huge FCF margins and sustain them over a long period of time.

CrowdStrike has the highest Rule of 40 score (revenue growth + FCF margins) because of its high revenue growth while also being one of the most efficient software companies on the planet.

S&M % - relative to revenue growth, CrowdStrike is one of the most efficient

R&D % - only 3 of the top 10 companies are more efficient, but CrowdStrike is expected to have longer durable growth so the higher investments in innovation makes sense

G&A % - CrowdStrike is certainly efficient in its G&A spend as well, but a lot of the variations in G&A is simply a result of scale. Crowdstrike has more revenue than all these companies except ServiceNow and Palo Alto

Stock-Based Compensation & Dilution

A constant critique of software companies (at least lately) has been their high stock-based compensation (SBC) expense which dilutes investors and their returns.

Below is CrowdStrike’s SBC as a % of revenue for the last several years.

CrowdStrike’s recent Q1 SBC is 20% as a percentage of revenue, which is in line with recent trends. This SBC % is also roughly in line with most other public cloud companies and on the lower end for high-growth cloud companies.

But the problem with looking at SBC is that it is a GAAP accounting expense which can cause this expense to not necessarily reflect the underlying economics. Check out my previous article - Lies of Stock-Based Compensation

Ultimately what investors care about in regard to SBC is dilution — i.e. how much dilution is being created from the SBC. Below is CrowdStrike’s quarterly shares outstanding since 2020:

FCF Per Share

Revenue growth, profitability, and dilution are all the drivers of the ultimate metric that drives long-term value — FCF per share.

CrowdStrike’s FCF/share has been marching steadily upwards for a long time to get to their 35% FCF margins. CrowdStrike’s FCF generation has significantly outpaced any dilution as evidenced by the strong increases in FCF/share over the past few years.

Although, it would be nice if all these tech companies had a bit less dilution…Thomas Reiner did an excellent post on SBC a few months ago that goes through how to evaluate it and shows the amount of dilution of tech companies.

The impact of dilution to FCF/share can be significant.

Takeaways

Winners often keep winning. CrowdStrike has been a strong performer since its IPO

Investors frequently misjudge revenue growth endurance (how long high revenue growth can last). Also, the higher the revenue growth rate the higher the risk of growth endurance weakness. CrowdStrike has had great growth endurance for a long time, despite the weaker performance in FY24 as a lot of companies experienced weakness last year.

The growth rate in 3+ years is a lot more important than next year’s revenue growth rate. Investors that can better predict long-term growth endurance have a major advantage.

The ultimate investor metric is FCF/share overtime. If you go one layer deeper there are three primary measures of value:

Revenue growth

Profitability

Dilution

Footnotes:

If you are a finance executive check out FSuite

Reply to this email if you are looking for bookkeepers or fractional CFOs that focus on tech.

My sponsorship slots are almost full for this year! Grab one of the last spots

I've got no problem with the management reward in terms of option grants and the resulting dilution if they keep putting up FCF/share growth like that. In fact, I'd rather that than cash bonuses. It shows that they're all in!

Really interesting to see how CrowdStrike jumped from #15 to #1 in revenue multiple ranking in just 12 months. The combination of 30% revenue growth + 35% FCF margins is exceptional and rare in software. What's particularly impresive is how they've managed to maintain such strong S&M efficiency while scaling - most companies see that degrade as they grow larger. The FCF per share growth chart really tells the story - this is what sustainable value creation looks like when you can outpace dilution with actual profit growth. Great analysis!