While a lot of people at private software companies are not thinking much about the potential value of their equity these days, it is important for folks to understand the basics and what is happening in the market. 409A valuation declines are normal and expected right now…

Once you understand some of the basics you will have a better idea whether your equity has any potential. This is especially important as people change jobs and are often forced to decide whether or not they should exercise their stock options or not.

Carta’s recent 409A trends report has lots of interesting insights.

409A Valuations

A 409A valuation is NOT done by your investors and does not necessarily represent what they would value the company at. The purpose of the 409A is to determine the value of common stock so that stock options and other equity awards can be granted to employees appropriately.

A 409A valuation is an independent appraisal of the fair market value of a private company’s common stock. This valuation is based on guidance and standards established in section 409A of the IRS’s internal revenue code.

VCs on the other hand get preferred stock. Preferred stock can have several features which make it more valuable than common stock — 1x (or greater) liquidation preference, particpaiting shares, ratchet provisions, redemption features, etc.

Frequency: 409A valuations must be done at least annually or when there is a material event (such as a fundraise).

409A Valuation

A commonly sited rule of thumb is that the common stock FMV should be ~1/3 the VC preferred stock price at the time of fundraise. Sometimes people would refer to the “built-in” gain on stock options being the spread between common stock and preferred stock — the VCs valued us at $[X] and you are getting stock options at 1/3 $[X]!

There are a few problems with that rule-of-thumb:

It depends on the stage of the company. The closer to an IPO/exit the closer the two converge while the earlier stage might be more spread.

Companies that had a lot of secondary sales of common stock will cause the common stock FMV to be higher

As fundraising timing becomes less frequent the spread can become much different

If your company last raised money between 2020 and 2021 then hopefully your 409A FMV is closer to 10% than 33% of your fundraise price.

409As are done for the purpose of employee equity so companies should generally want the FMV as low as possible for the employees’ benefit.

Latest Data from Carta

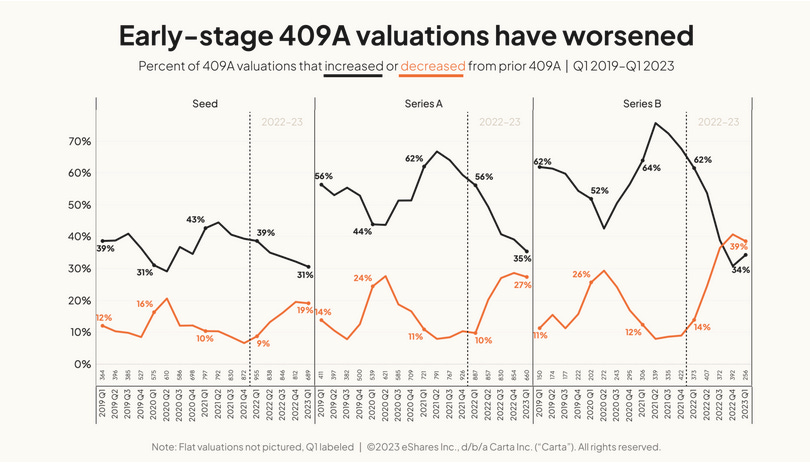

Below is the number of 409A valuation decreases overtime by stage.

Seed rounds have been the least impacted. This is not a huge suprise because seed round fundraising and related valuations have been the least impacted during the tech recession. But the later the stage the bigger the % of valuation drops.

In Series C and beyond 409A valuation decreases were huge. Valuation declines accounted for ~45% across these stages.

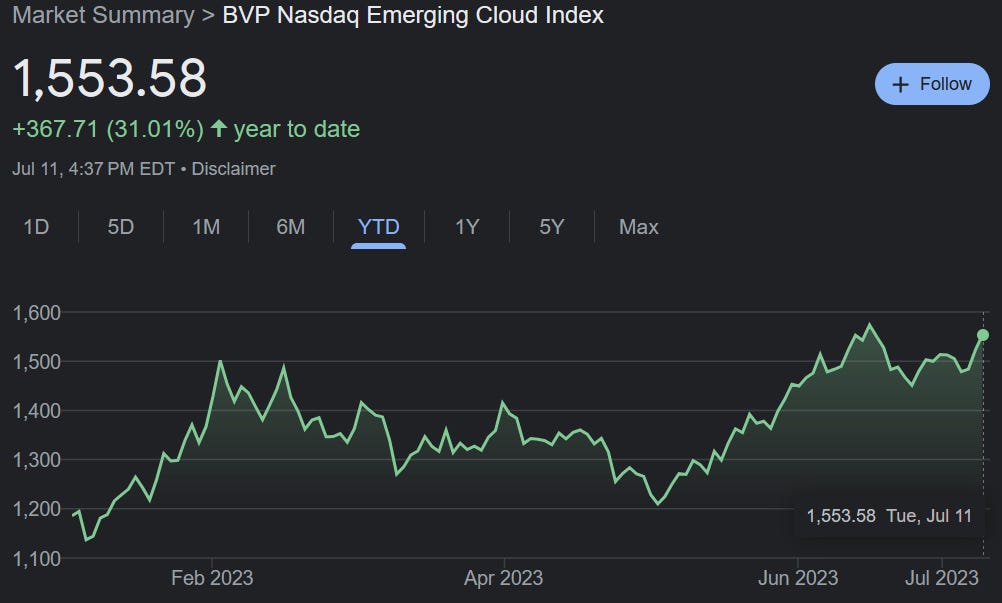

This is in sharp contrast to the public software companies which have seen solid stock gains (31% gain YTD from the Emerging Cloud Index) since the beginning of the year. But that is because 409A valuations significantly lag public markets because they are often only done annually.

It probably also took a while for some private companies to be honest with themselves about their forecasts so revenue forecasts have likely taken a while to come down to where they should be.

Exercising Stock Options

As you might imagine, A LOT less people are exercising their stock options when they leave a company than back in 2021. Carta data shows that the % of employees exercising has almost been cut in half since the peak in 2021. This has probably happened for a few reasons:

IPO window is shut so exit opportunties are much smaller right now

Lots of folks that can exercise now were granted at elevated 409A prices so they are underwater

Growth for many companies has hit a wall so there is less optimisim about value

People are worried about layoffs so they are holding on to their cash

Another interesting chart from Carta is the number of option grants being repriced.

When an employee is granted a stock option, they are given a “strike price” (i.e. amount they must pay to own the stock options after they vest) and that price is usually fixed and never changes. If an employee is granted options with a strike price of $1/share and the price is $20 after four years when the options are fully vested, they still only pay $1/share to own the stock (but there can be different tax consequences!). The same can be true in the opposite direction — you are granted options at $1/share but after 4 years the current value is $0.20 but you still must pay $1 to own the shares.

If the company was public then there would be no reason to exercise the stock option because you could buy the stock for less on the open market. But for private companies some folks may still want to exercise because they believe their is more value and they can’t buy the stock on an open market.

However, companies have the ability to “reprice” stock options — lower each employee’s strike price to the current 409A FMV. While this requires some legal paperwork and could potentially have negative accounting implications if done too frequently, it is relatively easy and can be a huge benefit to employees if the price has come down signficiantly.

Final Thoughts

Most companies 409A valuations are down or flat. 409A increases are the minority right now. It does not necessarily mean your company is doing horrible. All else being equal, you should be happy with a lower 409A price and sad if you have a high one. If you were granted stock options at sky high 2021 valuations then there might be less potential upside. Repricing stock options has definetely gained some popularity but the majority of companies still don’t do it.

Bonus Content: Stock Option Fun

Here is my advice for tricking employees about the value of their stock options! (this is a joke…but happens all the time so employees should watch out!)

Tell employees that they will definitely make tons of money from their stock options!

If the company raised at a crazy high valuation in 2021… Then tell employees that their options are worth the difference between their exercise price and the 2021 valuation!

Don’t tell employees the fully diluted shares outstanding.

“You get a stock option for 1M shares! I am sure that is better than any other offers you are looking at. Sorry, we can’t disclose the total number of shares outstanding” …

….there are 10B fully diluted shares

Don’t tell candidates the exercise price or the last preferred price.

Just say it’s confidential until they join. They won’t be the wiser!

Tell employees that you pay below market cash salaries since the stock options are so valuable.

This is a great way to get some quick cash savings!

Don’t tell employees that you signed a super “dirty” term sheet with a 3x liquidation pref that is participating with a full ratchet!

Thy have no chance of making any money off their stock options!

Reading

-Employee Stock Option Lottery Tickets

-Trends in 409A valuations (Carta)

*Nothing above is investment or tax advice. Due your own diligence and research.

I'm a former employee with some remaining options which i previously exercised. Am i entitled to any sort of reporting from the company re: annual financials?