👮🏻♂️Tech Unicorn Founder Goes to Prison for Fraud

The right financial controls are critical for avoiding fraud and errors

Brought to you by Leapfin

Leapfin has a great talk coming up, The best finance lessons I’ve learned with Strava CFO Lily Yang on May 8 at 10am PT.

Listen in as Lily and Leapfin product leader Caitlin Steel, CPA (and a former CFO too!) share advice you can put to use now, whether you’re currently in the CFO chair or on your way there.

In this 30-minute session, you'll hear what Lily has learned through her fin-wins and fin-fails, advice for other women in finance and accounting leadership, and what CFOs at high-growth companies like Strava need to prioritize in 2024 to succeed.

Manish Lachwani is the founder of HeadSpin, a SaaS tool for mobile app-testing. Lachwani was just sentenced to 1.5 years in prison for lying to investors about the company’s financials. At the peak of the fraud, HeadSpin raised at a $1.1B valuation and attracted top tier investors (Google Ventures, Iconiq, Dell Technologies Ventures, Battery Ventures, and Tiger Global) 🤯

One of my most popular blog posts is How to Trick Investors. While I am not sure how to feel about my audience being so interested in that post, essentially everything in that post was about the “grey areas” of how companies might attempt to intentionally (or unintentionally) juice financial metrics. The point of the post was to make fun of people doing these things and discourage others from trying them. Most investors are smart and would see right through them.

But what Lachwani did at HeadSpin wasn’t just financial metric creativity to make financials look a bit better…it was outright fraud and deceit.

The bizarre thing is that HeadSpin was and continues to be somewhat successful (at least from what is reported). Lachwani didn’t need to commit fraud to raise money…Maybe the valuation would have been smaller, but as a second time founder (previously founded Appurify which sold to Google) investors would have taken a bet on him. He let greed and desire to impress get the better of him…

The Lies and Fraud

Once you cross that line it is a very slippery slope. The thing with accounting is that the tricks (or flat out fraud in this case) always catches up to you.

A fraud might be able to continue for a while if investors keep giving you money and the actual business is doing OK, but eventually you will be exposed…

If you inflate revenue by $1m this year then you have to inflate revenue at least by that much next year otherwise revenue growth will suffer significantly. But if you have already crossed the line of fraud then you may be pushed to inflate revenue by even more next year to continue the lie of high-growth.

The things Lachwani did will make your head spin (see what I did there 😎):

Inflated revenue by as much as 4x

Included prospects in ARR schedules (i.e. annualized revenue)

Lied about the amount of revenue of customers

Included customers that had churned (no longer customers) in ARR schedules

Altered customer invoices to keep up the lie about revenue

Used HeadSpin cash to gamble on stocks and stock options of other technology companies (like Snap, Roku, and Tesla). Lachwani wrote the below to one of his board members 🤣

It is extremely sad to see money reaping really low interest

VCs are NOT giving startups money to go gamble in the stock market. Companies are supposed to have an investment policy approved by their board of directors that directs how cash is allowed to be invested. 99.9% of these policies should state that investments are just for the preservation of capital and balancing liquidity needs with yield (low risk and highly liquid).

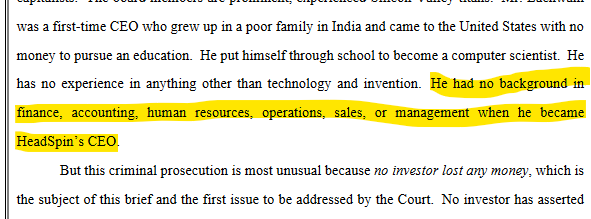

No HR department and only a junior bookkeeper. This may be ok in the very early days, but if you have raised $117M at a billion dollar valuation you need someone with experience in finance and accounting. It doesn’t have to be a highly experienced (and highly paid) CFO, but at least a strong Head of Finance type role. A great way to have this type of fraud is to not have an experienced finance person (unless the finance person is also in on it…)

Showed profits when there were actually losses. I don’t have the details of what he did to do this, but like I mentioned earlier, accounting tricks always catch up to you because you can’t fake the accounting forever.

Sold $2.5M of stock using his inflated metrics. It is not a bad thing for a founder to sell some of their stock and get liquidity ($2.5M is not a crazy amount). But it just looks extra bad when you are enriching yourself from your fraud.

The Fraud Triangle

In accounting classes they teach you about the “fraud triangle”. There are three things that have to be present for fraud to occur.

Pressure - motivation/incentive to commit fraud

Rationalization - person’s justification of why it is OK

Opportunity - knowledge and ability to commit the fraud

1. Pressure

Anyone who has been at a VC-backed software company (and basically any founder to ever live) knows how much pressure there is to succeed. Their careers, reputations, livelihoods, ego, etc are all on the line. There is always pressure.

2. Rationalization

Everyone is a bit different here, but lots of people will rationalize something that they feel is grey if they are pushed. Where that grey area falls is dependent on the person. When the pressure is high though then people can be pushed into the grey area (and beyond) if they don’t establish clear boundaries that they will never cross.

3. Opportunity

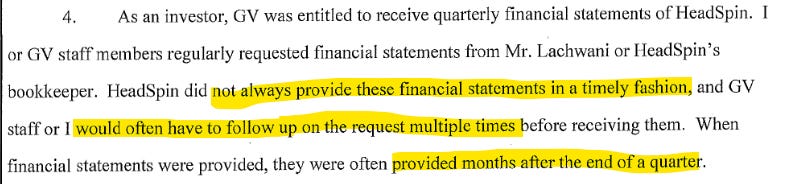

This is the one area of the fraud triangle that can actually be controlled. In HeadSpin’s case, committing fraud was too easy. Lachwani (the founder) controlled everything. This is fairly typical in small companies, but even after raising massive amounts of money the company was still using a single outsourced bookkeeper for all accounting/finance and had no HR department.

The board clearly saw the gap in controls and oversight and pushed Lachwani to hire a CFO….but he never did 🚩🚩🚩

Have the right finance/accounting resources. If your company is smaller (<15M in revenue) then some fractional CFO and bookkeeper support might be enough (complete this form and I’ll get your info over to a great tech-focused fractional CFO :).

At some point you will need to bring on full-time people in finance/accounting as things get bigger and more complex. You shouldn't wait too long for this but the exact timing can vary depending on the business and other skill sets at the company. But at a $1B valuation and $117M in cash....you 100% should have someone with appropriate experience full-time.

Put in some basic financial controls. There are a ton of things you can do to mitigate the risk of fraud, but below are some of the easy ones:

Bank controls - there are a few of these controls that you likely should set up. But make sure all outgoing money requires secondary approval.

All vendor payments should require department leader approval (larger payments may also require CFO/CEO approval)

Accounting automation software (like my sponsor Leapfin offers)

Monitor and explain all significant changes/trends in financial accounts. This would alert folks to unusual things (like the fake invoices that Lachwani created). These reports must be timely and distributed to the right people.

Fraud Excuses

Lachwani’s attorney made some hilarious excuses about why his fraud really wasn’t that bad…

He was not an accounting/finance expert

Lachwani’s lawyers: “Your Honor, Mr. Lachwani is not an expert in accounting/finance so how was he supposed to know that he shouldn’t make fake invoices? These are very complex and technical matters” —OnlyCFO interpretation of the below

Investors didn’t lose money so there was no crime

This is just stupid...so lying to investors is OK if it works out? Investors in private companies don't lose money until a company goes out of business. Until then the valuation is all theoretical until there is an exit. But would the investors have invested in something else if they had known about the lies? Is the investment worth significantly less because of the financial fraud so the risk/reward math has changed?

”Well, not everything was fraud so take it easy”. The below is from Lachwani’s attorney.

Just because some of the things that Mr. Lachwani did were fraudulent does not mean that everything the company did while he was CEO was criminal or fraudulent

“Even though its main investors knew the startup’s financials were not accurate, according to Mr. Lachwani’s lawyers, they chose to invest anyway, eventually propelling HeadSpin to a $1.1 billion valuation in 2020” — NYT

Are investors to blame?

I have heard many people say things like the below in regards to some of the recent frauds:

“It is the investors fault for not doing better due diligence”

“Why would you give a company so much money without proper diligence?”

“The fraud was going on a long time. How could the board not catch it earlier?”

First off….the person to actually blame in these situations should obviously be the person committing the fraud.

Should more diligence have been done? In hindsight, yes. But if a founder is determined to commit fraud then they can usually find a way to do it. The accounting is never perfect at early stage companies, but the assumption is that there isn’t blatant fraud.

Takeaway

Don’t commit fraud….it isn’t worth it and it almost always catches up to you

Set up basic controls to protect the company (and yourself from being tempted)

Make sure you have the right accounting/finance expertise

I’'ll end with a quote from the Judge on Lachwani’s case:

If you win, there are no serious consequences — that simply can’t be the law.

Footnotes:

Register - The best finance lessons I’ve learned with Strava CFO Lily Yang on May 8 at 10am PT.

I partner with a CFO/Accounting firm focused on software companies. If you are a software startup (less than $15M in revenue), reach out today for a free consultation.

Integrity & trust. Built in years, gone in seconds.

It is really interesting how many founders are involved in such sharp practices. Even others getting caught doesn’t even deter them actually.