The Future is Usage-Based Pricing

Metronome raises a $50M Series C to ride the wave of usage-based pricing

Today’s Sponsor: NetSuite

I created an OnlyCFO guide for financial dashboard reporting in partnership with NetSuite. This guide is exactly how I have built great financial dashboards for my leadership team and board.

Get my free guide and template for financial reporting dashboard 👇

Fundraising in 2025

Metronome raised a Series C of $50M earlier this year to power the accelerating move towards usage-based pricing (“UBP”).

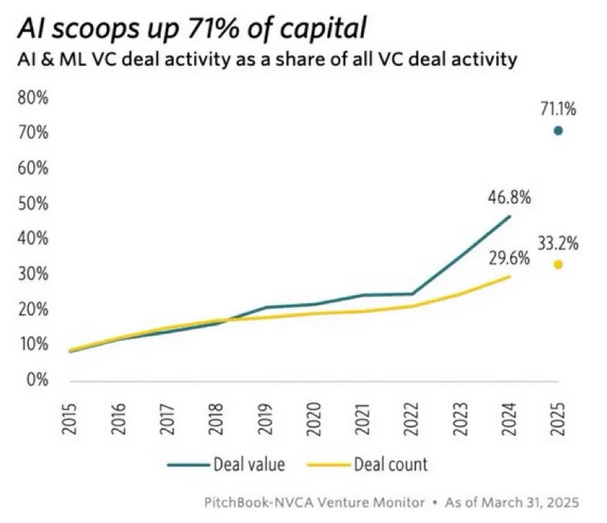

Typical SaaS companies are having a really hard time fundraising right now as most money is flowing to AI-first companies. AI deals made up 71% of all VC investment dollars in Q1’25! VCs are allocating a rapidly increasing amount to AI and ML deals…

But not only did Metronome raise a large Series C, they weren’t even looking to raise this year.

I chatted with Metronome CEO (Scott Woody) about their Series C and his insights on usage-based pricing.

Metronome Series C Process

Metronome launched in 2019 and has now raised a total of $128M. Their recently announced Series C for $50M came from some of the top investors in the world — NEA, a16z, etc

2025 Valuations

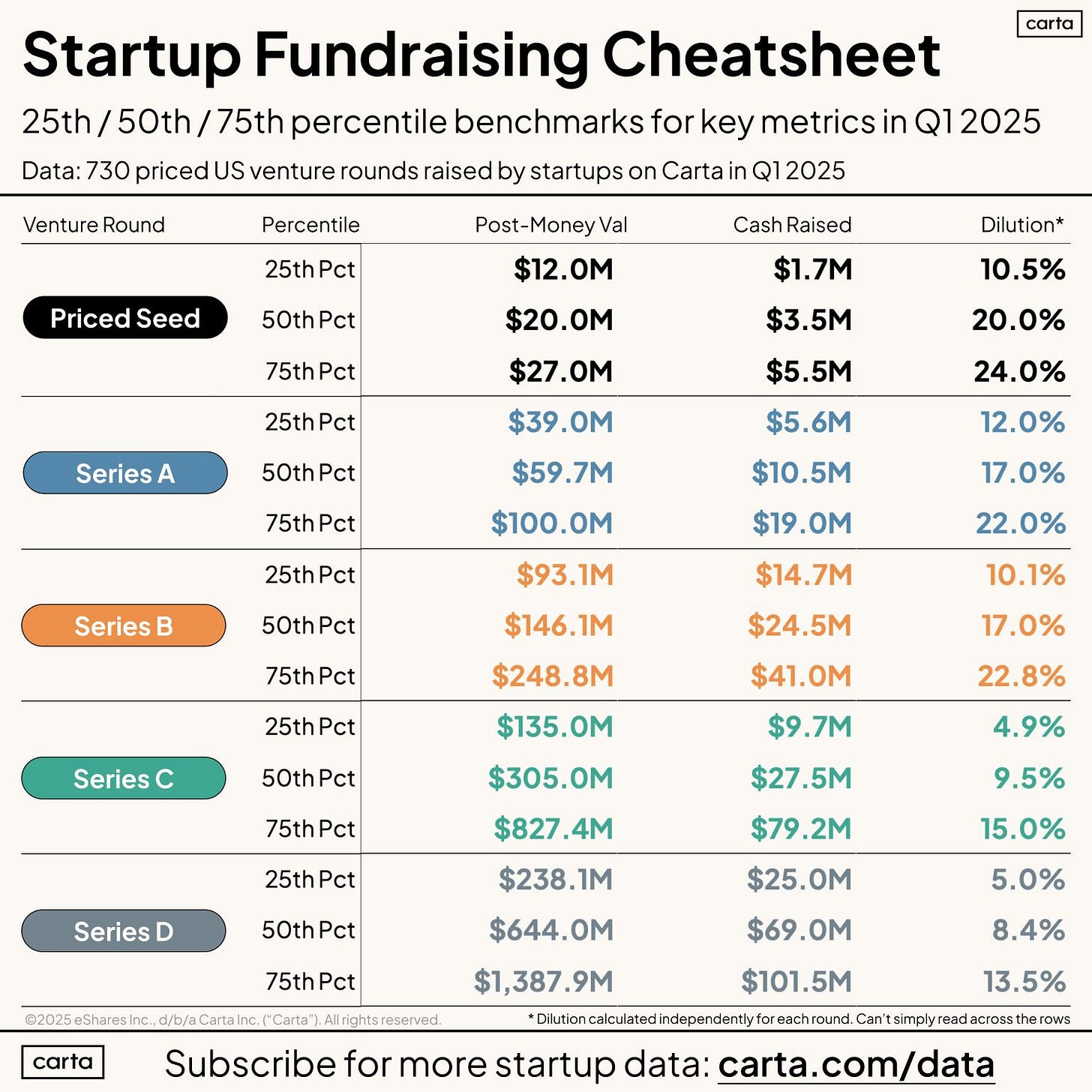

While companies often don’t disclose valuations and other key metrics when they raise a round, we often have enough data to make a pretty good educated.

For example. Metronome did not tell me their valuation but here is how I would try to back into it:

Metronome got a pre-empted Series C in a somewhat hot space (not AI-level hot, but SaaS hot) so growth is probably really good and they probably got a great revenue multiple. However, current benchmark data is skewed toward AI-first companies that are getting very high valuations so I will discount a bit from current benchmarks for being more traditional software.

Also, investors in the Series C will probably want at least ~10% ownership and given the tougher fundraising environment, they can get it.

Based on all this I would guess that Metronome’s valuation is ~$450M - $500M, which falls in between the 50th and 75th percentile of a Series C from the Carta data below.

ARR & Revenue Growth

When companies are raising REAL rounds in 2025 then they very likely have top quartile revenue growth. Non-AI deals just aren’t happening unless growth is great.

Growth is still priority #1. And honestly nothing else matters if you don’t have growth because the required VC outcomes can’t happen without growth. Assuming growth is great then they will also be looking for decent gross margins and to understand the overall cash burn profile.

Let’s say Metronome’s valuation was $500M for their Series C. They are in a pretty hot space (again, not AI hot). But for a Series C company at a $500M valuation that is a pre-empted round. I would guess their growth is something like 75% - 100% YoY. And if that is their growth rate then I would expect an ARR multiple of about ~20x based on current benchmarks and their size, which would put Metronome at about $25-30M in ARR.

I am obviously making A LOT of assumptions here so I could be a bit off but I just want to illustrate how folks can try to back into things like this. And the more information you have about a company the easier it is to do. I have very limited information in this case so it’s a bit of educated guessing based on how the recent round happened.

However…you would not be able to do this for most true AI companies. They are so hot right now that any valuations based on benchmarks and reasonable valuations based on actual traction go out the window.

Fundraising Process

Metronome didn’t need the money. They had just raised a $43M Series B one year earlier and they had plenty of cash/runway remaining.

The momentum in usage-based pricing, fueled by the explosive growth of AI, created a wave of interest. That led to our pre-emptive C. —Scott Woody (Metronome CEO)

Not needing money is obviously a very strong position to be in. It creates much more leverage in deal negotiations. And while Metronome is not an AI-first company, they are a major AI beneficiary.

What is the most important fundraising question by stage?

Seed: Do you have a killer team?

Series A: Do you have product-market fit and a big enough potential market?

Series B: Can you build a repeatable machine?

Series C: Are you still growing fast enough?

Series D & beyond: How durable is your growth and how strong are your unit economics?

Metronome’s early problem with VCs was explaining the TAM and helping investors understand it was big enough. They don’t have that problem today as usage-based pricing has become extremely obvious evolution of SaaS/AI pricing.

Investors are more concerned about our execution plan and knowing how we plan on winning the market.

In other words, Metronome has clear product-market fit and has been growing nicely, but…is the Metronome team able to execute on their plan and win in a competitive market and can they continue growing fast enough to justify a revenue multiple premium.

Building Moats in 2025

I have talked a lot about software moats today given the rapid commoditization of software due to AI so I am always interested to hear what folks believe their moat is:

Below is Scott Woody’s answer about Metronome:

Competition in the space is intense, but our moat is crystal clear—our customer base and enterprise ready product. We partner with the fastest-growing software companies in the world, which means our product has to match their speed and complexity. Solving for companies like OpenAI, Anthropic, and Databricks has forced us to build for extreme scale—something no other player in the market has cracked.

Metronome entered the usage-based pricing space before it became really hot and competitive. As a result of that and their early enterprise ready product, they were able to land some of the fasting growing AI companies in the world (which are leading the charge in usage-based pricing strategies).

It’s actually an interesting moat…Given Metronome’s customer base, they have to not only keep up with what their fast-paced, innovative customers want to do, but they have to be the ones developing new, innovative things to help drive these companies’ growth.

Usage-Based Pricing

Metronome started building out their platform in 2019 when usage-based pricing was still fairly early. They had a hypothesis that the future of software was a lot more usage-based pricing, but I am fairly confident they didn’t know the magnitude of impact AI would have on their business….

Metronome got a little bit lucky with their timing as they are a big AI beneficiary. Two of the strongest sales pitches for software tools right now are:

We help drive AI company growth (like Metronome)

We save you money

AI is making usage-based pricing a requirement for most companies. And adoption of UBP is taking off.

Even companies that are traditional seat-based models are adding elements of usage-based pricing because of their new AI features where UBP makes a lot more sense. There is a wide range of UBP adoption levels, but the vast majority of companies are moving to some element of UBP.

Nearly 50% of companies that adopted UBP did so in the last two years

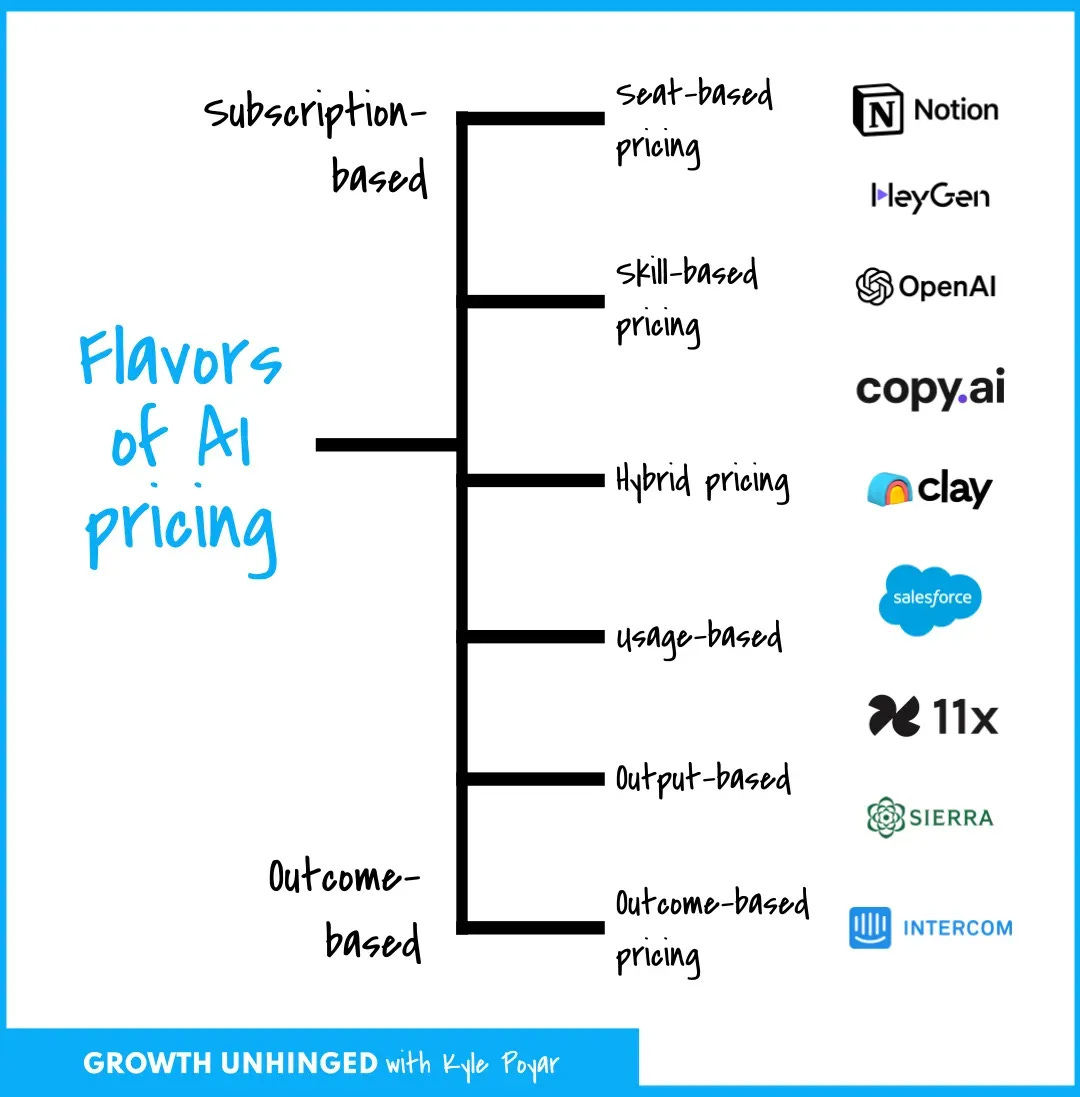

Seat-based pricing dominated for SO long in SaaS, but usage-based pricing is taking over. And as Kyle Poyar illustrates in the below image, there are A LOT of flavors of AI pricing now. In a world of AI, these make a lot more sense than seat-based pricing.

Final Thoughts

Fundraising in 2025 is REALLY tough if you are not AI or a major AI beneficiary. The goal is plan A, but…always have a plan B.

Plan A: Get to “default investable”. Your metrics are so good that you can raise money in any environment.

Plan B: Become “default alive”. Know what you need to do at any point in time to make your cash runway lasts forever.

Lastly, don’t ignore your pricing model:

Review your pricing models more regularly today. How you price your product is critical and it is not as easy as before.

Update your key financial metrics and definitions as you make changes and you introduce new types of products. You can’t rely on the same metrics as before.

Check out the OnlyCFO Financial Reporting Dashboard Guide & Template

Check out OnlyExperts to find offshore finance resources. They have some amazing talent for 20% the cost of a U.S. hire

You are the only reason I’m on Substack. Great stuff per usual.

Good read, thanks for sharing!