The True Cost of Churn

How much is avoidable churn actually costing you?

Spend smarter and move faster with Brex, today’s sponsor.

7 ways AI helps you move 3x faster

What’s the secret to a successful finance automation strategy? Focus on the 20% of tasks that consume 80% of your team’s time. Brex’s AI-powered automation guide reveals what those tasks are — and how to automate them. Discover 7 ways finance teams use AI to close the books 3x faster and unlock new value.

Understanding Churn

The real dollar impact of churn continues to be incredibly misunderstood and quantifying it is REALLY hard.

Churn has increased for most of us in the software industry over the last few years. For new AI companies it may be extremely high as companies try out new AI tools (“experimental revenue run rate”).

ARR is a double-edged sword:

Recurring revenue should repeat for multiple years

When customers churn then that is multiple years of lost revenue

Many people mistakenly say that they will “make up” for churn by closing more deals.

This is NOT how it works. When customers churn, you’re not just losing one year of revenue — you’re losing multiple years of future profits You can’t magically make up for churn by selling more.

Sure…companies can add more ARR, but sales reps would have theoretically closed those deals regardless of the churn because they only have so much sales capacity. A sales rep isn’t going to say “Hey, we churned a lot last quarter so I am going to work a little bit harder and close an extra deal this quarter to make up for the churn!”.

What Does Churn Cost You?

Short Answer: A LOT more than most people think!

Churn Impact Example

To fully answer this question let’s walk through a hypothetical example of how much churn is actually costing a company on a $150K ARR deal.

Assumptions

Gross margins are 80%. Assumes the company has good gross margins — between the median and top quartile for ICONIQ portfolio companies.

CAC Payback of 18 months. 18 months is pretty good for enterprise software. Below is top quartile benchmarks.

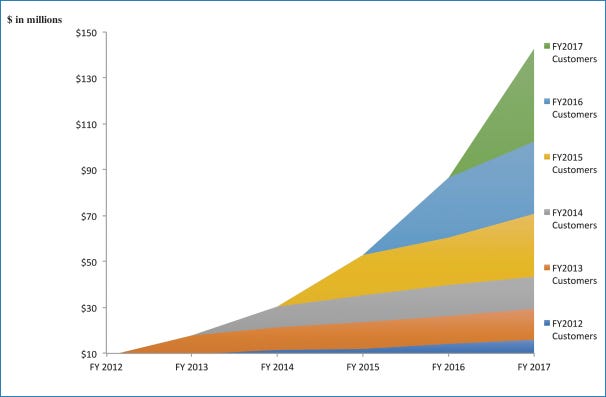

50% Expansion Revenue: I will assume that most expansion revenue occurs in the first few years and then starts to level off. The “layer cake” view of expansion revenue is always interesting to see (below is Zscaler)

Cost to maintain a customer is 15% of revenue. This is for all the customer support, CSMs, expansion reps, maintenance R&D, etc that a typical customer will need over their life to just maintain them. 15% of revenue is just a rough guess from me.

8 year customer life: Thinking through churn can be circular, but what I want to quantify is the impact of early churn (and churn rates increasing). In the example I am assuming a baseline of an 8 year customer life.

True Lifetime Value

Below is the fully burdened annual profit of selling a $150K deal.

In year one the company loses money because of all the initial customer acquisition costs (with an 18 month payback). After that it becomes increasingly more profitable as the company gets expansion revenue and only has “maintenance costs”.

Quantifying Churn

The below table shows the total lifetime lost profits based on what year the $150K ARR customer churns.

If the customer is really upset and churns after just the first year, then the company loses out on nearly $1M in lifetime profits! If the company had $100M in ARR and lost this one customer (a 0.15% churn increase) then it cost the company $1M in lost profits.

The cost of early churn is MUCH higher than most realize…

But wait! There is more!

The Silent Snowball: Second-Order Churn Effects

The direct impact of churn can obviously be massive ($1M in this example), but the lesser understood second-order impacts of early churn can be even bigger.

Second-order revenue consists of:

Sales from buyers that changed employers and buy the product again at their new employer

Sales from customer referrals

Second-order revenue is extremely powerful when it is working for you. It’s a proof point of product-market fit when it occurs and revenue seems to come easy.

But….we greatly underestimate its impact when we have avoidable, early churn. Early churn typically implies customers that are upset for some reason. And guess what very unhappy customers do? They talk…

Let’s continue our example and try to quantify what the TOTAL impact of churn might be:

Original churn impact: the $1M lost profits discussed above.

Champion changes jobs: For happy customers this is supposed to be an easy layup. Champion leaves, do a demo for the rest of the team and show ROI, and deal closes. But when a buyer churns early because they are upset then when they change jobs, they are probably buying from a competitor. You lose the easy sale. Losing at least one deal to this seems reasonable — could easily be more depending on how many folks were close to the bad experience and how upset they were.

Referral chooses competitor: When the original churn happens then those closest to the software talk to their friends about your software. Depending on how bad the experience was they will likely convince at least one company to go with a competitor.

Current customer churns early: Also very possible when the customer churns and tells their friends how much better another tool is that they will convince at least one of your current customers to churn early and go with another tool.

So what does the original $150K of churn cost you? Nearly $3.3M in lost profits…

Is this an extreme example?

Maybe….but maybe not. It could be even worse.

Churn has a snowball effect that can get out of control REALLY fast.

Final Thoughts

Churn has a much bigger impact than just the direct lost ARR dollars.

When churn increases by “just” 0.15% (from our example above) it is a BIG deal.

Higher churn may just be the new reality for software companies. If that is the case then your unit economics are changing. If you don’t adjust to reflect that new reality then higher inefficiency will creep up on you fast.

On the flip side, preventing additional churn (and higher churn rates) is SO important. Even if you can’t prevent the direct churn, maybe you can prevent the second-order revenue impacts.

Good luck and I hope your ARR stays RECURRING!

Footnotes:

Check out Brex’s AI-powered automation guide to see how to automate more in finance

Join the next OnlyCFO Webinar on how the definition of ARR is change and how you should adapt. You won’t want to miss it!

Check out OnlyExperts to find offshore accounting resources. They have some amazing talent for 20% the cost of a U.S. hire

Companies should watch for signs like low usage, support tickets or negative feedback. When these warnings appear, reach out with a quick check-in, extra training or a contract review to keep customers from leaving.

Great insights—even for those who don’t usually interact with customers.

Your last point really reminded me of the attrition waves that often follow major layoffs. Companies should invest not only in customer success teams for clients, but also in an internal ‘customer success’ approach to reduce employee churn and protect their reputation for future hiring.