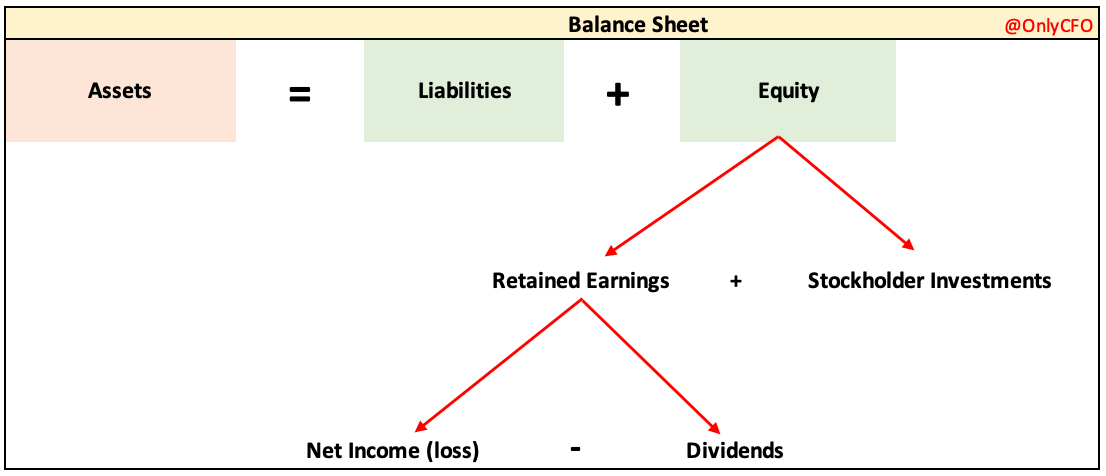

Understand the Balance Sheet

The ultimate balance sheet guide that all employees should read

👋 Join 35,000+ smart people and subscribe to the OnlyCFO newsletter to get insights, benchmarks, market updates for tech leaders.

Today’s Sponsor: Nominal

Finance teams have long been defined by spreadsheets, reconciliations, and closing deadlines. Agentic Performance Management (APM) changes that, replacing manual effort with autonomous Agents that manage accounting performance end to end. The result: a finance organization that runs itself, so leaders can focus on outcomes, not operations.

→ Read the blog: What Is Agentic Performance Management?

How to Read a Balance Sheet

This guide isn’t for CFOs (although maybe you will learn something too). This is for you to send your teams and all company leaders because the CFO’s job is a lot easier if everyone understands the basics.

The balance sheet is a snapshot at a point in time of a company’s financial health while an income statement is for a specific period of time (monthly, quarterly, annually, etc). The balance sheet represents the accumulation of all the activity from the beginning of time.

A balance sheet has three sections:

Assets: What a company OWNS

Liabilities: What a company OWES

Equity: Value attributable to stockholders

What many people don’t understand is that the income statement (see my previous P&L guide) is part of the balance sheet. This is how the balance sheet balances!

The income statement activity goes into retained earnings every period.

Example: Company spends $10,000 on google ads. That transaction will be recorded as follows:

Debit (increase) to advertising expense for $10,000

Credit (reduction) to cash for $10,000

The advertising expense is on the income statement and the reduction to cash is on the balance sheet, which would mean the balance sheet doesn’t balance! If this was the only activity then a negative $10,000 would flow into equity. Then cash would be lower by $10,000 and equity would be lower by $10,000

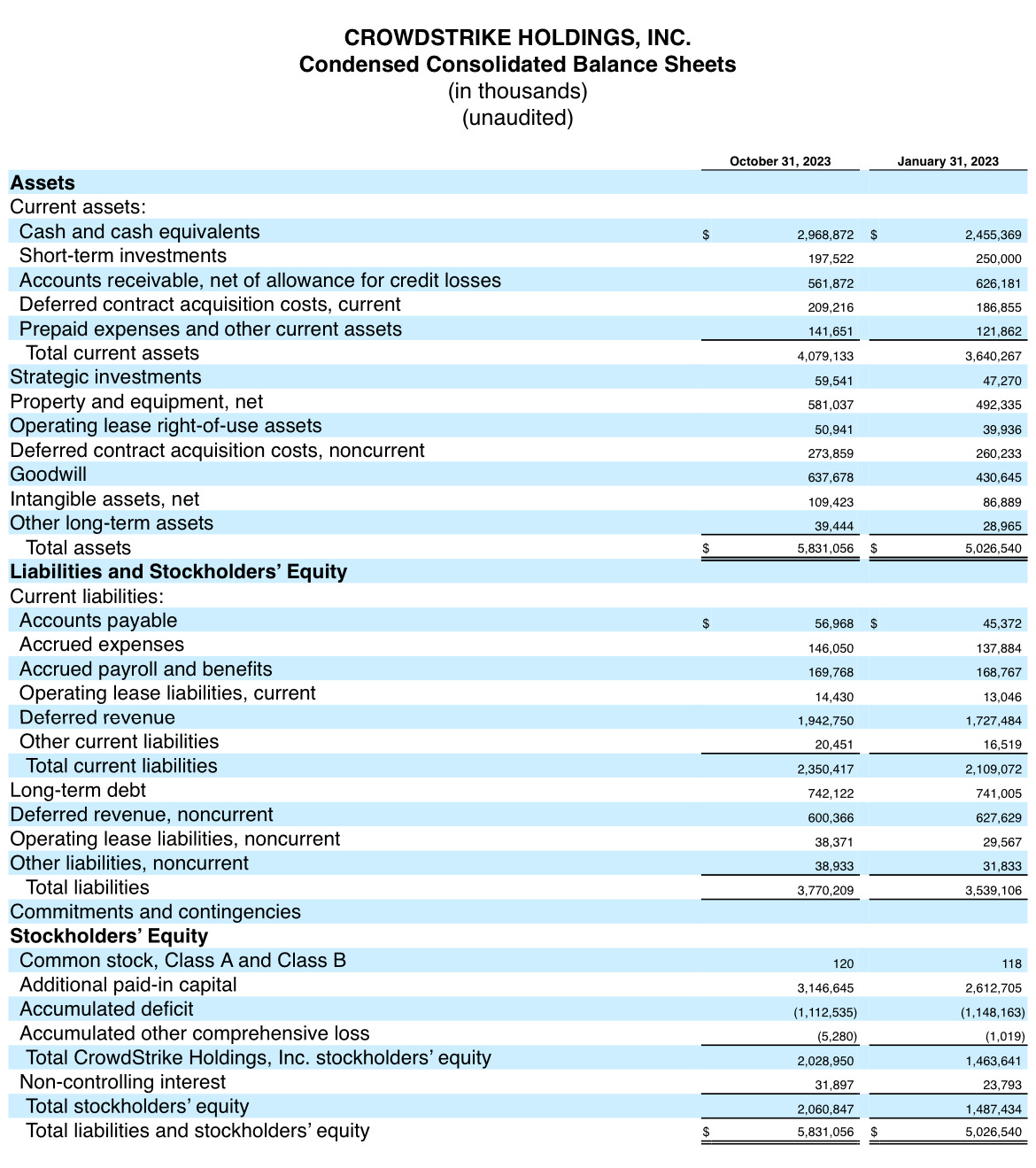

Let’s use CrowdStrike’s balance sheet as an example and walk through the different components:

Assets

The first section on a balance sheet is the assets section. Assets are what the company OWNS. Assets are things that can be sold for money or used to generate future benefits.

Assets are typically presented in order of liquidity (i.e. how readily they can be converted to cash or used to generate cash).

Below are the main sections of a company’s asset section:

Current Assets - Assets the company expects to convert to cash or be consumed within one year. Current assets include things such as the below.

Cash and cash equivalents

Money in the bank or in very short-term (<90 days), liquid investments such as T-bills, CDs, and money market funds.

Short-term investments

Investments in debt securities with maturities greater than 90 days (but typically less than 1 year) when purchased. This also might be called “marketable securities”. Companies think about this as part of their cash position because it will turn into cash soon.

Accounts receivable (aka “AR”)

Money currently owed from customers. This is the amount invoiced to customers or contractually owed based on services performed. If you have annual upfront terms, then the entire amount enters AR when the contract is invoiced. If true usage-billing then it enters AR at the end of each period based on actual usage.

Deferred commissions

Also known as “deferred contract acquisition costs” in the CrowdStrike example. Accounting rules typically require cloud companies to capitalize a large portion of sales commissions (meaning it goes on the balance sheet instead of immediately expensed on the P&L). Then the expense is recognized over time (typically between 3 and 5 years). The accounting rules are complex and nuanced so I won’t go into the detail, but be aware that if you are using accounting commission expense then your unit economic math might be deceiving. Check the impact on GTM efficiency metrics.

Prepaid expenses and other current assets

This can include a variety of things but some major items for cloud companies include: software, marketing events & programs, rent, insurance, etc. Items we pay upfront for but usage comes later.

Non-Current Assets - not expected to be converted to cash or used within one year. Some items here include:

Long-term investments

These are investments with maturities greater than one year. They may have a near guarantee to turn into cash but it will take >12 months to happen.

Property and equipment

Most cloud companies are not very capital intensive. CrowdStrike, however, has a lot of data center spend and also a lot of “construction in progress”, which the footnote tells us is more data center spend that hasn’t been placed in service yet.

Operating lease right-of-use assets

This represents the company’s right to use a leased item over the lease term. The most common leases included here are office leases, but there could be others.

Goodwill

Premium amount paid over what is determined to be the fair value of an acquired company. Public companies (and almost every private company) doesn’t expense this on the P&L. It usually just stays on the balance sheet forever (until there is impairment).

Intangible assets

These are assets that are not physical but frequently very valuable. These assets generally are a result of business/asset acquisitions because under accounting rules a company can’t typically create an intangible asset. There are two types of intangible assets: 1) finite-lived assets and 2) indefinite-lived assets.

Deferred commissions, non-current

This is the amount of deferred commissions that will be expensed after one year.

Other assets

There is often some miscellaneous stuff in here, but larger companies like CrowdStrike may also have equity investments in both public and private companies also included in this section.

Liabilities

Liabilities are what the company OWES.

Liabilities are presented in order of when they are due, with the most current showing first. Similar to assets, liabilities are presented in two main sections (current and non-current).

Current liabilities - obligations expected to be settled in <1 year

Accounts payable (aka AP)

Vendor bills that are due for payment

Accrued expenses and other current liabilities

Accruals happen when services/product have been received or another type of obligation arises, but it hasn’t been paid and its not in AP.

Operating lease liabilities

This is the other side of “operating lease right-of-use assets” mentioned above. It is the amount owed over the contract term of the lease.

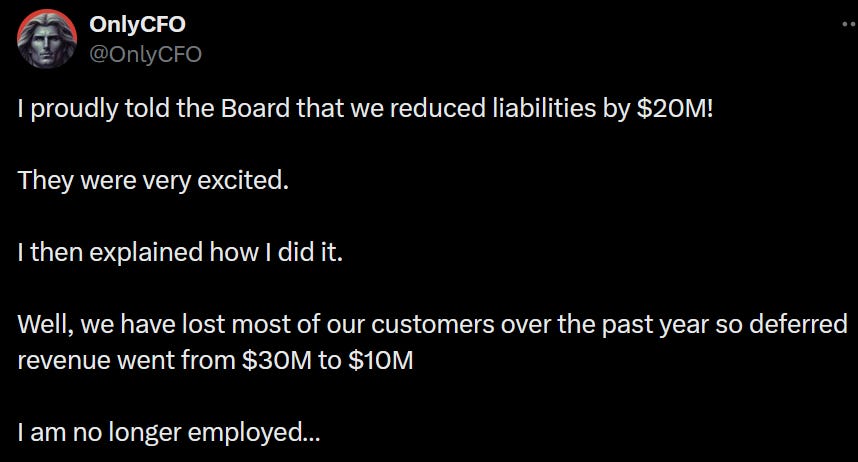

Deferred revenue

For most cloud companies, once an invoice is sent to a customer then the amount of the invoice is added to both AR and deferred revenue. AR decreases when cash is received while deferred revenue decreases when revenue is recognized. Deferred revenue is the one liability that cloud companies want to be continuously increasing because it means that new customer sales are increasing faster than revenue is being recognized. If you understand the joke below, then you have mastered the balance sheet :)

Non-current liabilities - obligations expected to be settled in 1+ years

Operating lease liabilities, non-current

This is the long-term portion (1+ years) of the operating lease liabilities noted in the section above.

Deferred revenue, non-current

This represents the portion of deferred revenue that won’t be recognized as revenue for 1+ years. Usually only relevant with multi-year contracts paid upfront

Debt

While most VC-backed cloud companies are primarily funded via preferred equity from venture capital firms, some companies will also use debt to help finance operations or acquisitions.

Other liabilities

This is for other miscellaneous liabilities that don’t fit into one of the previous buckets. If anything becomes big enough in this section then it will need to be broken out separately.

Stockholders’ Equity

Stockholders’ equity is the value attributable to the business owners (aka stockholders).

Some people think of this section as the company’s net worth after netting the company’s assets and liabilities. But A LOT of a company’s value is not represented on the balance sheet….

This is because companies build up significant value in their brand name, customer relationships, technology, etc that accounting rules prevent from being recognized on the balance sheet.

The main sections of stockholders’ equity include:

Common stock & Additional Paid-in Capital

These two sections primarily refer to all the money invested in the company by shareholders.

Retained earnings (or accumulated deficit)

This represents the cumulative net profits/loss from the income statement. There are two things that impact retained earnings:

Net income / (loss) adds to or subtracts from it

Dividends paid out decrease it

A lot of cloud companies are not profitable for a long time, so they will use the caption “accumulated deficit”. Once a company is profitable and digs itself out of the hole, the caption will switch to “retained earnings”.

Why Does the Balance Sheet Matter?

Understand liquidity and runway

How much current assets do we have versus current liabilities?

What are long-term liabilities?

How much cash runway do we have?

A strong balance sheet enables companies to weather storms and capture opportunities

Will your company crash and burn if there is a temporary downturn?

If there is a downturn and there are lots of opportunities, can your company take advantage of them?

Understand the true financial health of the company. A lot of stuff can be hidden in the balance sheet:

Hold a lot of AP to make cash burn look better

Be super aggressive in accounting treatments and amortize expense over a really long period (e.g. amortize commissions over 10 years). This will make certain assets look unusually high

Concluding Thoughts

The income statement is more intuitive and more commonly understood, but understanding the balance sheet is critical for understanding the overall health of a business.

Companies that have a strong, well-managed balance sheet have a major advantage over those that do not.

A good CFO knows how to properly manage both.

Footnotes:

Check out our sponsor’s blog post on Agentic Performance Management (APM) - using autonomous agents that manage accounting performance end to end

Check out OnlyLawyer (cousin to OnlyCFO) for all things legal for tech companies