Winning Software Budgets in 2024

Software budgets are tight in 2024. What questions are CFOs asking and how can you get deals past the CFO?

Today’s Sponsor: NetSuite

CFO's Ultimate KPI Checklist: 50 Step-By-Step Checklists to Drive Your Company's Success

Finance professionals: Maximize your business’s success by measuring the right KPIs. Get clarity on which metrics should represent your company’s needs and goals HERE.

The days of public software companies with really high revenue growth seem like a dream.

Below is a snapshot of the software companies with the highest revenue multiples as of November 2021:

The revenue multiples look insane in hindsight….But the average revenue growth was an incredible 51%! Software budgets were wide open as all companies were scaling very quickly and money was abundant to spend on accelerating that growth.

How the times have changed….2024 feels MUCH different.

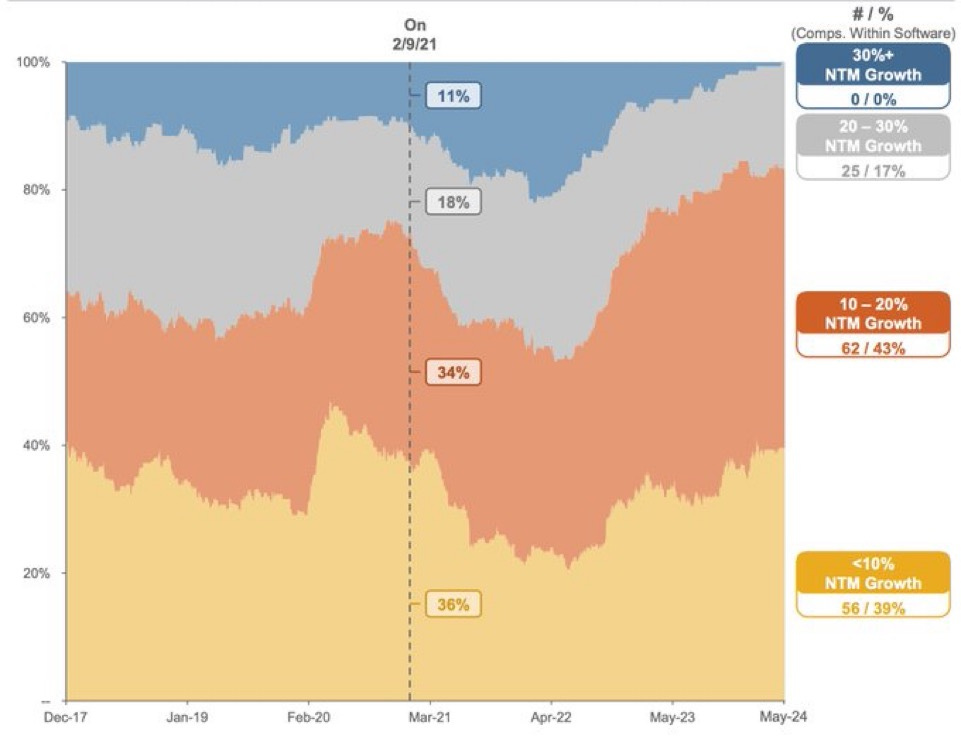

Below is a recent chart that shows the trend of the various revenue growth buckets of software companies. The low to mid-growth revenue buckets are growing while the traditional high-growth bucket of 30%+ growth has gone to zero…We no longer have any hyper-growth software companies!

This context is important because it is directly related to the tougher software sales environment - revenue growth slows, headcount slows, software needs slow, focus on efficiency increases, cuts and optimization increases, etc

It’s a vicious cycle.

There are two primary audiences for this post:

Finance leaders who are thinking about budgets and how to improve efficiency

Sales teams that need to understand how budgets are being created and how to sell to the CFO

[Bonus audience] - Every other company leader who owns a budget should know this stuff and every investor would also benefit from understanding this because it should impact their investment criteria.

Budget Scrutiny

Every CFO (that is good) is asking a lot more questions and adding more scrutiny on all spend. While headcount often accounts for 70%+ of total spend, the focus of this post is on non-headcount spend. Although, you can’t completely separate these two things because they are often related to some degree.

Below are some questions and information I want the team to consider before approving any software spend. The level of depth I want is dependent on the amount of spend.

Tool Need

Why do we need [X] tool now? What has changed in our business to require it now?

What bucket does the tool fall into and can you quantify its impact?

Increases revenue

Mission critical (e.g. cybersecurity)

Improves efficiencies

“Candy” - nice-to-have tool that doesn’t really fit into the above groups

Is the spend in the budget? If not, how will you make up the difference?

How does this tool help us meet our company objectives for the year?

How urgently do we need the tool? Can we push it out?

How does (or will) AI impact the decision?

Does the build vs buy decision change?

Will the tool add more or less value over time?

Choosing Vendors

What tools do we currently have that does something similar? I check with the IT team and other relevant people.

If similar tools exist that are 80% the same, why can’t we use those?

Does an existing vendor have a tool that does a similar thing? Can we consolidate on one vendor and save money?

Similarly, does the vendor we are considering have other modules/features that we might need in the future?

How “big” is the vendor?

This is a MUCH bigger concern in 2024 now that some of us have been burned by a startup shutting down. Tools that are mission critical or can get deeply intertwined in our processes/systems are a major concern.

How long will the vendor’s tool scale with the company? Will we have to replace it in 12 months?

What does the vendor’s roadmap look like? Are they continually innovating and will they implement AI to make the offering even better (more so than competitors)?

Hidden Costs

What are the people time requirements?

Does it require hiring more people to implement and maintain?

What are the direct and indirect implementation costs?

Will we need to upgrade plans soon to an enterprise tier or some made up tier?

Pricing

If usage-based pricing:

I want a detailed analysis on how pricing works and modeling for what our planned usage will look like.

I start with distrust on the total estimated tool cost for usage-based pricing, so you better earn my trust with a thoughtful analysis.

What does cost look like this year and how does it scale next year?

If seat-based pricing:

I don’t want to buy a bunch of extra seats for planned growth. That got a lot of people in trouble in 2021 as headcount growth halted and layoffs happened.

Does everyone actually need a license?

I hate nothing more than seeing half the licenses of a tool being used once every few months.

If we significantly underutilized licenses or usage under the first contract, then I am pushing hard come renewal. So teams need to make sure the company is getting maximum value out of the tool at least a few months before renewal otherwise I am going to try to slash.

What Are CFOs Doing?

Better Tools and Reporting:

There is no shortage today of vendor spend management tools to help companies track and report on software spend. The ability and level of tracking of spend is even higher today.

But more importantly, the power of the CFO to enforce efficiency has never been higher for software companies. CFOs are creating and strictly enforcing spend rules today. Other leadership have quickly gotten the message and those who don’t will not have a job soon.

Discounts

We all know software companies have wiggle room to discount more. Nobody is being fooled by the *very* special end of month discount. I get the tactic and I know everyone does it, but sales reps shouldn’t overplay their hand.

CFOs are checking with their network and other resources to make sure they get the best deal possible. And we know that all sales team are doing everything they can right now to win deals given the current environment, so expect CFOs to push on pricing hard.

Multi-Year Contracts:

While multi-year commits have a larger discount, the risk is too great to justify in a lot of circumstances. I have always believed this, but this is even more true today

Things change so fast (especially with AI) that it often isn’t worth the risk. The exception might be things like AWS and Salesforce.

Also, I almost always wait until the second year of using any software before considering committing to more than one year - a lot can go wrong or not work as expected that first year.

Sales Folks: Don’t overly incentive and push sales reps to close multi-year deals. It’s OK to get pulled into these conversations, but when reps push hard on this a lot of customers will eventually be upset which will cause a lot of second order revenue to vanish.

Auto-renewal:

I always try to negotiate these out and if the vendor refuses then I will just send an opt-out notice immediately after the contract is signed. Auto-renewals can be 30-60 days before the end of the contract so make sure you are tracking it properly if you keep them in the contract.

Also, if you provide notice of cancellation right after you sign the contract, for some reason the account manager of the vendor engages a lot earlier for the renewal conversation….it’s magic :)

And when renewal conversations start earlier you are more likely to save money on the renewal - at least that is what the data shows.

Payment Terms

Annual upfront is typical for enterprise software and I have historically been just fine with that (makes my accounts payable team’s life easier). But with the significant rise in interest rates (the importance of time value of money), I may ask for shorter payment terms for larger contracts.

Some Other Thoughts

Tool consolidation: It’s a great way to save money and/or streamline processes, BUT it needs to be a cross functional effort. If it’s just the CFO shoving it down everyone’s throats then no one is going to be happy and it won’t be successful. It isn't always the right answer.

Constraints: Leaders should work early with their CFOs to understand their constraints and what CFOs want to see to approve spend requests. CFOs need to hit the company plan for revenue and expenses. Be prepared to address where the budget is coming from. If you can live within the expense budget, it will be a lot easier of a conversation.

Leader education: The best way to improve efficiency is to make sure all leadership (and the broader company) understand the financial health of the business and what success looks like. The CFO can’t look into the detail of all spend the way the individual department leaders can.

How to get spend approved

The #1 thing that makes a purchase approval easy is my trust of the internal buyer.

If I have worked with the budget owner on purchases, know that they do their diligence (gone through the questions above), and that they carefully consider the financial implications to the business then I am much less likely to push back too hard on requests.

CFOs immediately know who is lazy (or lacks experience) and hasn’t done much analysis/diligence. In these cases, CFOs will push back hard, make them look at alternatives, ask other people, etc.

Budget owners need to carefully think about the questions I listed earlier and provide a thoughtful analysis on why the company needs to purchase a tool.

Sales Folks: Your job is to help equip your champions to do that. Spend extra time with those who are less experienced, new to a company, or may not have the trust of their CFO. Because they are the ones who need to earn trust to get the purchase approved. CFOs don’t want to talk to the salespeople. They want to hear a thoughtful analysis straight from the internal buyer.

CFOs are not the experts in the tools or department needs.

Final Words

CFOs are blocking a ton more purchases in 2024. Rightfully so. A lot of companies are still stuck with a bunch of software tools that add little value or are a lot more expensive than originally anticipated.

Budget owners need to be more thoughtful on the tools they purchase and the value they add to the organization because belts continue to tighten and those who don’t get the message will fail.

Sales folks need to work closely with their champions and enable them to gain the trust of their CFO to get their purchases approved.

Footnotes:

Check out OnlyExperts if you need offshore accountants (good name :). I am partnered with them to help CFOs and finance teams hire offshore accounting talent.

Check out NetSuite’s CFO KPI Checklist

Sponsor OnlyCFO Newsletter and reach 22k+ CFOs, CEO, and other leaders in the software industry

"Is the spend in the budget? If not, how will you make up the difference?"

I think something similar can be asked. Just because something was in the budget, why do you need it? CFOs should be evaluating all spend, not just net new spend.

Outstanding newsletter 👌.