2025: Revenue Retention or Bust

Cloud companies live or die by revenue retention. What does good look like and why does it matter?

Today’s Sponsor: Totango

Churn prevention requires all hands on deck in today’s market. But it doesn’t have to.

AI helps businesses predict churn, identify expansion opportunities, and accelerate customer-led growth, faster and more accurately than your teams alone. Listen to an unfiltered discussion with Totango and G2 execs on how to quickly gain deeper intelligence from your customer data – and stop the sneaky churn that’s killing your forecast.

Retain or Die

2025 will be the year that cloud companies must prove that they have customer retention under control. Many companies have seen retention deteriorate over the past few years, so proving retention isn’t getting worse (and hopefully improving) will be critical to their survival.

Investors are paying close attention to revenue retention metrics as a leading indicator of revenue growth endurance and ability to grow efficiently.

Both NRR and GRR will be closely watched metrics. Those companies that continue to have retention problems in 2025 will likely die (for many it will be a slow death).

NRR vs GRR

Gross Revenue Retention (GRR) = measures how well a company retains revenue from existing customers, ignoring any revenue expansion

Net Revenue Retention (NRR) = measures the net change of all increases and decreases from existing customers

The only difference between GRR and NRR is that expansion is included in NRR. But BOTH exclude any changes related to new customers over the measurement period.

GRR and NRR are cohort metrics.

GRR Example

In the example below, we see a company that starts the year with $25M in ARR. During the next 12 months those same set of customers that made up the $25M (cohort) churned/downgraded by $1.5M ARR.

This excludes any activity from new customers over the next 12 months. It also excludes any expansion from this cohort of customers, which is why the GRR max is 100%.

In the example below the company has a 94% GRR. This means that if the company does no upselling, then it can expect 94% of its starting ARR to retain after 12 months.

NRR Example

NRR is the same thing as GRR except you also include the expansion ARR from the starting cohort of customers. Because you include expansion, NRR can be >100%.

In the example below, we add $4M of expansion ARR which results in 110% NRR. Calculated by taking the $27.5M ending ARR / $25M beginning ARR.

What does good look like?

Like all benchmarks - it depends.

I see way too many people comparing their company to the wrong benchmarks and then making poor decisions based on that data.

Unless the benchmark data gives your clear details into the firmographics of respondents and has different slices of the data then it probably won’t be very helpful for you.

Public Company Benchmarks

Public company data is a bit easier in someways because we know exactly what companies are included. The problem is that there is no requirement to disclose NRR or GRR so many do not. While many report NRR, very few report GRR.

The median NRR for public companies that report it is 110%.

For companies with expensive sales cycles, you need higher NRR for the economics to make sense. For companies with less expensive sales cycles, a lower NRR is acceptable because they can afford it.

NRR has been declining steadily since 2022, but it finally seems to be bottoming at 110% for public cloud companies.

Private Company Benchmarks

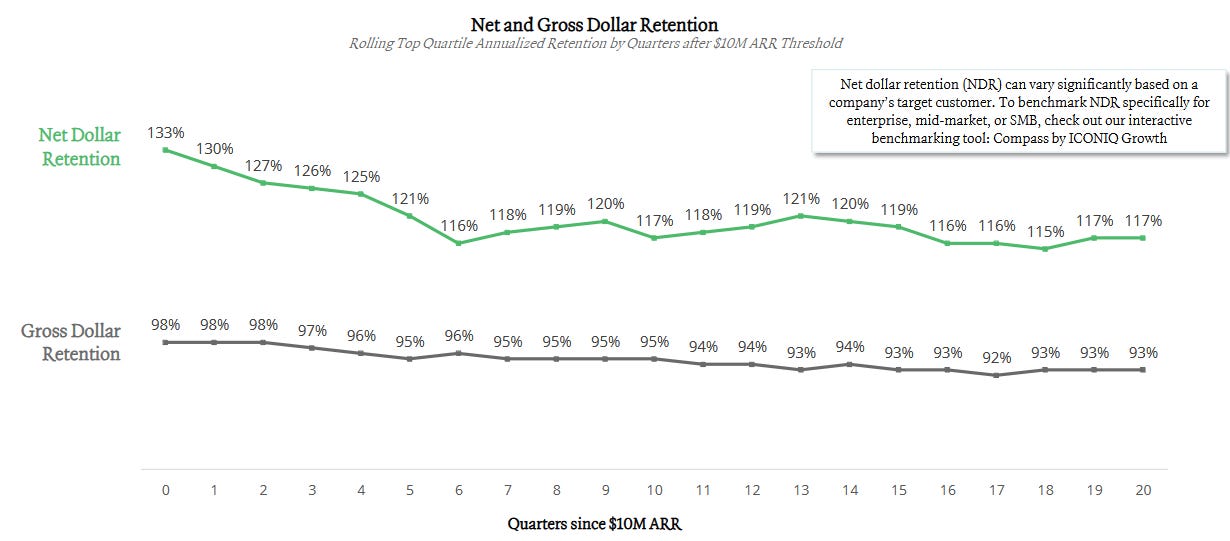

NRR can vary a lot based on stage of the company. The smaller the ARR base the easier it is to have a higher NRR.

NRR is also dependent on the segment you sell to and your pricing model. NRR is generally higher for usage-based businesses and/or product-led growth companies because the original deal landed will be smaller and then grow over time (more expand $ versus initial new logo $).

Until a company reaches scale, both NRR and GRR will decrease until hopefully leveling off at healthy levels.

Be careful what you benchmark against because there are lots of variables that impact what “good” looks like.

Is GRR or NRR more important?

Trick question. You need them both.

For a long time operators and investors put too much weight on NRR and believed that GRR didn’t really matter as long as NRR was strong. In other words, as long as a company makes up for all of its churn with higher expansion then the churn rate doesn’t matter.

This is NOT TRUE!

GRR can be a more leading indicator of fundamental problems for a company such as the following.

Product issues

Overselling

Intense competition

Lost product/market fit

All of these issues raise red flags about the endurance of a company’s revenue growth.

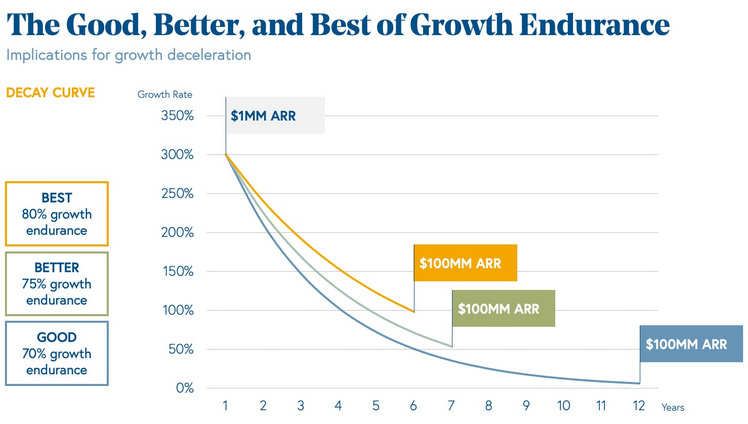

Revenue endurance = current year revenue growth % / last year’s revenue growth %

Strong revenue growth is essential for cloud companies to be worth a high revenue multiple.

Bessemer released the below chart in 2021 showing the “good, better, best” of growth endurance. While the past couple of years revenue growth endurance looked worse for many cloud companies, these are good targets.

Companies with lower GRR generally have future issues with revenue growth endurance because of what I refer to as the “Churn Snowball”. The churn snowball is sneakily destructive to value…This is why GRR can’t be ignored.

Final Thoughts

Don’t let expansion revenue mask a churn problem. Both NRR and GRR are important metrics for cloud companies.

A churn problem will eventually catch up to a company and make it really hard to continue to hide the issue with expansion revenue.

If a company has strong GRR, then expansion revenue will come. High long-term revenue growth endurance is critical for success and that is only possible with high GRR.

And lastly, low GRR is often correlated with inefficiency. It is REALLY hard to grow efficiently with a churn problem.

Go retain those customers!

Interesting Read

I am always happy when I predict something that turns out to be right…Last week I wrote about the Macy’s financial statement “fraud” and predicted that the issue was likely not outright fraud (employee benefited) but rather a combination of the culture/pressure of management and an error that snowballed. Turns out that it was an accountant that made a mistake and tried to keep burying the problem…

Footnotes:

Check out this discussion to see how you can get better insights on customer data to do better forecasting

Sign up for the OnlyCFO webinar series! Our first webinar is next week on annual planning.

Check out OnlyExperts to find offshore accounting resources. They have some amazing talent for 20% the cost of a U.S. hire

Are you not including/considering contraction revenue as part of your GRR/NRR calculations?