Annualized Gross Profit - New North Star?

If the usefulness of ARR is dying, what is a better metric to replace it?

Today’s Sponsor: DataChat.ai

Every CFO wishes their team could analyze data as quickly as ChatGPT, but no CFO in their right mind would send company data to an LLM.

Using DataChat, though, you can harness GenAI without exposing any of your data to it. Just ask questions about your data in plain English. DataChat answers instantly and shows all its work. It’s that easy. Get started today.

ARR Is Foundational

The software industry has been using Annual Recurring Revenue (ARR) as their North Star metric for a long-time, but those days are numbered. Or at least its usefulness as a metric is diminishing quickly.

My post from a few weeks ago (Is ARR Dead?) hit a nerve with some people on both sides of the discussion - many folks agreed while others strongly believe the concept of ARR is still alive and shouldn’t be changed.

The cloud industry has been built on the concept of ARR, so lots of things rely on ARR as the foundation:

Valuation multiples - valuations as a multiple of ARR/revenue

Financial Metrics - lots of financial metrics are tied to ARR (burn multiple, GTM efficiency, etc)

Benchmarking - spend benchmarking as a % of ARR/revenue

Sales Commissions - based on a % of ARR

The issue today is that ARR has lost meaning (and will continue to lose meaning). There are two primary reasons that ARR as a foundational metric has made sense for the cloud industry:

Predictability - ARR has been a very predictable metric. For most cloud companies, ARR was truly recurring and could be counted on repeating each year. And with net revenue retention > 100%, ARR was an easy baseline for future revenue.

Gross Margins - the median public company gross margin has hovered around 75% for a long time. There hasn’t historically been a ton of outliers from this in the traditional cloud space.

The issue is that both of these factors are changing dramatically, especially with AI products being introduced.

Breaking SaaS Unit Economics

The issue with both of these changes (predictability and gross margins) is that they will break SaaS unit economics if nothing else is changed.

Shorter customer lives and lower gross margins are an unfortunate reality for the majority of cloud-based companies in the future. These changes can be OK if the right adjustments are made. The problem is that many companies will still operate under the old playbooks and burn way too much money before making the right changes.

ARR has been the foundation of so many things that it will require a lot of organizational buy-in and change to do something different.

More Focus on Gross Margin

I am not saying that companies should necessarily drop the use of ARR completely. ARR as a concept can still be helpful in many ways. But…lots of companies will be better served by focusing more on annualized gross margin dollars instead.

Gross Profit ($) = Revenue less cost of goods sold

Gross Margin (%) = Gross profit as a percentage of revenue

Gross margin will be a much better comparable top-line metric than ARR in the future because of how much variability in gross margins between companies (and products within a company) there will be in the future.

And most companies should assume that gross margins will be lower in the future as they think about their forecasted annualized gross profit dollars.

Yesterday’s gross margins will NOT be tomorrow’s gross margins.

1. Valuation Multiples

Revenue multiples are a shorthand valuation framework. And since most cloud companies are not profitable (or barely breakeven) revenue has been the best metric to compare the entire industry against.

Well…times have changed. Not only is the quality of revenue vastly different now between many cloud/AI companies, but the gross margins can be significantly different.

Looking at gross margin dollars will make the top-line metric more comparable. Otherwise, with widely varying gross margins people will just be making huge gross margin adjustments for the multiple anyways…

As a reminder to the discounted cash flow (DCF) haters, in theory a DCF is a perfect way to value a company. The mental framework of a DCF is important to remember when valuing a company….

2. Financial Metrics

ARR has become the foundation of so many financial metrics, but for companies with lower (and declining gross margins) these metrics will not be as relevant anymore.

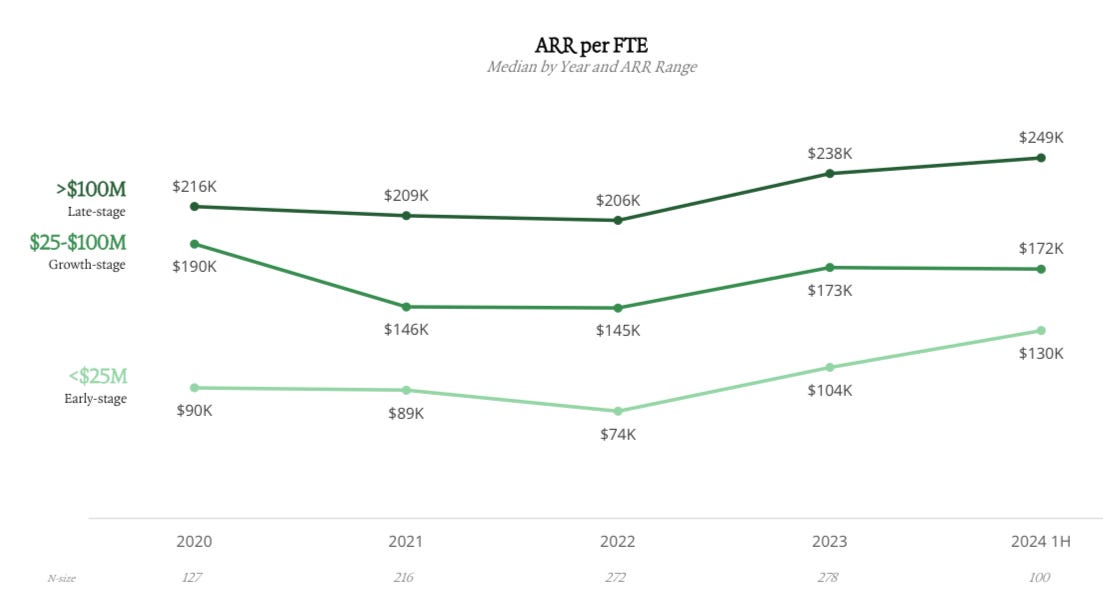

For example, ARR per FTE (full-time employee) has been a popular metric for cloud companies.

But what the ARR/FTE metric implies for a company with a 50% gross margin versus one with an 80% gross margin is VERY different.

There are many metrics that are based on ARR that will diminish in value and provide misleading results in the future.

3. Benchmarking

Similar to financial metrics, if you are just basing everything off ARR then the benchmarks will be very misleading when companies have very different gross margin profiles.

Just because the benchmarks say 50% of revenue is typically spent on sales & marketing for cloud companies, doesn’t mean that your business with 25% gross margins should spend the same.

The unit economics change dramatically depending on a company’s gross margins, which means your other expenses have to be much more efficient OR you accept lower FCF margins and a MUCH lower valuation.

4. Sales Commissions

Almost all cloud companies pay sales reps based on ARR. But if gross margins are low or highly variable between products does this make sense?

The real efficiency metrics for sales are a lot different on an 80% gross margin product than a 20% gross margin product.

I see too many sales teams not care about gross margins at all and this will become incredibly value destructive for companies.

Final Thoughts

I am not saying every company should drop ARR completely. Although, many probably would be better off if they did. The problem is that many folks will hold on to ARR as their North Star metric and they will make bad decisions as a result.

The companies with faster declining gross margins are more likely to hold on to ARR because it will make them look better…

My main point with this post is for companies to question the metrics that they have been using (that are widely popular) and ask if they are the best metrics to guide your business. Time to use your brain and not rely on what everyone else is doing!

It might be a tough pill to swallow and change is hard…but your company will be better off if you use metrics that better align with how your company operates today and in the future.

Lots of things are changing, so your metrics should too.

Footnotes:

Sign up for my recurring webinar series that will cover lots of interesting topics (similar topics as my newsletters). There will be some really excellent guests that you won’t want to miss!

Send an email to onlycfo@onlycfo.io if you want to be a sponsor of the OnlyCFO newsletter or my new webinar series. Get in front of 27K+ finance/accounting professionals

Check out OnlyExperts to find offshore accounting resources. They have some amazing talent for 20% the cost of a U.S. hire.

Switching focus from ARR to annualized gross profit is a smart move. Gross profit gets us closer to the real unit economics—it's a better lens for understanding true financial health in today’s market.