Death From Lost PMF

Building product-market fit (PMF) is the only thing that matters

Today’s Sponsor: Leapfin

Webinar: Budget for better accounting in 2025 with Help Scout CFO Shawna Fisher

Leapfin is hosting a timely webinar to help you budget more strategically. In 2025, prepare to finally address the underlying issue that slows every close, obscures rev insights, makes audits painful, and crushes your teams: your accounting data. Register now! You’ll learn:

why your accounting data is the problem

how CFOs and controllers can ace collaboration to budget for better outcomes

how Help Scout uses Leapfin to find and fix revenue inconsistencies

Plus, you’ll get a critical tip about investing in AI for accounting.

Losing PMF

I used to think that product-market fit (PMF) was a startup problem and that once it was “obtained” you didn’t have to worry about it.

I was definitely wrong.

PMF is like muscles. You are either working out and getting stronger OR you are doing nothing and getting weaker. But for a long time it has felt like companies haven’t had to do anything and growth would still come. Many companies are finally facing reality that the end of ZIRP and the AI platform shift has left them with very weak PMF.

The question is if they have the right team and can execute on rebuilding PMF.

All companies that go out of business do so for the same reason – they run out of money. —Don Valentine

What causes a company to run out of money?

They never find or don’t continue to build PMF

They don’t properly manage expenses and cash runway

Poor execution

#2 and #3 are critical for any business to survive but they both require strong management. These are nearly impossible to overcome with weak management.

#1 - Weak or lost PMF is a death sentence.

During ZIRP, lots of software companies appeared OK with weak PMF for a period of time because they were well-funded and the environment was very favorable. But weak PMF eventually catches up to you if no changes are made.

What is PMF?

PMF occurs when a company addresses a good market with a differentiated product that can satisfy a market segment’s needs.

Below are some of my favorite quotes about PMF:

Do any users love our product so much they spontaneously tell other people to use it? —Sam Altman

Product-market fit is when your customers become your salespeople. —Michael Porter

When the customers want your products so badly that you can screw everything up and still succeed. — Don Valentine

As I mentioned before, PMF is NOT a one-time thing. The only thing that matters for companies is finding PMF and then once you have it, fighting everyday to build it.

The ZIRP era had many impacts, but one of them is it created a lot of weak leaders that didn’t need to make hard decisions. We are now in hard mode for many companies so tough decisions have to be made. Building PMF should be at the top of the list for every company.

Death By PMF

False indicators/confidence in PMF is a great way for a company to get killed.

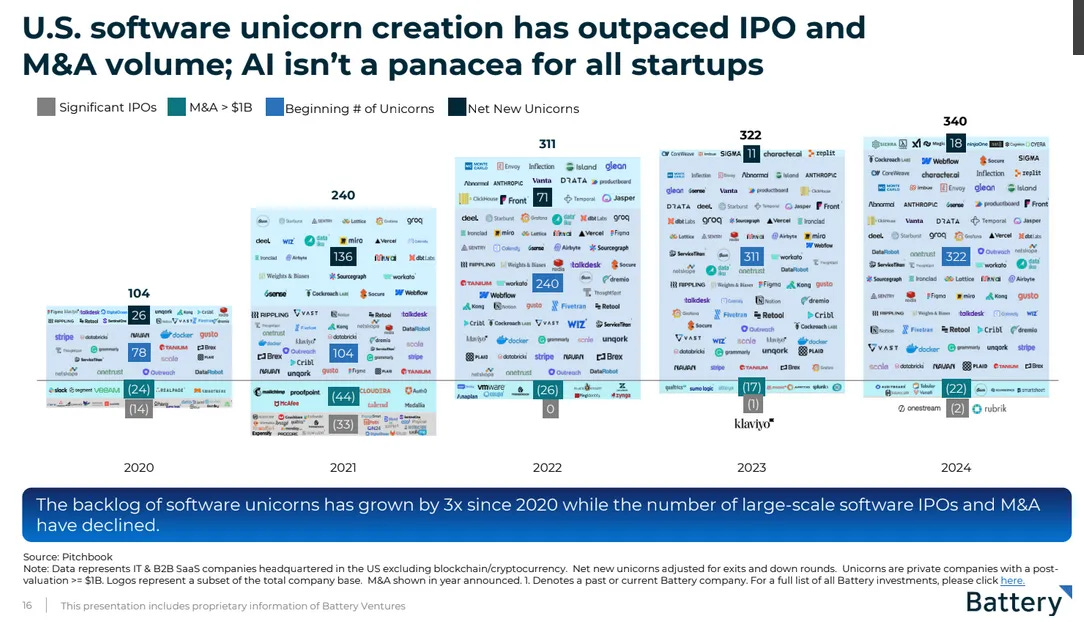

One of these false indicators is raising large amounts of money. We have lots of “unicorns” and aspiring unicorns that have raised lots of money with relatively little revenue.

Most of these unicorns raised enormous amounts of money in the good times of 2021. We are seeing the same thing today with AI companies.

The issue with receiving a ton of money at very little revenue traction is the company’s perception is that they have PMF figured out and they just need to scale and sell. Companies start thinking less about ICP (ideal customer profile) and PMF because they received a stamp of approval (via lots of money).

Making these problems worse is the expectations. When you receive a ton of money at a huge valuation relative to your size there is a ton of pressure to grow into that valuation and become a big company.

Death by expectations.

All of the sudden there is no time to pivot, no time to not build the sales team and sell, no time to focus on PMF, etc. The perceived time pressure to be great can kill the company because the focus turns quickly to scaling.

There certainly should be a sense of urgency, but the urgency should prioritize getting to and building PMF first. Everything else should follow that.

Finding PMF Today

There is not a single right answer on how to build PMF today. A lot has changed.

But there are at least a couple of ways that I am more bullish on than others that I have written about recently:

More verticalized software.

Kyle Poyar with OpenView and others just released a benchmark report with some interesting insights on this. Vertical SaaS and AI-first solutions are outperforming horizontal software. You can check out the full report here

Compound Startups

With the explosion of point solutions and rapid decrease in software development costs, customers expect more from their vendors - compound startups might be the answer for many. Check out my post below on this topic:

Takeways

PMF is not a startup problem, but something every single company needs to be thinking about. Generative AI is knocking a ton of companies out of PMF. Many of these companies remain in denial and blame the macro environment.

At least it’s easier for startups to know they don’t have PMF and adjust. Larger, well-funded companies may take a long time before realizing they have a PMF problem (because they lost it).

As you plan for 2025, make sure a discussion around PMF takes place. What will you do if it is lost? What do you need to do to build it?

Footnotes:

Sign up for the OnlyCFO webinar series! Our first one is on how your annual planning might break in 2025.

Send an email to onlycfo@onlycfo.io if you want to be a sponsor of the OnlyCFO newsletter or my new webinar series. Get in front of 28K+ finance/accounting professionals

Check out OnlyExperts to find offshore accounting resources. They have some amazing talent for 20% the cost of a U.S. hire.

PMF isn’t a milestone, it’s a muscle, as you put it so well. But how often do we conflate PMF with momentum? Generative AI and ZIRP-era expectations have made this distinction unavoidable, pushing us to unlearn growth at all costs and rediscover true market resonance. Sustaining PMF, and evolving it daily, is the real test.

I think this is especially true for biotech and pharma since there's a regulatory barrier to even assessing if you have PMF. Clinical trials and convos with doctors/patients can act as a proxy but it's not the same feedback as SaaS where you can hear from users right after launching