Metrics Needed to IPO | Time to IPO!

The first half of 2025 should (hopefully) be a busy 6 months of cloud IPOs. Get ready!!

Today’s Sponsor: Ordway

Do you hate your billing and revenue software? Don’t suffer through another year of month-end madness. Make the switch to Ordway. With Ordway’s elastic billing technology, you can automate all the “creative” pricing and contract structures the sales team needs to win big deals without requiring your finance team to pull all-nighters to close the books.

See Ordway in action today!

Time to IPO

Time to stop messing around and IPO now! If your company is >$250M ARR with decent metrics, you should be seriously considering an IPO in 2025. Hopefully you have put in the work to start acting like a public company so an IPO is actually an option for you in 2025.

We had a fantastic litmus test for the market’s appetite for cloud IPOs last week with the ServiceTitan IPO. I hypothesized in a prior article (IPO Floodgates Opening?) that if the ServiceTitan IPO was successful then it would open up the floodgates for cloud IPOs because of ServiceTitan’s fairly average financial metrics (which would encourage MANY other later stage private companies with similar metrics to also IPO).

Well…it is go time because the ServiceTitan IPO was definitely successful and saw a massive IPO pop!

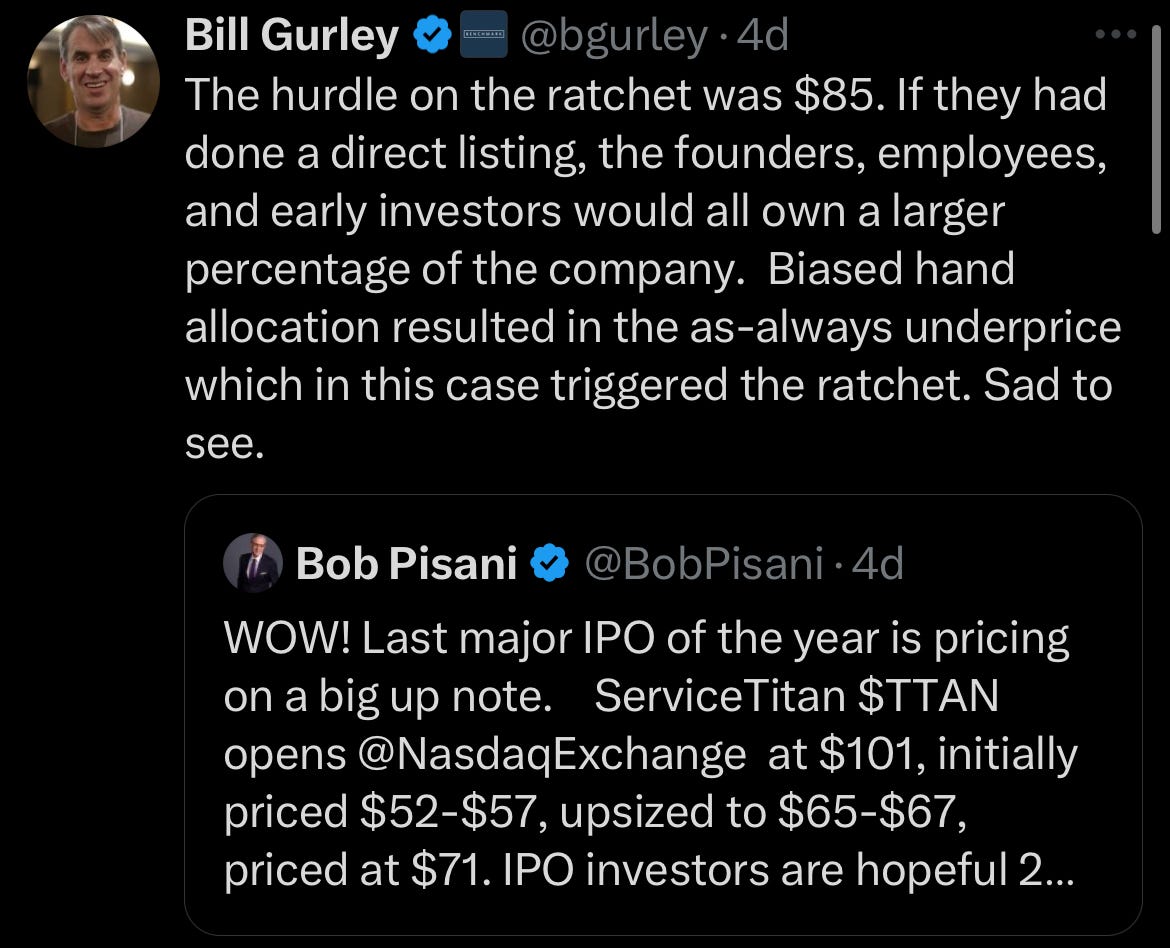

ServiceTitan initially priced $52 - $57, then increased to $65 - $67, and then actually priced at $71. A massive 33% increase from the initial midpoint. You could argue they originally priced too low, but based on their metrics I don’t think it was too far off from a realistic initial range. The median cloud IPO sees a 21% jump from the initial midpoint while ServiceTitan had a 33% increase.

IPO opened at $101 — a massive 42% IPO pop. So after a 33% increase in IPO price, it still popped 42% when it went public. Classic Gurley pointed out that if they did a direct listing instead then ServiceTitan wouldn’t have left so much money on the table due to the IPO pop. I actually don’t know how true that is because the circumstances between a direct listing and an IPO are so different so the stock could be trading much lower if they did a direct listing…..hard to know for sure though.

The ServiceTitan IPO was 30x+ oversubscribed from what I have heard, which is definitely on the high-end.

Currently trading at a ~11x NTM revenue multiple (which is really good for their metrics).

Cloud is Back!

It is not just ServiceTitan either. Cloud has been making a real comeback! It got pretty dire there for a while in 2023 and mid 2024 when everyone thought SaaS was dead….but in the last few months the cloud index is up 33%

From Jamin Ball on SaaS investor excitement we have seen in the last few weeks.

The median software multiple has risen 6% from Jan 1 to today (6.3x to 6.7x). Meanwhile the median year-to-date stock performance of the software universe is 9%. So roughly in line. That being said, from early November to today we’ve seen the median software multiple expand 20%! From 5.6x to 6.7x. So ALL of the multiple expansion has happened in the last ~6 weeks.

Things are going so well for SaaS that 10x+ revenue multiples are becoming common again….There are 22 public cloud companies trading >10x NTM revenue. ServiceTitan is hitting the market at ~11x revenue multiple assuming some similar growth as last year.

From a metric standpoint, ServiceTitan is basically the worst company on the list above (other than C3 which is getting a massive premium because of a potential AI story). ServiceTitan’s growth is pretty good, but they are still losing money so their Rule of 40 Score is not great. While ServiceTitan might be getting a premium because its vertical SaaS, durable vertical, etc….other late stage companies will see their success as an encouraging sign for the success of their own potential IPO.

Metrics to IPO

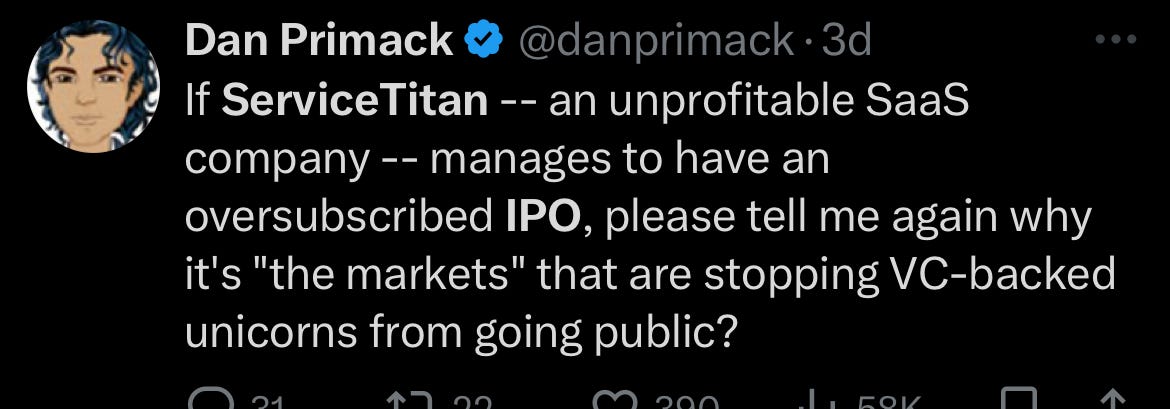

Now that unprofitable SaaS companies (with mediocre metrics) can have successful IPOs again, lots of other late stage companies are wondering if now is their time.

If ServiceTitan can have a successful IPO then so can you! *This is not a knock on ServiceTitan, but an observation of the market sentiment shift and the fact that most of ServiceTitan’s metrics are not top quartile.

What metrics are required in 2025 to IPO?

Revenue Scale

A lot of people have said that the markets want cloud companies to have >$500M ARR to IPO. I disagree with that for 2025 given the momentum in the cloud industry right now.

Here is how I see it:

“Meh” financial metrics - for this group of companies, getting to >$500M ARR is important so they can show some growth endurance at scale and that they can get to FCF positive.

Top quartile metrics - this group of companies likely can have a successful IPO at smaller revenue scales, but I think the low end of the bar is ~$250M ARR. I want to see a company in this bucket IPO in 2025.

ServiceTitan litmus test: ServiceTitan has fairly mediocre metrics but they are getting a very generous ~11x multiple. Obviously, there is some excitement with the IPO, but if ServiceTitan can stay >10x revenue multiple with their metrics then those companies with better metrics shouldn’t have a problem IPO’ing at a slightly smaller revenue scale.

Growth & Profits

Investors care a lot about revenue growth, especially for a new IPO. Investors want to see relatively high revenue growth AND profitability (or clear path to strong FCF margins).

A lot of late stage companies can IPO if they are willing to adjust their valuation expectations enough though. But it can be VERY hard to take the downround size that would be required for many companies.

Let’s look at the current population of public cloud companies in two buckets as a hint of what type of metrics would be required to IPO based on ARR size:

<$1B ARR companies

>$1B ARR companies

And I am going to rank these different groups of companies by their Rule of X Score. As a reminder, Rule of X is a measure of how companies balance revenue growth and profitability with more weighting applied to growth given its importance.

Rule of X = (Growth Rate * Multiplier) + FCF Margin

For companies with <$1B ARR I applied a 3x multiplier to growth and for companies >$1B ARR I applied a 2x multiplier (revenue growth is more important the smaller the company)

<$1B ARR Companies

For these companies to get a lot of investor IPO interest I think around ~25%+ revenue growth is required. And probably 30%+ for companies on the lower end (<$500M ARR).

The higher the growth the less FCF margins will be required to receive a revenue multiple premium, but investors still want to a clear path to high FCF margins. ServiceTitan was not FCF positive at IPO and had just OK growth though, so if you have a strong story with decent metrics, you might still receive a pretty good valuation.

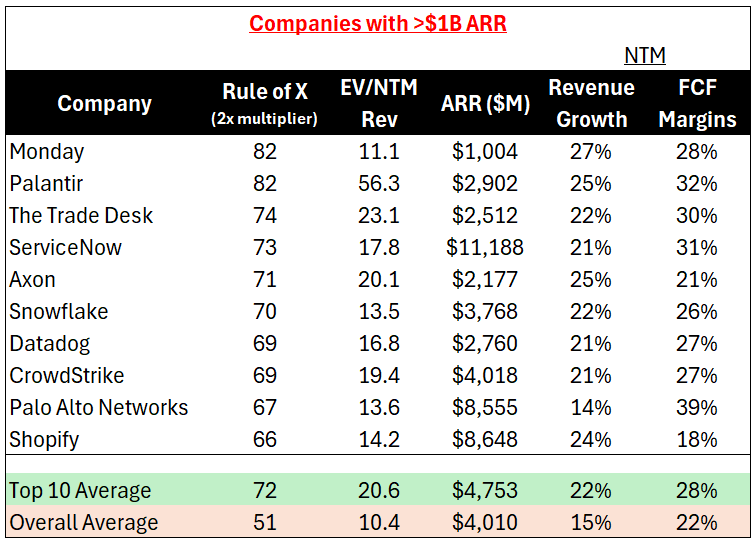

>$1B ARR Companies

Below are the metrics for companies that have greater than $1B ARR.

Can you see the valuation problem for smaller companies?

These larger companies are much bigger but revenue growth is very similar to the <$1B group of companies AND they have ~2x better FCF margins.

So if a smaller scale company is growing at the same rate with worse FCF margins then they shouldn’t be anywhere near as valuable as the larger ones. And that shows up in the revenue multiples. The EV/Revenue multiples of the larger companies are nearly 2x that of the smaller ARR companies.

Final Thoughts

Private companies may still need to adjust their valuation expectations, but the IPO window is certainly open if a company like ServiceTitan can have such a successful IPO at such a favorable valuation.

And I expect a lot of late stage private companies are now seriously considering an IPO in 2025 given ServiceTitan’s success. Check out my IPO Guide for all the important stuff you need to know about preparing for an IPO.

I hope your company has put in the prep work needed to be acting like a public company so accounting/finance is not holding you back from an IPO.

Footnotes:

Check out Ordway if you are thinking about an IPO and need to get billing and revenue in order

Sign up for the OnlyCFO webinar series! Our first webinar is on Wednesday (Dec 18th) and we are covering annual planning for 2025.

Check out OnlyExperts to find offshore accounting resources. They have some amazing talent for 20% the cost of a U.S. hire