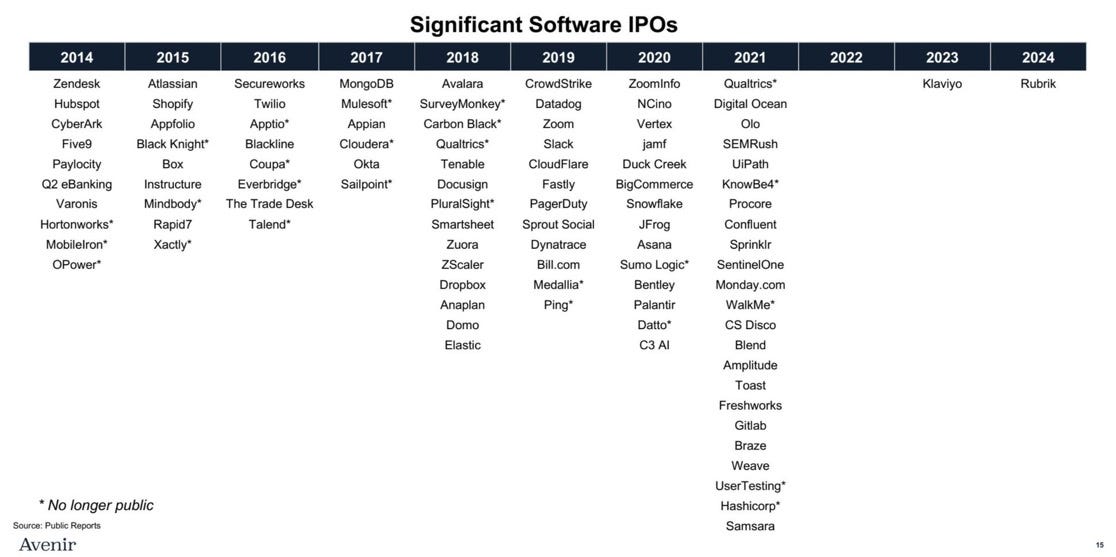

Software IPOs in 2024

Where are all the cloud IPOs and when can we expect them?

Today’s Sponsor: NetSuite

I published a SaaS Chart of Accounts Guide in collaboration with NetSuite. A good chart of accounts is the foundation for all financial reporting so make sure your company is set up properly!

This guide includes a full sample chart of accounts and department listing. It is exactly what I use as a finance leader at software companies.

For many many years to come I will look back at 2021 as one of the most unique times in my career. I will be telling my great grandchildren about the good old days of 2021:

Companies with basically no revenue went public at stupid valuations (👋 SPACs)

Employees expected to be promoted annually (and they got it)

Multiple job offers at top market compensation (one engineer apparently held 10 full-time jobs at the same time)

Every startup was “2ish years away from an IPO”

100x revenue multiples were common in the private markets

Everyone talked about how much money they raised…not the actual business

And IPOs every week…

2021 was the golden age of cloud IPOs. How the times have changed…

So far in 2024 we have only had one cloud IPO (Rubrik) but we will likely have at least one more with OneStream as they recently released their S-1 in preparation of an IPO.

Lots of eyes will be on the OneStream IPO as an indicator of public market appetite for cloud IPOs and whether smaller scale cloud companies can have a successful IPO. Given the lack of recent IPOs, particularly at a smaller revenue scale, I would assume OneStream bankers price it fairly conservatively. Hopefully it performs well and opens the door for more IPOs.

If you are thinking about an IPO, check out my IPO Preparation Guide.

Software IPO Outlook

There has been lots of discussion around the “IPO window” lately (at least in my nerdy circles of friends) and when will more cloud companies go public.

Private market investors need more exits (IPO or M&A) to get liquidity on their investments. It’s what makes the tech ecosystem go round. As exits increase and investors get liquidity there is a higher willingness to invest in other companies.

Why aren’t we seeing more cloud IPOs when the stock market is near all-time highs?

The “market” and the cloud industry have had two VERY different paths over the last 5 years….

Below shows the price movement of two ticker symbols representing the general market versus cloud companies:

The purple line is the QQQ ETF which represent the broader technology market

The blue line is Bessemer’s cloud index (stock ticker WCLD), which is an ETF that tracks public cloud companies

The broader tech stock market has been crushing it and is up 157% over the past 5 years. While cloud specific companies from WCLD are up only 25% over the same period of time.

The market recently hitting all-time highs is being propelled by a small number of huge companies. Nvidia alone accounts for ~35% of the S&P 500 gains so far in 2024 🤯.

While the overall stock market has done quite well, software companies have mostly been out of favor with investors recently, which makes taking a software company public trickier.

What profile of company can go public right now?

There have been some interesting discussions recently about whether companies need at least $500M of revenue in order to IPO.

Both sides of the arguments I have heard are basically true:

The >$500M folks were basically arguing that you have to have at least $500M of revenue to receive a favorable valuation right now.

The <$500M folks were arguing that the IPO window is always open for great companies

Both of these statements can be true.

Public market investors might discount the unproven subscale cloud companies, but as long as companies are willing to accept the public market pricing then of course they can go public. Amazing companies that can continue to execute in the public markets will do just fine and the valuations will fix themselves.

What are the concerns with subscale companies?

The problem with subscale companies (<$500M in revenue) trying to IPO right now relates to expectations and risk/reward tradeoffs relative to other investment opportunities.

The valuation multiples that subscale companies were getting in the private markets required really high revenue growth endurance over a long period of time for the valuations to make sense. The issue is that most revenue growth rates have fallen significantly recently.

Revenue multiples are based on an LTM or NTM revenue basis. But what it doesn’t capture is revenue growth endurance (i.e. how durable are revenue growth rates over time).

Investors are comparing the subscale company profiles against the mature, proven companies and evaluating the risk/reward tradeoffs. A subscale company may be at 45% revenue growth at $250M in revenue, which is good…but what will the growth rate be at $400M or $800M? Can these subscale companies maintain good growth and get to high profit margins?

The risk/reward analysis on these subscale companies are hard to justify at high valuations when you can get a mature, proven company with similar metrics. This is why many of the subscale company valuations will get heavily discounted.

Look at the top 10 revenue multiple companies below.

CrowdStrike for example is growing at 29% with 32% FCF margins with $3.6B in ARR. If a subscale company is growing at 45% and is barely breakeven on FCF then investors are going to compare that to a mature company like CrowdStrike with more proven metrics.

The public companies with the highest revenue multiples (from image above) right now are all companies with relatively large market caps - the smallest is AppFolio with a $9B market cap, but the average is closer to $70B and they are all at a significant revenue scale….

The subscale cloud companies have a lot more risk while the potential reward doesn’t appear that much greater than many other large, proven cloud companies given their growth rates.

This is why their revenue multiples will be a lot lower - to account for this additional risk and to appropriately balance this risk/reward tradeoff. If this risk is a lot higher then the reward needs to be potentially higher, which means the revenue multiples must be lower given similar financial metrics.

Can/should subscale companies IPO right now?

Can they IPO? Yes.

Should they IPO? Maybe.

Many won’t get the valuation they think they are worth. Most CEOs have adjusted their expectations, but there is still usually a valuation gap with the public markets right now. So the first hurdle is if they can go public at a valuation acceptable by the company and its investors.

Being public is probably good for a lot of these companies because it will pressure them to get fit (efficient) faster and hopefully make better decisions quicker. As long as everyone can get over the valuation hit, then subscale companies can IPO.

Then it just comes down to the company’s ability to continue to execute. Public market investors are skeptical of these subscale companies to continue to have strong growth and get to high profit margins. But any great company that can execute (maintain growth and be efficient) over a long period of time will do just fine in the public markets. There may be unfavorable valuation multiples initially, but if they are great companies then maybe they should take the hit, execute, and prove they are worth a high multiple.

OneStream IPO

The OneStream IPO will be an interesting test of the cloud IPO market.

They have pretty solid metrics:

They have right around $500M ARR and growing nicely at 34% YoY

118% NRR and 98% GRR

FCF margin of 11%

Rule of 40 Score = 45

But as I mentioned earlier, 34% revenue growth is good but should be looked at in the context of revenue size. If OneStream can’t quickly prove that it can maintain that high revenue growth and show meaningful progress towards even stronger long-term profit margins then investors will pay a lot less for it.

Footnotes:

Check out OnlyExperts if you need offshore accountants. I am partnered with them to help CFOs and finance teams hire better finance talent for less.

Grab my SaaS Chart of Accounts Guide and get your books set up the right way

*not investment, legal or tax advice.

Added risk to OneStream's growth is that much of their success to date has come from enterprise sales. They're going to need to continue to move down market to keep up that growth. It will be interesting to see if they can maintain such high levels of growth targeting a lower ACV customer (which is a totally different game).

💯Fast expansion is great, but it's best to focus on growth and profitability in the long run.