Will AI Save Inefficient Software Companies?

Thoughts on Battery's "State of the Open Cloud" Report

If you haven’t seen it yet, check out Battery’s State of the Open Cloud report that was released this week. A big focus of the report was artificial intelligence’s impact to company efficiency.

But before I get into the actual report, the below intro sentence might be the most important and a concept I keep telling people.

But what if the new, more-challenging macroeconomic environment, coupled with powerful new technologies like AI, means we should rethink the metrics we’ve all gotten used to – and encourage companies to reevaluate the right set of benchmarks to survive and thrive?

Yesterday’s benchmarks are only good today to the extent they are relevant to the company’s current situation. There are a lot of problems with using benchmark data that I covered in depth in a previous post: Death From Benchmarking.

Averages of dissimilar companies

Reviewing data in isolation

Bad data/comparisons

Time period covered

Significant technology changes

Significant technology changes is the only one on my list that has the potential to change how we think about the unit economics. The other four are problems with the benchmark studies themselves or the users. Generative AI is obviously a significant technology change so we can’t keep using the same benchmarks for ratios, metrics, KPIs, etc.

State of the Open Cloud Report

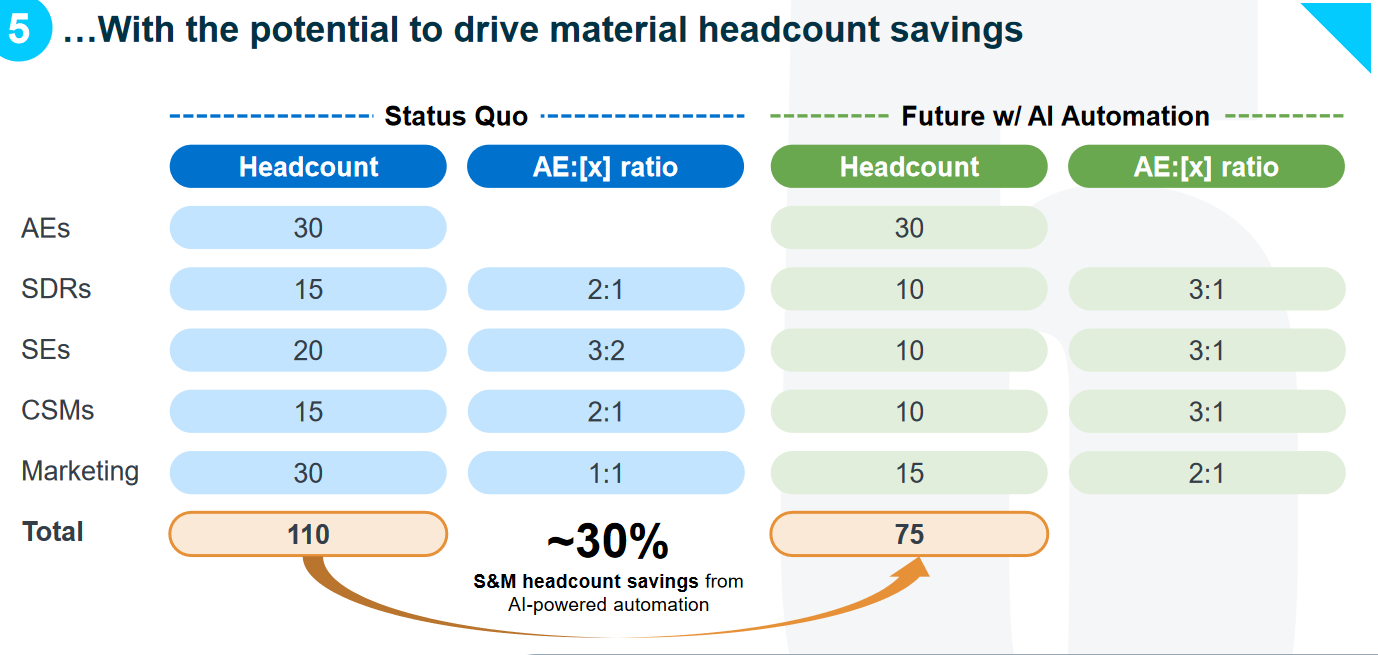

With generative AI all departments can be more efficient and typical headcount ratios can expand. Battery’s report suggests a typical 1:2 SDR: AE ratio might go up to 1:4 or ramp time might drop from 9 months to 6 months.

This would eventually create a lot of additional headcount savings versus the old benchmarks. The other departments (R&D, G&A, support, etc) would see similar savings/efficiency.

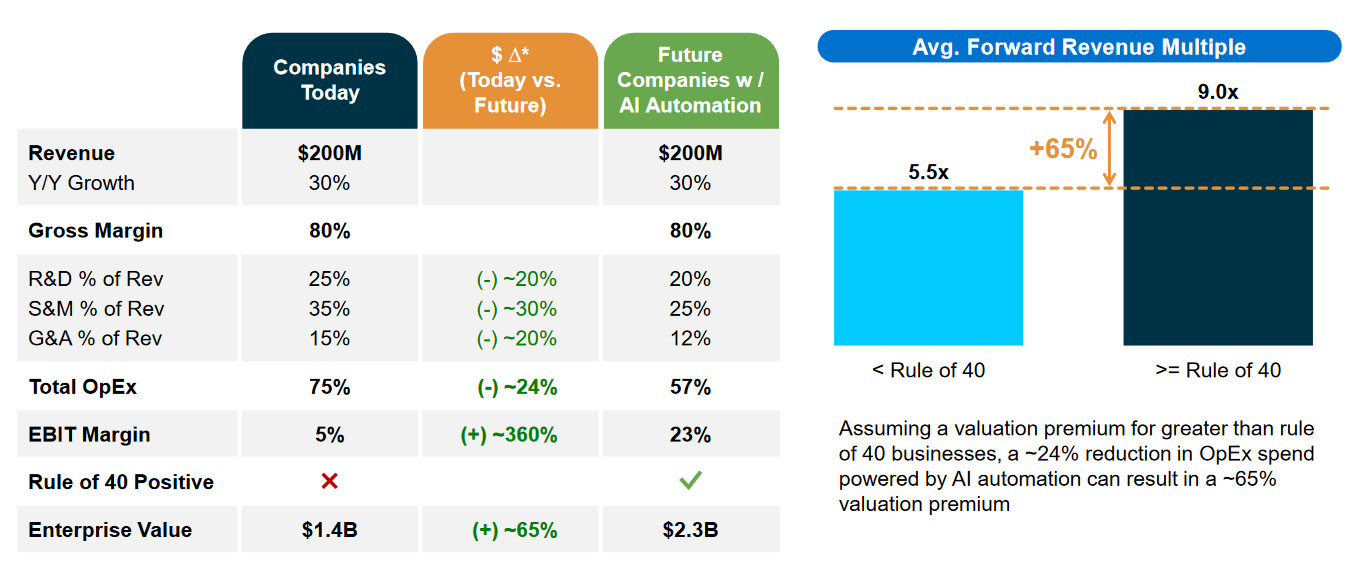

Battery then hypothesizes the financial and valuation impact to companies. Lots of cost savings and a 65% increase in enterprise value.

My Thoughts

Generative AI will clearly unlock efficiency gains, but you can’t only look at the pros and not the cons. The hypothetical income statement and enterprise value in Battery’s report only considers how generative AI positively influences the financials but fails to consider the longer-term negative impacts.

In the short-term Battery might be right for companies that have early adopted AI tools. But companies shouldn’t be valued based on a single year’s metrics. Longer-term I think there are some negatives that both operators and investors should consider because some might be in for a major head fake.

Significant revenue growth pressure on the majority of companies.

If all companies can save 20-30% on OpEx, many companies will pass at least some part of those savings to the customer.

Competition also exponentially increases for most companies as its cheaper/faster to build causing pricing pressure and/or a lower win rate

Savings from generative AI are reinvested to better compete as competition heats up.

Gross margins are negatively impacted due to the pricing pressure mentioned above and/or due to the cost of embedding generative AI.

This certainly isn’t an exhaustive list, but folks need to consider how their unit economics will change with generative AI both in the short-term and the longer-term. Generative AI is likely a net positive for many companies, but don’t just look at the positives.

Will AI Save Inefficient Software Companies?

My answer is generally no. The highly inefficient companies today will still be inefficient with generative AI.

Companies are typically inefficient because of a lack of PMF or have bad execution. AI does not fix that. Any cost savings these companies get from AI will be eaten away by the things I mentioned above.

Other Stuff

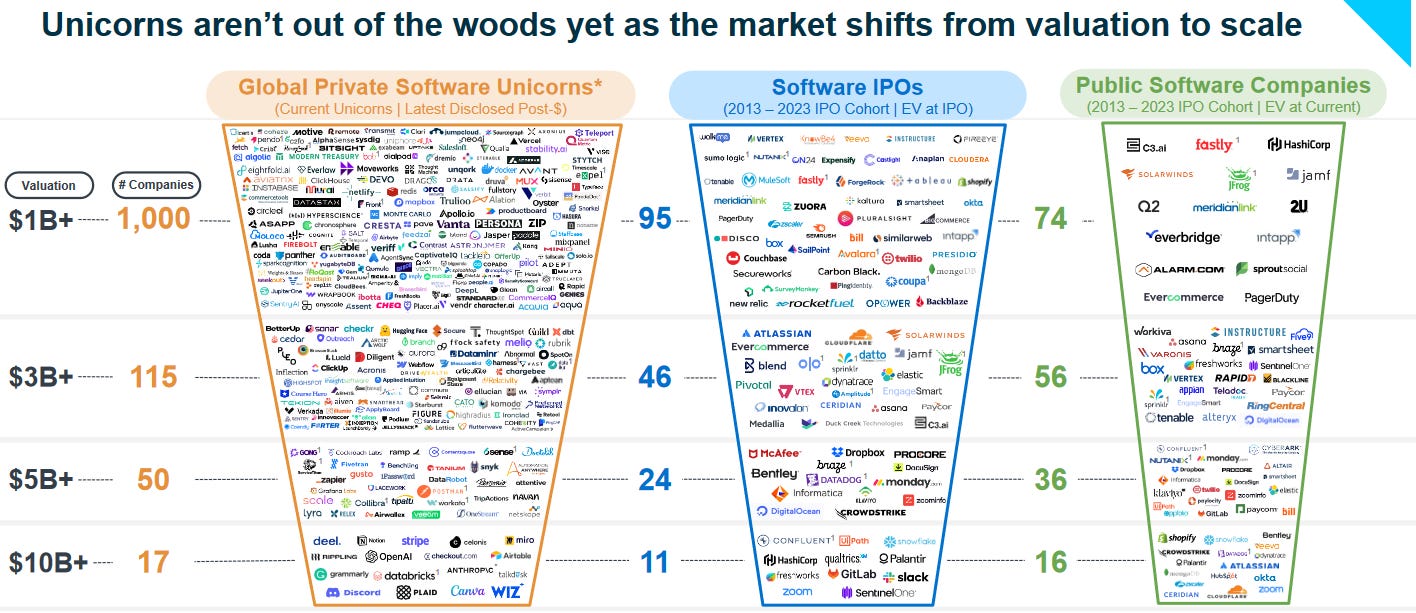

This is a great chart…So you are telling me that 200 software companies went public in the last 10 years, but there are 1,200 companies dreaming of going public in the next couple of years?

We would need a software IPO every week for the next 23 years….

Fabulous post

This one paragraph is the most important to grok/process

"

Significant revenue growth pressure on the majority of companies.

If all companies can save 20-30% on OpEx, many companies will pass at least some part of those savings to the customer.

Competition also exponentially increases for most companies as its cheaper/faster to build causing pricing pressure and/or a lower win rate

Savings from generative AI are reinvested to better compete as competition heats up.

Gross margins are negatively impacted due to the pricing pressure mentioned above and/or due to the cost of embedding generative AI."

Excellent post as always