The Startup Finance Checklist

What founders and other leaders need to be thinking about. Includes free finance/accounting templates and other guides to use at startups.

Today’s newsletter is brought to you by Brex, the AI-powered spend platform.

How do the world’s leading companies make every dollar count? Brands like DoorDash and SeatGeek control spending before it happens, automate the busy work, and earn more rewards on every purchase. And they do it with Brex. See for yourself.

When I was a boy of fourteen, my father was so ignorant I could hardly stand to have the old man around. But when I got to be twenty-one, I was astonished at how much he had learned in seven years. — Mark Twain

Hard-working, ambitious, and high achieving professionals develop a high level of confidence in their field (often rightfully so). But for many folks, that high confidence then creeps to areas outside of their domain expertise. They have the same level of confidence but with little knowledge and experience.

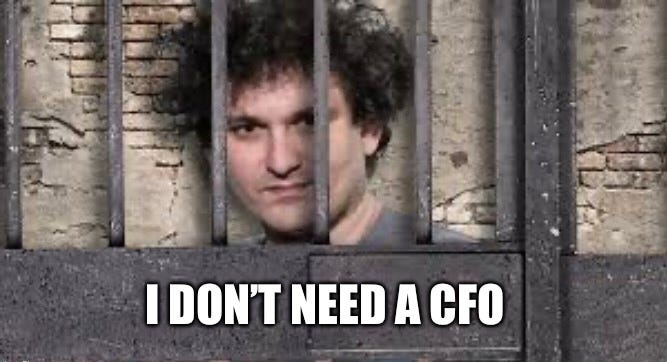

My favorite example of this is the below quote from Sam Bankman-Fried (SBF) about why he hadn’t hired a CFO despite the amount of money that his company, FTX, managed.

We all know how SBF’s story ended…Apparently CFOs can be useful :)

John J. Ray III was the guy appointed to clean up the mess after the Enron fraud blew up. John was also appointed to clean up the FTX fraud. Here is what he had to say about FTX:

Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here. -John J. Ray III

Having someone who can be the adult in the room and just make sure the kids running the company don’t do stupid things was in hindsight an obvious thing missing at FTX.

There are many things that founders/CEOs need to think about and often finance stuff is not super high on their list. But…if ignored, some of the below stuff can cause a lot of pain. While not a comprehensive list, it is a good start to make sure you aren’t neglecting some important things.

*Reply to this email if you have any questions on the below. I would love to hear from founders or early stage leaders on this topic. I will also make intros to finance leaders if you need someone (no charge).

The Startup Finance Checklist

Finance:

Finance terms properly defined (ARR, NRR, GRR, etc). Check out my post on how to define ARR

Tracking important cloud metrics. These are important for both driving internal performance and for board reporting. See cloud unit economics post

Cash runway and forecasting. Cash is king. Know your runway.

Multiple scenario planning. Important so the company is aligned on how to react in different scenarios.

Budget vs actuals. Important to review internally to see how to improve forecasts and what to change to meet targets. Also, the board will want to see it.

Commission plans. Need plans that create a motivated but also an efficient sales org. Check out my post on building commission plans

Vendor negotiations. Make sure someone with experience does this. There are lots of potential pitfalls. Best practices for managing software spend

Headcount planning. Model out various scenarios and related cash burn. Free headcount planning model

Product pricing. Planning the impact and forecasting under different pricing models.

Board slides. Don’t embarrass yourself in front of the board with finance stuff that doesn’t make sense.

Financing - equity and debt. Make sure you know what each of these really mean for the company, the terms and how it impacts potential exit alternatives.

M&A stuff. So much can go wrong here on both the buy and sell side.

Exec dashboards. Finance dashboards can provide important insights early. Post on building great dashboards.

Accounting:

Follow proper accounting rules. So much is wrong here at startups. Accounting is frequently wrong and doesn’t follow cloud standard practices.

Proper accounting setup. Set up your GL accounts and departments properly. Get my free SaaS chart of accounts here.

Gross margins. Important to get this right early because investors care a lot about it. But SO many startups get it wrong. Post on how to read income statements and categorize expenses

Cash vs accrual accounting. Important to do accrual once you are a certain size. It’s expected by investors.

Proper revenue recognition. Screwing up revenue recognition is a great was to loser potential investor confidence. Free rev rec template here

Internal controls. Companies need stage appropriate controls to safeguard assets.

T&E policies and management. Setup T&E guidelines/rules and the management of them.

Other:

Treasury. Bank controls, proper investment strategy, cash management, etc. Post on properly managing cash.

R&D Tax Credit. Up to $500k/year in free money for startups

Sales Tax. Huge potential liability if not properly collected and can hurt M&A and valuations.

Tax stuff. Tax extensions, income tax returns, franchise tax, etc

QSBS (qualified small business stock). Huge potential tax benefit for early employees

Section 174. This is a tax thing that many are still hoping gets repealed, but it is creating some major tax problems for many startups.

Employee equity pool management. Manage employee equity grants, dilution and available pool.

None of these are particularly hard or time intensive, but having the right person helping can save you LOTS of money and set the company up for success. Don’t end up like SBF (in jail or unnecessarily wasting money)…make sure someone is thinking about all these finance things.

Footnotes:

Need a fractional CFO and/or bookkeeper that specializes in software and tech? Reply to this email (or email me at onlycfo@onlycfo.io) and I will help you.

Check out Brex (today’s sponsor). They help a lot of companies with some of these finance problems.

Check out OnlyExperts for to find offshore accounting resources. They have some amazing talent.

This is golden! You just made my sales process super easy! 😂

This should (or could) be a b-school CFO track.